Credit Analysis for Vonage

Bank credit analysts have traditionally referred to the five Cs of credit analysis: capacity, character, capital, collateral, and conditions.

Capacity

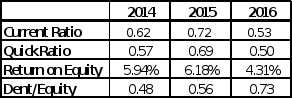

Capacity refers to the borrower’s legal and financial capacity to borrow. The first consideration is to verify Vonage is capable of borrowing. By comparing the current assets and current liabilities for the current ratio a bank can measure the ability for Vonage to repay a loan. After analyzing Vonage’s financial statements from 2014 to 2016 fluctuated but remained under 1.0. Lower than 1.0 means Vonage could have problems in meeting loan obligations. The difference between 2014 and 2015 could indicate that there could have been a hold on too much of the inventories that could not be sold and too much cash on hand which may have been hard to utilize.

Table 3A

Character

Capital

When it comes to capital, a company must have sufficient equity. When a company has sufficient equity there is cushion to withstand a failure in the inability to generate cash flow. The balance sheet

Table 3B