Cash Flow Problem Sets

Problems

BASIC PROBLEMS

5-1 FutureValue Compute the future value in year 9 of a $2,000 deposit in year 1 and another $1,500 deposit at the end of year 3 using a 10 percent interest rate. (LG5-1)

5-3 Future Value of an Annuity What is the future value of a $900 annuity payment over five years if interest rates are 8 percent? (LG5-2)

5-5 Present Value Compute the present value of a $2,000 deposit in year 1 and another $1,500 deposit at the end of year 3 if interest rates are 10 percent. (LG5-3)

5-7 Present Value of an Annuity What’s the present value of a $900 annuity payment over five years if interest rates are 8 percent? (LG5-4)

5-12 Present Value of an Annuity Due If the present value of an ordinary, 6-year annuity is $8,500 and interest rates are 9.5 percent, what’s the present value of the same annuity due? (LG5-6)

5-15 Effective Annual Rate A loan is offered with monthly payments and a 10 percent APR. What’s the loan’s effective annual rate (EAR)? (LG5-7)

5-39 Loan Payments You wish to buy a $25,000 car. The dealer offers you a 4-year loan with a 9 percent APR. What are the monthly payments? How would the payment differ if you paid interest only? What would the consequences of such a decision be? (LG5-9) (Calculate monthly payment only)

EXAMPLE

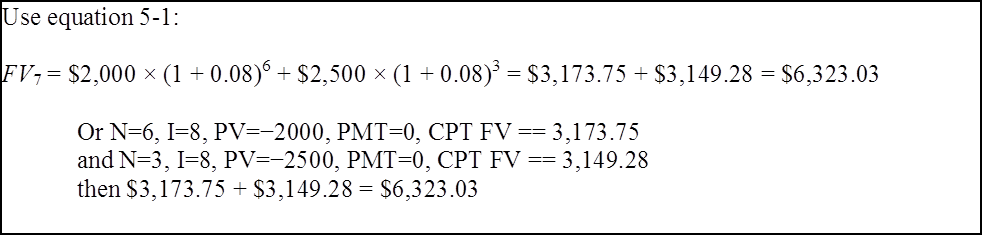

| 5-2 FutureValue Compute the future value in year 7 of a $2,000 deposit in year 1 and another $2,500 deposit at the end of year 4 using an 8 percent interest rate. (LG5-1) | ||||||||||||||||||||||||||

| (LG5-1) | ||||||||||||||||||||||||||

| Interest Rate | 8% | |||||||||||||||||||||||||

| Year | Deposit | Year | Deposit | |||||||||||||||||||||||

| $ 2,000.00 | ||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||

| $ 2,500.00 | ||||||||||||||||||||||||||

| Future Value | $3,173.75 | $3,149.28 | ||||||||||||||||||||||||

| Total Future Value: $6,323.03 | $6,323.03 | |||||||||||||||||||||||||