GIT

Apple Incorporation

Brian Smith

ECO/561

Professor Mc Gee

2/25/2017

Introduction

Apple Inc. is a worldwide American company that produces cell phones, computer software, consumer electronic products and personal computers. The commonly known products of the Apple include: the iPhone, the iPod, the iPad and the Macintosh line of computers ("Apple Inc. | American company", 2017). Approximately 301 retail supplies in 10 nations are operated by Apple in August 2010. The Apple software is found on the Mac OS X operating system, Final Cut Studio, iWork suite of productivity software, Logic Studio which is a music production tool’s suite, iOS; a mobile operating system, the iLife suite of multimedia, the iTunes media browser and creativity software, the Aperture; which is a professional photography package, AirPlay, Airprint, etc. Apple Company was established on the 1stApril, 1976 by co-founders Steve Jobs and Steve Wozniak in California. It was first named Apple Computer Inc. for 30 years and later on January 9, 2007, the word “Computer” was removed.

The market structure

Apple Inc. can be considered to stand in two different market structures such as the oligopoly and the monopolistic competition. Oligopoly market is a form of market structure that is controlled by few competitors who are referred to as the oligopolists (Tey, & profile, 2017). Companies in the oligopoly market usually maintain position in such a market since it very costly and difficult to enter into such a market. The Apple Inc. is oligopoly in smartphones operating systems’ firms. There exist three operating systems which are very competitive in the market. They include the iOS owned by the Apple Inc., windows phone which is owned by the Microsoft and the Android which is owned by the Google. These three are the very most competitive operating systems globally and they keep improving their features so as to dominate their competitors and they form the oligopoly type of market. In addition, the Apple Inc. lies in the monopolistic competition market in the branded computers. In monopolistic market, there is no competitors thus the Apple’s iMac and the MacBook are considered to be monopolistic competition.

Market share

The overall market share of the Apple Inc.in United States signifies the percentage of the sales of the Apple’s devices in only the U.S. Market. For instance, the iPhone 7 and the iPhone 7 plus hit the ground running. The iPhone sales represented a percentage of 40.5% of the smartphone sales in three months up to a notable 7% points years over a period of one year from 33.5%.

Market competitors

The Apple Inc. offers a range of products as well as services worldwide. This makes the company face fierce competition in different industries which range from the personal computers to the entertainment media to the mobile payment systems.

In personal computers, Apple Inc. has been facing competition from Dell, Lenovo, Acer and Hewlett-Packard (Jurevicius, 2017). Microsoft running operating systems has remained to be favorite to the consumers since 1980s, though the Apple Inc. has maintained loyal following of the users who report high satisfaction with the company’s operating systems. In the mobile computers, Apple faces competition from Samsung, Nokia, Google and Asus. The iPod transformed the business model of Apple and stimulated the entire industry of mobile computing imitators. In the smartphone industry, the Apple iPhone has dominated after the Canadian giant Research in Motion. The company faces competition from phone producing companies such as Lenovo, HTC, Huawei, Samsung, Sony and others.

Barriers to entry

There are numerous barriers to entry into the electronic device industry in the United States. The very toughest barriers to the entry are high capital requirement in purchasing the manufacturing plants, hire amount of capital for the raw materials as well as hire labor. In addition, there are also barriers such as High research and development cost – Apple Inc. spends much on research and development thus sending a signal to the potential entrants that the company has large financial reserves. So as to compete with the Apple Inc., the new competitors has to exceed this level of spending so as to compete in future. This will in return deter the new competitors from joining the market. Another barrier to entry is the ability of mass production so as to reach the affordable value for the customers. Distribution could be a major barrier to the new entrants especially because the industry lots have less space and there are many existing electronic device production companies.

Competitors’ analysis

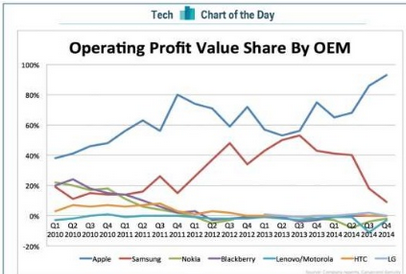

The Apple Inc. is relatively the only company making commendable profit from the sale of Smartphone brand compared to its competitors. Due to the barriers of entry in the Apple market, Apple Inc. takes look at the state of profits smartphone companies in every quarter since it has invested heavily than its competitors. Apple competitors have hard time since for them to outshine Apple Inc., they have to invest as much as the Apple did and thus cannot be possible. Because of this reason, Apple Inc. remains to enjoy the highest percentage of the market share. For instance, Apple has been the leader for long but for a short time Samsung it looked as if it was going to catch with Apple but since then, Samsung share of the profit is down to approximately 9%. Currently, Apple Inc. has won the market with the introduction of iPhone 7 and iPhone 7 plus which has big screens than the products of its competitors. From the previous year data, Apple Inc. sold 74.5 million iPhones last quarter thus registering approximate of $12.5- $13.6 billion in profits. The graph below shows the difference between the competitors in the market with their profits.

Trends in current macroeconomic

Apple Inc. has been a very successful company over the last three years. It has been creating products which many people love and also the company has directly created nearly 50,000 American jobs though many Americans criticized the company for not locating the manufacturing operations in the US. It is not enough for the Apple Inc. to have transformed the world with the innovative consumer electronics. The company must rebuild the American manufacturing but not any manufacturing. The utility for Apple Inc. is to provide framework within which the significant changes which have happened in the worldwide economy for the recent period.

Apple Inc. is in its maturity stage of the life cycle. This is because the market for the Apple Inc. products is already saturated. I.e. most consumer companies that are sales forecasts are using the products. Sales in this stage grow about on a par with the population. Price competition in the Apple products is now intense. So as to compete with the competitors, Apple Inc. makes finer differentiations in their products, promotional practices as well as their customer services. This stage naturally calls for emphasis on competing more efficiently and effectively. The Apple Inc. has to appeal to its customers based on their prices and also the marginal product differences.

It is estimated that Apple Inc. is 0.5% of the US gross domestic product (GDP) and 0.15% of the Global gross domestic product. GDP measures the worth of the goods and also the services produced in a given country and it is usually not identical to the revenue of the company. It is possible to conclude that Apple Inc. is more into devices creation business but not job creation. In the $1 billion data center built down in the North Carolina created only 50 permanent local jobs which works out to be around $ 200,000 per spot. In earlier data, the U.S. bond sales raised a total of $17B in the year 2013, $17B in 2014 and $8B in 2015. During the latest earnings report, Apple Inc. advised that it had executed $153B of the planned $200B stock buyback program.

Trends in demand

The Apple Inc. registered quarterly revenue totaling to $46.9 billion and also the quarterly net income worth $9 billion, or $1.67 per diluted share ("Document", 2017). These data compare to the revenue worth $51.5 billion as well as net income worth $11.1 billion, or $1.96 per diluted share, for the year-ago quarter. The gross margin was registered to be 39% compared to the 39.9% in the year-ago quarter ("AAPL Income Statement | Balance Sheet | Cash Flow | Apple Inc. Stock - Yahoo Finance", 2017). The international sales registered was62% of quarter’s revenue. The September quarter results of Apple Inc. was strong and thus made the 2016 fiscal year to be very successful for the company. The customers positive response to the iPhone 7, iPhone 7 Plus as well as the Apple Watch Series 2 made the revenue to grow by 24% setting all-time record.

Apple Inc. is making the most stunning financial runs in the corporate America. From the records, the company made sales of over 365 million devices for the last five years. Out of these devices, 50 million devices were sold in the last quarter and now the company is averaging nearly $4 billion as monthly profit. The company has total$110 billion in cash and since the company is well positioned it can take advantage of the major changes in the new digital economy and register high profit than before.

Price elasticity is the amount of percentage change in the quantity demanded related to one percent change in the price. The Apple’s price elasticity of demand is generally high which implicates that it is fairly elastic. The reason to why demand is elastic is because there is more than one existing substitutes thus the market gives the consumers chance to select and buy from the sellers of their choice. Large competition in electronic devices field sets a range for pricing of the devices. The marginal cost of manufacturing 16-gb Apple iPad is estimated to be $260. This cost is inclusive of the $95 for touch-screen display as well as $26.80 for device’s processor. The Apple flash memory is around $29.50 in costs on the 16-gb model, $59 in 32-gb version and $118 in the 64-gb model. The variances in the costs of the flash memory push the manufacturing cost of the 32-gb version of iPad, which costs between$599 and $289.10. Apple Inc. has healthy profit margins on its devices; approximately 48% for 16-gb iPad, 50% for 64-gb iPad and 52% for 32-gb iPad.

Market strategies

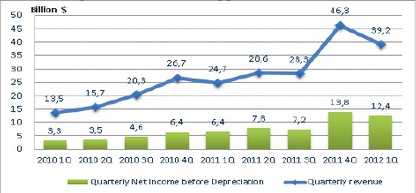

According to the results of the Apple Inc., 2012, it is clear that the company makes good use of its strength so as to maximize the rate of profit as well as outshining its competitors. The reason beside this is the increase in revenue from 24.7 billion to a value of $39.2 billion which is calculated to be 59%. In addition, the quarterly net income also increased from $6.4 billion. The figure below shows the revenue of Apple Inc. in 2012.

From the graph above, the demand and supply of the Apple Inc. products is increasing daily. The net income from the graph above is increasing from one year to another. This implicates that the Apple Inc. while maximizing its revenue, the net income also increases hence in return register good profit margin. If Apple Inc. keeps making good use of its strength, the net income will proportionately increase for the next following years.

Costs of Production

There are many production costs that Apple Inc. faces. These costs can be divided into two sub divisions which include the fixed costs and variable costs. Fixed costs are the costs which remain unchanged for all the production process while the variable costs are the costs which change with every project. The manufacturing industry, the research and development costs are examples of the fixed costs while the labor costs, administration cost and raw materials are variable costs. These costs are required in the process of production so as to ensure the company makes profit. Apple cannot do away with any of the costs because the devices cannot be assembled without labor.

Recommendation

The SWOT analysis of Apple Inc. shows that the company has major strengths which can be utilized to efficiently address the organizational weaknesses Apple Inc. should use the strengths of the company in exploiting the opportunity to increase its distribution network. In addition, the company should use its brand image as well as the fast innovation processes in order to successfully improve and unveiling new product appearances. However, Apple Inc. faces major threats of hostile competition and Imitation. The Company should address these threats through creating a strong patent portfolio as well as a continuous invention so as to ensure the competitive advantages of its products even if its main competitors try to catch up. The Apple Inc. should try to reduce the prices of their products. This will assist in creating new potential customers as well as retaining the existing customers and in return increase its market share. The company should also improve on its relation with the workers. It should reduce the working hours for the employees as well as increase the rate of salaries. By so doing, the workers will work on a good relationship with the company hence register commendable profit.

References

AAPL Income Statement | Balance Sheet | Cash Flow | Apple Inc. Stock - Yahoo Finance. (2017). Finance.yahoo.com. Retrieved 24 February 2017, from http://finance.yahoo.com/quote/AAPL/financials?p=AAPL

Apple Inc. | American company. (2017). Encyclopedia Britannica. Retrieved 24 February 2017, from https://www.britannica.com/topic/Apple-Inc

Document. (2017). Sec.gov. Retrieved 24 February 2017, from https://www.sec.gov/Archives/edgar/data/320193/000162828017000717/a10

Jurevicius, O. (2017). Apple Inc. SWOT analysis - Strategic Management Insight. Strategic Management Insight. Retrieved 24 February 2017, from https://www.strategicmanagementinsight.com/swot-analyses/apple-swot-analysis.html

Tey, J., & profile, V. (2017). The market structure of Apple Inc.. The-apple inc.blogspot.co.ke. Retrieved 24 February 2017, from

http://the-apple-inc.blogspot.co.ke/2013/10/the-market-structure-of-apple-inc.html