finance assignment

QUESTION 1

The company LT Ltd is considering the introduction of a new product. Generally, the company’s products have a life of about 5 years, after which they are deleted from the range of products that the company sells. The new product requires the purchase of new equipment costing $400,000. The ATO’s depreciation schedule allows an effective life of 10 years for such equipment and that the company chooses to use the Diminishing Value Method for tax purposes meaning the annual tax depreciation rate would be 100% higher than the rate connected with prime cost depreciation. Assume that at the end of 5 years the equipment can be disposed of easily and will generate proceeds of $157,500.

The new product will be manufactured in a factory already owned by the company. The factory originally cost $150,000 to build and has a current resale value of $350,000, which should remain fairly stable over the next 5 years. This factory is currently being rented to another company under a lease agreement that has 5 years to run and provides for an annual rental of $15,000. Under the lease agreement LT Ltd can cancel the lease by paying the lessee an amount equal to 1 year’s rental payment.

It is expected that the product will involve the company in sales promotion expenditures which will amount to $50,000 during the first year the product is on the market. Additions to net operating working capital will require $22,500 at the commencement of the project and are assumed to be fully recoverable at the end of year 5.The new product is expected to generate net operating cash flows as follows before tax:

Year 1 $200,000

Year 2 $250,000

Year 3 $325,000

Year 4 $300,000

Year 5 $150,000

Required rate of return is 10% and the company tax rate is 30%. Calculate the NPV. Show all calculations and ignore the existence of any applicable GST

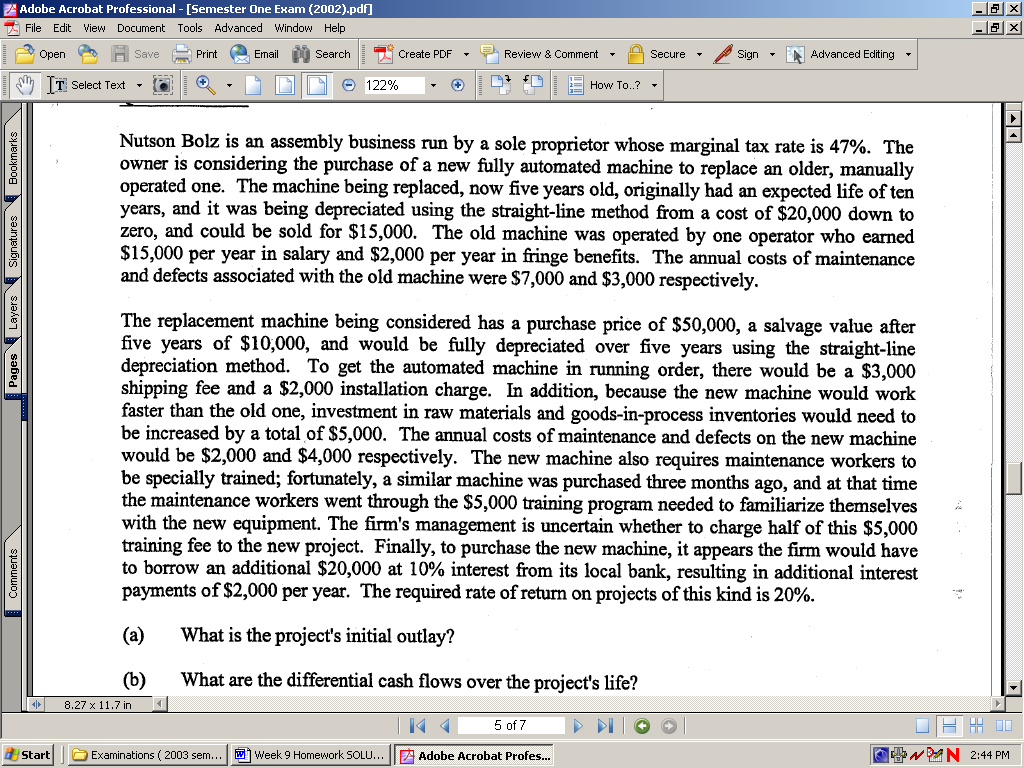

Q UESTION 2

UESTION 2

Note on interpreting the above:

To stop any confusion around the cost of existing labour just take it that the operator of the machine costs the company $17,000 p.a. in total wages and on costs and that the full $17,000 is tax deductible to the firm.

Required:

What is the project’s initial investment?

What are the incremental cash flows over the project’s life in years 1-4?

What is the incremental cash flow in terminal year (year 5 cash flow)?

What is the NPV?

What is the IRR? You may need an Excel spread-sheet to make this calculation.

Should the project be accepted (yes/no)? Why/why not