company analysis paper revision using comment

Running head: AMAZON; A COMPANY ANALYSIS 1

Amazon; a Company Analysis

Student’s Name

Institutional Affiliation

Amazon is the planet’s largest online retailer and a famous provider of cloud services. The establishment was originally seller of books but has grown to sell an assortment of end user goods, digital media and also its own line of electronic devices like Kindle e-book reader, Kindle Fire tablet and Fire TV, and streaming media adapters. Amazon also provides its customers with high efficiency online shopping experience and is known to be the provider of a great customer service experience. Prime membership to the company resonates with receiving access to movies, books, and online reading among other benefits. It is worth mentioning that Amazon is a well differentiated company; with prospects such as Amazon Web Services, the company offers existing and prospective customers cloud computing platforms that are comprehensive, an d evolving. The first ever AWS offerings were established in the year 2006 to offer online services for client side applications and websites. In essence, Amazon’s Simple Storage Service (S3) and Elastic Compute Cloud (EC2) are the pillar of the corporation’s large and ever growing collection of online services. Jeff Bezos registered the corporation as Cadabra in the year 1994 but later altered the name to Amazon for the website launch in the year 1995 . Bezos purportedly looked up the dictionary for a word that starts with “A” for the sake of alphabetic placement. He chose the name Amazon since it was “different and exotic” and as a indication to his vision for the establishment to match the size of the Amazon River, one of the biggest rivers in the planet. Amazon has its headquarters in Seattle, Washington. The corporation has customized websites, customer service centers, centers of software development, and fulfillment centers in many places all over the world. This paper is going to give invaluable insights on Amazon’s profile, products, services and profitability. Other company information such as the goals, mission statement and values will be highlighted.

Amazon; an Overview

Why Amazon is regarded as the best strategic player in technology

More than any other establishment of the Internet Age, Amazon embraces the emerging culture of business strategy. It is the modern day General Electric and Bezos can be likened to Jack Welch. For instance, when a definitive book on corporate strategy for the early internet epoch is written, Amazon will be the primary example and not Google, Apple, Facebook, or Microsoft. Unlike other big corporations that define the corporate world in these times, Amazon did not ascend to power through the invention of a new service or product. It became famous through systematically bringing down a whole industry. It is a business tale that called for strategic depth and not technical wizardry, brilliance in design or sheer energy (Jain, Madan & Singh, 2016). In the competitive world of technology, no one regards Amazon’s engineers as extraordinary geniuses or all its designers as modern day Leonardo Da Vincis. They are good but not great. Yet every now and again Amazon emerges as the winner.

Industry Profile and Amazon’s Position within It

Amazon is categorized as a company that is in the online retail industry. The company has continued to be a leader in the online retail market as a result of proper consideration of the Five Forces Analysis in the strategy of the firm (Rachet, 2014). The Porter’s Five Forces has proven to be a useful tool for the external analysis of Amazon. All the external factors help in the definition of conditions within the e-commerce industry environment, with concentration on the online retail market. Amazon still remains the largest operator in this market and to maintain its current position, the company has to time and again find out the external factors in the online retail industry sector.

Overview; Amazon’s Five Forces Analysis

Amazon.com Incorporation is in competition with a number of companies; these include small scale online retail stores and big brick and mortar enterprises such as Walmart. The world scope of the e-commerce business also places Amazon under a disposition of a diverse set of external forces. Therefore the company has to make sure that it stays strong in the middle of changes in the conditions of the online retail industry surroundings. The table below shows the intensities of the external factors that affect Amazon, with respect to the Porter’s Five Forces Analysis model.

| | Porter’s Five Forces Analysis Model |

| 1 | Competition or competitive rivalry (strong force) |

| 2 | The bargaining power of end users (strong force) |

| 3 | Bargaining power of Amazon’s suppliers (moderate force) |

| 4 | Threat of substitution or substitutes (strong force) |

| 5 | Threat of new entry or new entrants (weak force) |

Amazon Inc ought to address the primary forces of consumers, competition, and substitutes respective of the Porter’s Five Forces Analysis of the corporation. It is commendable that that Amazon has to take care of the strong force of competition through the emphasis of e-commerce strengths and competitive advantage. For instance, Amazon is obliged to go on building its brand image, which is among the most pronounced in the industry. To address the strong force of end user bargaining power, the company can concentrate on the quality of their services. For example, the reduction of counterfeits can better the experience of end users whenever they get to use Amazon’s e-commerce website. Another recommendation is for the corporation to counteract the threat brought about by substitutes through making its service delivery to end users more attractive. For instance, the corporation has to go on bettering its brand image and position, which happens to be the strongest in the industry. Besides, Amazon Inc can take care of the external factors related to the strong force of buyer bargaining power through concentrating on service quality. For example, the reduction of imitations can better the experience of customers in the course of utilizing Amazon’s e-commerce website. Another recommendation is for Amazon to quell the threat of substitution by making its service more attractive. Additionally, the corporation must go on enhancing the user friendliness of its online platform to perfect the experience of users. These recommendations look to increase the competitiveness of Amazon and potential for long term success in the online retail industry environment.

Competition or Competitive Rivalry

Amazon is in competition with robust competitors. This aspect of Porter’s Five Forces Analysis model tackles the effects of companies on one another. In the case of Amazon Inc, the factors that contribute strongly to the competitive rivalry that Amazon experiences is high aggressiveness of firms, low switching costs, and high availability of substitutes.

Retail firms are basically aggressive and they project a robust competitive force against each other. For instance, Amazon Inc directly competes against conglomerates like Wal-Mart, which has an important and expanding e-commerce online sight. Amazon also faces the strong force of substitutes due to its high availability. Low switching costs keep up a correspondence with low barriers to customers to transfer from one seller to the next, or from one corporation to a substitute provider. In essence, competition has to be a strategic priority to make sure Amazon realizes long term competence.

Bargaining Power of Amazon’s Customers

Consumers influence firms and industries a great deal. Factors that support the strong intensity of the bargaining power of customers in affecting Amazon Inc include high quality of information, high availability of substitutes, and low switching costs. Consumers have the access to high volumes of information in relation to the services and goods that online retailers put at their disposition. Bargaining power affects Amazon with respect to the capability of consumers to find options to Amazon’s online retail service. In essence, the low switching costs make it very easy for end users to make transfers of allegiance from Amazon to other companies like Wal-Mart. Moreover, the high accessibility of substitute goods further gives power to customers to shift from a single retailer to the next. For instance, as opposed to buying goods on Amazon’s e-commerce website, an end user can go to one of Wal-Mart’s departmental stores, which are positioned strategically all over North America. The external factors in this facet of the Five Forces Analysis depict that Amazon must place an emphasis on the influential bargaining power of buyers as a primary factor in addressing business challenges in the online retail industry setting.

Bargaining Power of Amazon’s Suppliers

The suppliers of Amazon control the ease of access of supplies or fast moving consumer goods that the company requires for its e-commerce operations. The influence of suppliers that define the online retail market environment is highlighted in this aspect of the Five Forces Analysis model. Amazon Inc can attest to the moderate intensity of supplier bargaining power with respect to small population of suppliers; moderate forward integration; and moderate size of suppliers. The small populace empowers suppliers to impose a strong force on Amazon Inc’s e-commerce operations. For instance, fluctuation in equipment prices from a decent number of suppliers ought to influence the firm’s retail operational costs. All the same, the modest forward integration is equivalent to a moderate degree of control that suppliers have in the sale of their goods to companies like Amazon. Besides, the moderate size of most manufacturers of equipment limits their influence on the corporation. With respect to this aspect of the Porter’s Five Forces Analysis relating to Amazon, the external factors place an emphasis on the modest importance of suppliers as a strategic determinant in the online retail industry setting.

Substitution or Threat of Substitutes

Amazon is in competition with a lot of substitutes in the online retail market. These aspects of the Porter’s Five Forces Analysis model finds out how substitutes affect the environment in the industry (Ritala, Golnam & Wegmann, 2014). For Amazon Inc, the number of external factors that resonate with the threat of substitution includes low switching costs, low cost of substitutes, and high availability of substitutes. Amazon continuously addresses the issue of substitutes, which threatens the firm’s e-commerce performance. The low switching costs is a sign that customers can change their loyalty from Amazon to other competitors. For instance, customers can easily make a decision to make purchases from Wal-Mart stores or other retail stores as opposed to buying from Amazon. The high accessibility of substitutes and the low costs of their consumer goods offerings further amplify the influence of substitutes against Amazon. Therefore, the exterior factors in this light of the Porter’s Five Forces depict that substitution is among the priorities in the firm’s strategies for long-term accomplishment in the online retail industry surroundings.

New Entry or Threat of New Entrants

New companies basically limit the market share of Amazon in online retail. The effects of new entrants are well thought-out in the aspect of Porter’s Five Forces Analysis model. Amazon Inc experiences the frail intensity of the threat of new entrants with respect to a number of external factors. These include low switching costs (strong force), high cost of brand development (weak force), and high economies of scale (weak force). The customers of Amazon can easily switch to new companies, thus giving power to new firms to impose a robust force against Amazon. The above mentioned condition comes about as a result of low switching costs, or the low negative consequence of switching from a single service provider to the other. All the same, the high cost of developing a brand in online retail makes the threat of new entrants weak on the general performance of Amazon. For instance, it would take a number of years and billions of money to come up with a strong brand that directly competes with the Amazon brand. Moreover, Amazon benefits a great deal from the high economies of scale that makes its e-commerce enterprise strong. With such a disposition, new competitors ought to realize similar high economies of scale to compete against Amazon. With respect to the external forces in this aspect of the Porters Five Forces Analysis, new entrants are a minute strategic issue in the company’s performance in the online retail industry environment.

To determine all the competitors of Amazon, there is a need to look at the three segments it is involved in. Amazon operates in the media segment, electronics segment, and other merchandise. Respective of the media segment, the company competes with media game-changer Netflix, auction site eBay, Time Warner Cable, media producer Liberty Interactive Apple with iTunes, Google with its Play Store.

In addition to the afore mentioned, Amazon happens to have a number of competitors in the general merchandise and electronics segment, many of which are brick and mortar competitors and these include Family Dollar, Best Buy, Target, RadioShack, Staples, Sears, Walmart, Delia, Systemacs, and Big Lots. In the general merchandise and electronics segment, Amazon Incorporation’s competition is inclusive of the Alibaba Group, Overstock.com, LightInTheBox Holding Company, ;PCM, VipShop Holdings, JD.com, Wayfair Incorporation and Zulily. In the other operating segment, Amazon is in competition with a number of the globe’s biggest companies including PC Connection, CDW, Google, Insight Enterprises, Acenture and Critix Systems, and Oracle among others.

An example of a good indicator of Amazon’s success is its performance in the 2013 financial year where it recorded a total of 74.45 billion USD in terms of revenue; with a market capitalization of $ 153.37 billion as of November 20th in the year 2014.

Company ProfileAmazon is a company that is within the Cyclical Consumer Goods and Services sector. What’s more, it is in the Department Stores industry. The company offers both existing and prospective customers an assortment of goods and services through its websites. Amazon’s products comprise content and merchandise that it buys for resale from retailers and those offered by third-party dealers. The corporation has three segments: North America, International and Amazon Web Services (AWS). This segment of Amazon within North America concentrates o retail sales of fast moving consumer goods from subscriptions and sellers, via its focused Websites within North America such as www.amazon.ca, www.amazon.com, and www.amzon.com.mx.

On the other hand, Amazon’s international segment is characterized by export sales from its internationally focused websites, inclusive of export sales from its sites to end users within the United States, Canada, and even Mexico. The corporation’s AWS section concentrates on the sales of compute, database, storage, and myriad other AWS service offerings for start-up companies, academic institutions, government agencies, and enterprises among others. The company puts Amazon Prime at the disposal of customers; this happens to be a yearly membership program.

It is worth mentioning that Amazon is also a major player in the book industry; the executives and the management chose to take over by storm every part of the supply chain and not only retail. The whole corporation started, not only with an idea but a decision that was data driven i.e. books were a category of products that brought about an unfair advantage for ecommerce. When it comes to books, the company provides value to customers through one-click shopping and free shipment of over $25. Besides, Amazon was the first company to market books with a usable, meaningful, and predatory offering for all customers interested in self-publishing through Amazon Advantage. This was sometime in the late 90s when realizing traditional distribution as a small scale or self-publisher was next to impossible. Amazon has also been of great utility to customers since it brought forth a used-book marketplace that caused used books to go from 4% of the market to a figure of 30% in less than half a decade. Getting involved in a fight with on-demand printers within a supply-chain battle, and putting to use its 24-hour shipping model as a tool to introduce print volumes to Book Surge, Amazon is basically in-house operation. Undercutting Lulu, the revolutionary self-publishing operation that caters to writers with its Createspace offers, is the company’s way of rewarding authors who use Amazon with better margins. Finally, the booting up of the Amazon Affiliate program accounts for approximately 40% of the sales (Mishra & Kotkar, 2015).

There is one primary reason why Amazon is outpacing its competition within the retail space; end users are visiting its mobile websites much more often and staying for longer than they do in other sites of the company’s competitors. A recent analysis by the Business Insider reported that users of mobile phones spent an approximate 103 minutes per every 30 days on Amazon, in comparison with 20 minutes on the mobile site of Target, and 14 minutes on Wal-Mart. Besides, customers also returned to Amazon’s website approximately six times every thirty days, vis-à-vis 2.5 times for Wal-Mart and 2 times for Target. Upcoming retailers like Nordstrom and Macy’s also attest to the reality that consumers conduct return visits to their mobile sites between two and three times within one month. Amazon not only leads its competitors when it comes to mobile usage and adoption, but that the gulf between spending time on the company’s website and basically all the other platforms is rapidly expanding, suggesting further gains in market share ahead.

Since 80% of online shoppers are visiting sites that give a retail opportunity on their mobile phones, bringing forth a user experience that is compelling has become very important for Amazon. The company has responded to this market trend by making all the necessary and up to date updates to its mobile experience (Chou, 2016). The efforts have really brought about success for this online retail giant, which give it a quarter on quarter earnings report that supersede the expectations of the market and analysts. For instance in one afternoon, the founder of the company had his fortune balloon with an increase of 6 billion USD within a single afternoon.

What’s more, the company’s well established mobile experience also presents itself as a traditional retail stores endeavors to keep all their doors ajar. For instance in April 2016, department store J.C. Penney introduced salary cuts and froze overtime for all its workers all in a bid to cost cut and avoid bankruptcy. In addition to that, its counterpart Sears closed more than 200 locations over the past two years and teen-apparel chain Aeropostale filed for bankruptcy in May 2016. The history of Amazon as a company depicts a journey of diversification and product development. Moreover, company’s customer centric approach sees to it that all customer needs are well taken care of. Amazon’s unique set of products has provided it with a strong brand image and a multitude of repeat customers.

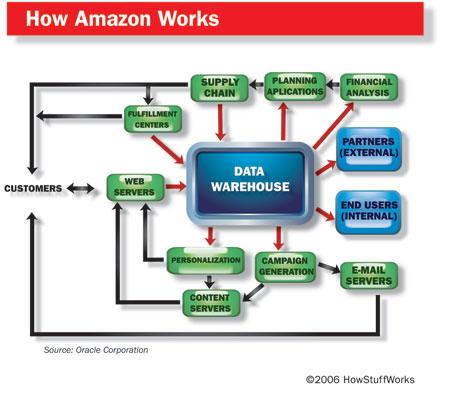

Information TechnologyAmazon utilizes Information Technology to support and enable a number of its businesses process and competitive strategies. Mainly, the company has found Information Technology hardware and software programs useful in the storage of data, data processing, data security, e-commerce cash wiring and transactions, and data sharing which revolves around the company’s Knowledge Management strategies. The image below is a depiction of how Amazon works; keep in mind that the company is mostly powered by Information Technology.

The major core of technology that keeps Amazon running is exclusively based on Linux. As of the year 2005, Amazon is in possession of the planet’s three largest Linux databases, with a total data storage capacity of 7.8 terabytes, 18.5 terabytes, and 24.7 terabytes in that order. The central Amazon data warehouse is composed of 28 Hewlett Packard servers, with four Central Processsing Units per node, running Oracle 9i database software.

The company’s data warehouse is basically divided into 3 functions: query, ETL, and historical data; a primary database function that pulls information from a single source and incorporates it into another one. The query servers are composed of 15 terabytes of raw data by the year 2005; the click history servers manage to hold 14 terabytes of raw data; and the ETL cluster is composed of 5 terabytes of raw data. The company’s architecture of technology is able to handle millions of back-end operations each single day that passes and questions from more than 500,000 third-party sellers. Respective to a report released by oracle after it facilitated the migration of Amazon’s information warehouse to Linux in the year 2003 and 2004.

The company’s technology can help it process a top-end 1 million shipments and 20 million updates in its inventory within a single day. The company’s present sales volume is a surefire way of telling that hundreds of thousands of end users send their credit card information to the company’s servers with every passing day and data security is a primary concern. In addition to the automatic encryption of credit card details in the checkout process, Amazon permits its end users make a choice to encrypt every piece of data they enter into the system such as address, name, and gender.

Amazon uses the Netscape Secure Commerce Server utilizing the SSL (Secure Socket Layer) protocol; this stores all credit card numbers in separate information systems that cannot be accessed through the internet; this cuts off the all possible entry points for hackers. End users who are particularly careful and can choose to enter only a partial credit card number over the internet and then offer the remainder by phone the moment the online order is submitted. Save for the normal security concerns relating to credit card purchases made online, Amazon has in some instances suffered from phishing challenges that has plagued PayPal and eBay. Cyber criminals have a habit of asking customers their Amazon.com account information (Bai, Dhavale & Sarkis, 2014).

In a nutshell, Amazon uses Information Technology to make it easy for customers to navigate around its website; this is because user friendliness encourages customers to carry out repeat purchases. Effective communication enabled by technology helps the company to continue with its 24-hour shipment program that makes deliveries two times faster. Amazon, being an online market platform that used information technology to run most of its operations, marketing through pop-up ads included, can attribute 95% of its success to information technology.

Leadership

Amazon’s leadership is first and foremost defined by its founder and CEO Jeff Bezos; he is also the company’s chairman and president. Other leaders of the company include Werner Vogels who is the CTO, Jeff Wilke who is the CEO of the company’s consumer segment, and Andrew Jassy who is the CEO of AWS. With respect to the deployment of Information Technology, Amazon prefers to keep up with the times; to spend more in the short run but to get more returns in the long run. For instance at the moment, Amazon is serviced by 28 Hewlett Packard servers; with the kind of leadership that Amazon has, it would not hesitate if there was a need to buy more servers (Medhat, Hassan, & Korashy, 2014). What the company founder and CEO Jeff Bezos identified that made the company what it is today is that people from different parts of the world needed goods from overseas countries that were not produced in their home countries. If given the chance, such individuals would be very willing to pay the price of the good in question and even make a little contribution in shipping expenses.

Market and Financial PerformanceAs at 2016, Amazon’s revenue reached 135.98 billion USD; this was paired with an operating income of $4.2 billion. The total assets of the company stand at 84 billion USD and the net income of the company is US $2.371. Amazon’s total equity is close to 20 billion USD.

With respect to recent industry figures, Amazon Inc is the number one retailer in North America with an annual average of more than 107 billion USD in net sales. Most of the corporation’s revenue is generated via electronics sales and other product sales, followed by other activities and media. As of now the company boats of 304 million active consumer accounts all over the world. The price of Amazon’s acquisition of Zappos was 136 billion dollars and with 341,400 employees; besides, Amazon’s outbound shipping costs are in the tune of 16.2 billion dollars on an annual basis. Amazon’s brand value is $45.73 billion and the year over year revenue growth of the company is 27%. With an online user reach of 81% in the United States, Amazon is doing fairly well in the states; the company’s Kindle e-reader market share is 73.7% and the Kindle Fire tablet content revenue is $ 5246.8 million. Overall, it is worth mentioning that Amazon’s yearly revenue of internet services amount to 12.22 billion USD.

TrajectoryAmazon depends on knowledge and information sharing through the internet to thrive. The company business level strategies revolve around customer centered products and services while its corporate level strategies center around the use of information technology to better end user experience. The company is effectively positioned for the future since it has plenty of capital reserves at its predisposition to take up new corporate projects and survive market fluctuations.

References

Bai, C., Dhavale, D., & Sarkis, J. (2014). Integrating Fuzzy C-Means and TOPSIS for performance evaluation: An application and comparative analysis. Expert Systems with Applications, 41(9), 4186-4196.

Chou, M. (2016). An Analysis of Buyers and Reviewers Community in Amazon. com Through Wenger’s Domain-Practice-Community Framework.

Heizer, R., & Barry, R. (2013). Operation Management, Sustainability and Supply Chain management (Vol. 11). Pearson, UK.

Jain, E., Madan, M., & Singh, S. (2016). Impact of Value Creation on Stock Prices: A Study of Amazon. Com, Inc. Middle East Journal of Business, 11(2).

Medhat, W., Hassan, A., & Korashy, H. (2014). Sentiment analysis algorithms and applications: A survey. Ain Shams Engineering Journal, 5(4), 1093-1113.

Mishra, S. V., & Kotkar, S. N. (2015). A Study of current status of E-Commerce in India: A comparative analysis of Flipkart and Amazon. International Journal of Advanced research in Computer Science and Management Studies, ISSN, (2231-7782).

Rachet, B. (2014). Six Sigma at Amazon. Com. Docs. school Publications.

Ritala, P., Golnam, A., & Wegmann, A. (2014). Coopetition-based business models: The case of Amazon. com. Industrial Marketing Management, 43(2), 236-249.