operational plan

| Soupman, Inc. |

| Business Plan |

| Marketing Plan |

| Team 2: Brandi Seich, Mark Seich, Jonathan Downes, Jessica Gonzalez, Yiren Jiang, Jiachen Li 2-27-2017 |

Soupman, Inc. focuses on reaching three primary segments under the name “Original Soupman”:

The Convenience, Quality Shopper. Someone interested in purchasing a consistently tasteful quality, fresh product for themselves and/or their family, which can be prepared with ease and convenience.

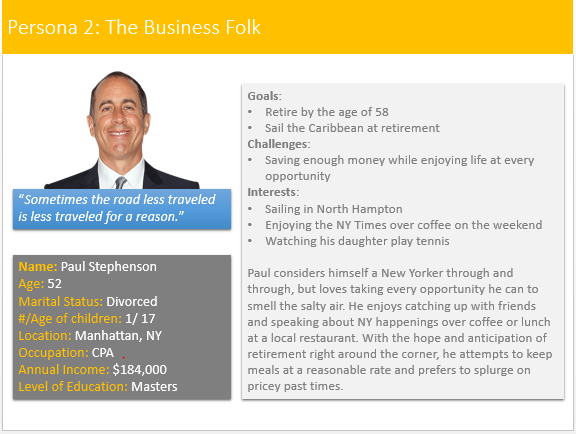

The Business Folk. Local business workers within the tri-state area of NY, NJ and CT in search of a local dining experience for lunch or a quick dinner.

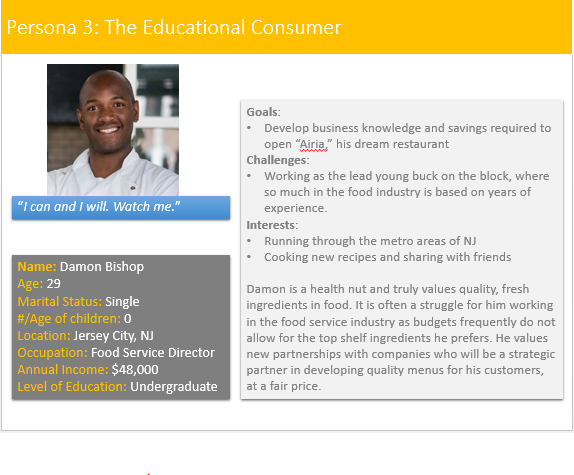

The Educational Consumer. Buyers within the educational market of high schools and colleges looking to provide vegetarian, quality products to students and faculty.

Soupman, Inc. under the name Original Soupman will continue to focus on three key market segments: convenience, quality shoppers; business folk; and educational consumers. There are multiple delivery systems to service these three markets including: grocery locations, food services – brick-and-mortar and mobile; and educational.

The convenience, quality shopper would be those individuals shopping at a grocery or soon to come convenience store location looking for a quality, convenient product they feel confident in for their own consumption or their families. Their needs are met through the Original Soupman soups which are available in 17 ounce Tetra Pak cartons delivered through the grocery segment in 6,500 grocery stores. The soups have prime positioning beside market leaders such as Campbell’s and Progresso. Some of the prestigious retailers within the grocery segment include Kroger, Costco, Safeway, Albertson’s, Publix, Wegman’s, HEB, Shoprite, Acme, Shaw’s and Winn Dixie among other regional chains as well.

The business folk are those within the NY, NJ, and CT area who are looking for a quick, convenient, but consistently tasteful dining experience for lunch, dinner or anything in between. In addition to soups, sandwiches and salads are also available. These consumers are served in one of our eight franchised and licensed brick-and-mortar locations. They can also be served by our mobile location, which provides a daily calendar for consumer convenience. This mobile market is served through using heat ‘n service pouches to ensure consistent flavoring no matter the location of choice.

The educational consumer is served in a number of schools and colleges in the NY area. This segment is serviced through the use of bulk flash-frozen soups and other products (e.g., Mexicali Beans, Stewed Pinto Beans and Curried Chick Peas with Tomatillos).

Soupman has identified substantial distribution opportunities in national restaurant chains, college campuses, stadiums as well as other food service venues. Early testing has begun within a national restaurant chain and has been quite successful.

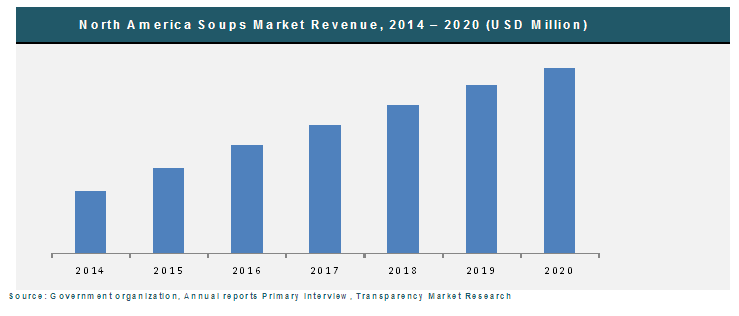

Significant opportunities reside within the grocery segment. The North America Soup market shows continual growth in revenue of 0.7% compound annual growth rate (CAGR) between 2014 and 2020. Chart I demonstrates the continued projection aligned to this prediction. As the Soupman has gained positions within 6,500 grocery store locations across the US, we see continued sales growth within existing locations, as well as opportunities in similar distribution channels such as convenience stores.

CHART I: North America Soups Market Revenue

To broaden our reach within the convenience, quality shopper to the millennial demographic, related products to our core offering such as bone broths will be offered in 2017. This will be in addition to new flavors of soups. These additions are a natural extension of our brand and the category is trending positively on sites such as Amazon.com and ThriveMarket.com.

Target Market Segment StrategySoupman, Inc. is geared to serving the buyer who is looking for a consistently tasteful, quality, convenient soup at a reasonable price with fresh ingredients. The buyer doesn’t have time to prepare a gourmet soup, but has money to purchase something outside of the norm, with no preservatives and served in BPA free packaging.

To reach this segment, Soupman has identified 30 second radio ads within the grocery store to be the most cost effective and providing the highest return (44% within the test market). When available this channel will be utilized, whereas in other locations sampling as well as promotional pricing will be used. Pricing previously tested showed a spike in sales with the slight discount offered from $3.49 to $2.99 per unit. Our target market testing has confirmed that once a consumer tries our product they will purchase and continue to purchase over other competitors in the market.

Personas

At Soupman we have developed a persona for each of the three segments we target: grocery, food services, and educational.

According to the US Soup Survey in 2014, nearly two-thirds of respondents report buying condensed canned/boxed/carton soup for someone in their household within the last six months. The predominant use of the soup was for the lunch mealtime for busy consumers and fewer than half of the respondents reporting eating for soup for dinner. There was a total of 14% of respondents who reported eating soup as a snack between meals. This data opens up the opportunity for better positioning of dinner time use as well as the drinkable soup solution, which presented Campbell’s Soup on the Go with growth of 39.6% between 2012 and 2013.

Additional product features of importance were low-sodium, added vitamins and minerals, high fiber, all natural/organic, and a full servings of vegetables. A third of the respondents who do not buy soups say it is due to the preference for homemade soup.

An overall conclusion of the survey is “Overall, it appears that slow market growth stems from a number of factors, including the perception among many consumers that while soup is a relatively healthy meal, soups that contain high amounts of sodium, artificial ingredients, and/or preservatives actually may pose a health risk.” This presents another opportunity for better brand positioning and awareness of the Soupman brand, which is indeed a better for you option.

Soup stations have also been identified as an important area to concentrate on by U.S. retail executives in 2015. This can present another opportunity for sampling events or for retail sales within the deli department.

Market GrowthThe soup market had a moderate decline between the years 2008 to 2011, but then slowly began to increase between 2011 and 2013. These soup sales are expected to continue growth between 2013 and 2018 from $6.9B to $8B.

The North America Soup market shows continual growth in revenue of 0.7% compound annual growth rate (CAGR) between 2014 and 2020 as previously shown in chart I.

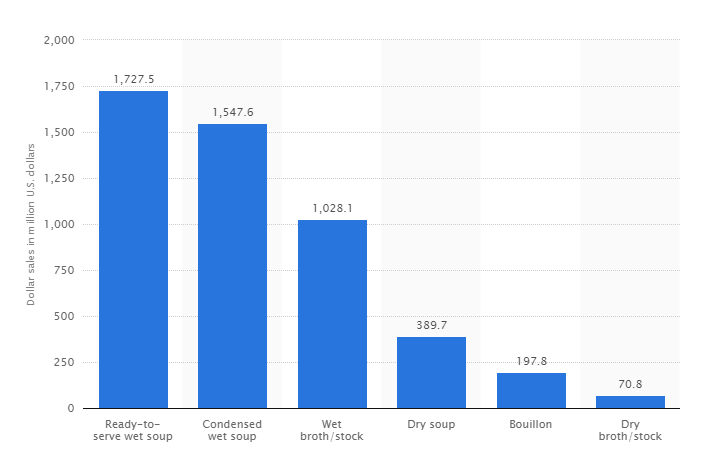

Specific to the ready-to-serve wet soup market compared to other types of soup, the category split can be seen in Chart II.

CHART II: Dollar sales of soup in the US in 2016, by category (in million USD)

The US consumer craves convenience, but with quality ingredients. This is exactly what the Soupman stands for. Consumers need products they feel confident giving to their families without long term harmful effects on their body.

According to the US Shopper Trend’s 2016 survey, 66% of consumers seek product claims to avoid negative ingredients implicated in health conditions or concerns and 22% worry that the food they eat isn’t healthy enough. With so much pressure on being a health aware consumer, product labeling should offer insights into these areas.

Industry AnalysisConsumers in the United States consumed over $5 billion in soup as recently as 2015. That amount showed a 4% rise in sales that has continued upward since some declines back in 2010/2011. This success can be attributed to ready to eat or serve (commonly referred to as RTE or RTS) as younger professionals look for quality easily to prepare soups. While some other segments of the soup industry have remained flat or have slight declines, the focus on quality products and ease of preparation have been a driving force for the rebound in soup sales. While the larger players in the market such as Campbell Soup Co. lead market share with 44%, that total has been in decline. This is being driven by smaller companies coming into the market that are specializing in quality products and focusing on a target segment of the consumer population instead of the masses. The forecast on the industry as a whole is to remain flat or even decline in some segments. However, the innovation of some segments will be the driving force to reach a wider consumer base than the traditional soup buyers. The rise in consumption of soups in North America is supported by increasing busy lifestyle and growing demand for ready to go foods in the U.S. In addition, the growing demand for healthy foods will drive the growth for soups market over the next few years.

SWOT Analysis

The largest segment of the soup industry comes from the grocery segment where consumers purchase either ready to eat, wet or dry soups to prepare at home. Another big piece of the consumption comes from the food services side where soup is provided in bulk to restaurants and other commercial food suppliers. However, with the largest segment of growth expected to come from innovation along with the professional consumers, the niche focused companies have an opportunity to widen the consumer base within the grocery segment.

Competition and Buying PatternsThere are a few different competitors in the various areas where Soupman operates. These include restaurant chains that center around soup specialties on their menu such as Zoup, the grocery segment suppliers such as Campbell Soup, Progresso, as well as the specialty fresh private label and niche suppliers, and lastly the bulk soup providers to for restaurant and educational segments such as Kettle Cuisine among others. There is a wide distinction between the various products and expectations of the products between each of those segments. They also tend to cater to different demographics depending on the channel.

In the restaurant segment is where The Original Soupman began and gained its notoriety. This segment caters to great tasting high quality ingredients that as their slogan states “The soup that New Yorkers – who don’t wait for anything – lined up around the block for”. While many restaurants offer various soups they create on their own, given the local nature of The Original Soupman with 8 locations in and around New York and New Jersey, the direct competition isn’t as aggressive. There are numerous national chains and local individual restaurants that have a similar look and feel, but for various purchasing reasons. These include time of order to receive, as well as some looking to have the authentic cultural experience of an original New York specialty eatery. However, with the growing success of food truck specialty eatery, this is a competitor that could begin to challenge the experience seekers.

Consumers of the grocery segment vary widely. This variation is due to the nature of various demographics and desires ranging from using soup as a piece of other meal preparation, to quick and ready to eat, and also the desire for having high quality ingredients and taste. While national competitors exist here such as Campbell Soup and Progresso, who lead in market share, the smaller up and coming suppliers of fresh, high quality soups are seeing the biggest growth filling a demand from the younger 40 and under professional health conscious buyers.

For the bulk supply aspect of the business, this again has a wide range of consumers and competitors. The large educational institutions and restaurant chains seeking acceptable quality at a low prices may buy from larger competitors such as Kettle Cuisine or even Sysco. But those organizations seeking a high quality product at a reasonable price would look to more specialty suppliers such as Soupman or Boulder Soup Works. These smaller organizations put a higher weight on quality ingredients and those competitors can be the same fresh ingredient suppliers in the grocery segment as many of them offer bulk and private label products and are a direct competition to Soupman.

Main CompetitorsSoupMan Inc has no direct competitors that mirror their entire operating model since we have three very distinct different ways to provide products to our consumers and operate in a regional basis for the restaurant piece. However, in the grocery and bulk food segment there is significant competition on many fronts. These range from national large corporations to smaller regional focused new suppliers that provide products to both of those segments.

Restaurant CompetitorsZoup was founded in 1998 and is now one of the fastest growing soup restaurants lead by its fast food like structure providing hundreds of premium and proprietary soups, though only offering 12 rotating soups at a time. This franchise model has grown to nearly 100 stores and focuses on the convenience of fast food, but providing high quality products. They were awarded #34 Top 100 Food & Beverage Companies by Inc. 5000.

Soupman has some significant competitive advantage over these type of regional chains such as Zoup because of the following offerings:

New York experience and local notoriety

Community grounding to their non-franchisee model

We offer our products in grocery stores for wider scale consumption

We offer bulk sales of our product to educational institutions as well as other restaurant chains like Tim Hortons

Consistent menu

In recent years Campbell Soup Co. closed a plant while letting go over 700 employees amidst a 2 percent decline in U.S. soup sales in 2012 which included a 7 percent drop in ready to serve product sales. While they still held a strong market share of 44%, they are struggling to find a way to stop the decline and turn the products around. Campbell’s has varying product lines attempting to target different consumer groups, but all around the canned product ready to eat line. Other smaller niche companies are showing substantial growth in this market such as Boulder Soup Works. They provide to retail stores such as Whole Foods, Kroger (as does Soupman) and over 500 other retailers throughout the country. They also provide a private label option for their buyers that provide another client base option than Soupman. Their sales have increased from 115-120 percent each year since opening in 2009 and have tripled their workforce. They focus on fresh ingredients and target a specific demographic.

The competitive edge that Soupman has over these competitors include:

Restaurant service options

We offer bulk sales of our product to educational institutions as well as other restaurant chains like Tim Hortons

We package using Tetra Recart packaging providing a more marketable shelf space, and also providing more product per square foot of shipping and shelf space

High quality fresh ingredients over national chains such as Campbell Soup

Companies such as Kettle Cuisine create a tough competitor as they provide fresh private label options and sell their products in bulk. Their all-natural soups are provided to both restaurants and institutions who desire high quality products and ingredients. At one point Kettles did provide a retail product, they since discontinued that line and now solely sell business to business. With over 60 percent of their sales coming from food service institutions and restaurants. Kettles also provide ethnic varieties to widen their audience and offerings.

In the bulk food segment, Soupman has a competitive edge because of the following:

Restaurant service options

Large retail product offering

We package using Tetra Recart packaging providing a more marketable shelf space, and also providing more product per square foot of shipping and shelf space

High quality fresh ingredients over national providers such as Sysco

Soupman realizes there are other niche market players in all of the various segments that we offer products. We will have to continue to improve and leverage innovative solutions to differentiate our products and brand. We have now started to offer our retail products on Amazon as another way to get in front of our buyers in a convenient way. There will always be another competitor doing a specific thing better than Soupman, but collectively with all of our operations Soupman will hold its quality to a high standard while recognizing the needs of the consumer.

Conclusion of Industry AnalysisThe North American soup market is expected to continue its growth into 2020 at a rate of 0.7% from 2014-2020. Retail outlets such as supermarkets will be the driving force behind this growth and expected to lead the distribution share of the soup market by 2020. Recent results from 2015 found that the current soup value growth was 4% and volume growth at 2% in the U.S., ahead of expectations.

Sales of pre-packaged soup in the retail segment are expected to continue growing slowly between 2013 and 2018, from $6.9 billion to $8 billion with a large portion by consumers aged 25-44. This will be driven by the current marketing trend of fresh quality ingredients on the store shelves. The global market intelligence agency Mintel has forecasted that the US soup market will grow slowly between 2013 and 2019. This aligns with other market research and also supports the indications that brands can encourage that growth by offering higher quality, better-for-you soups. Additionally by offering expanded flavor varieties, and more convenient packaging that can allow easier consumption by heating and eating from the same container will drive desire for the product. There is a challenge in the future outlook at the moment as younger consumers aged 18-24 are least likely to choose a higher quality product item due to the high price point and their lower household income. However, as they move to a higher income, the question is will they begin to seek those products or stick to their more reserved buying behaviors? Either way, the industry is growing and Soupman has an opportunity to grow with it.

Sources:

Avention. (2017). Avention One-Stop Reports for Soupman Inc. Concord, MA: Morningstar.

Scarborough, N. M. (2014) Essentials of Entrepreneurship and Small Business Management. Upper Saddle River, NJ: Pearson Education, Inc.

Retrieved February 19, 2017, from http://www.transparencymarketresearch.com/north-america-soups-market.html.

Retrieved February 19, 2017, from http://www.preparedfoods.com/articles/115140-top-soup-trends-in-2015.

Bender, J. (n.d.). Topic: Soup Industry. Retrieved February 19, 2017, from https://www.statista.com/topics/2083/soup-industry/

FMI. (2016). Retrieved February 19, 2017, from http://www.fmi.org/docs/default-source/webinars/fmi-2016-us-grocery-shopper-trends-overview-webinar5ce7030324aa67249237ff0000c12749.pdf

Retrieved February 19, 2017, from http://www.retailleader.com/top-story-trends-soup_s_on_as_retailers_provide_fresh_varieties_-1369.html

Retrieved February 19, 2017, from http://www.euromonitor.com/soup-in-the-us/report