Mangerial accounting HW

Note: (all numbers are in thousands of U.S. dollars and thousands of units)

Question 1

Using budget data, how many Apple iPhone 4’s would have to have been completed for Danshui Plant No.2 to break even?

Answer

Contribution Margin = Sales – Variable Cost

Contribution Margin Ratio = Contribution Margin / Sales

BEP $ = Fixed Cost / Contribution Margin Ratio

Price per unit = sales / units

BEP units = BEP $ / units

Therefore:

Contribution Margin = $41,240 - $40,411 = $829

Contribution Margin Ratio = $829 / $41,240 = 0.02

BEP $ = $729 / 0.02 = $36,450

Price per unit =$41,240 / 200 units = $206.2 per unit

BEP units = $36,450 / $206.2 per unit = 176.77 units

Question 2

Using budget data, what was the total expected cost per unit if all manufacturing and shipping overhead (both variable and fixed) were allocated to planned production? What was the actual cost per unit of production and shipping?

Answer

Total Expected cost per unit = Expected Total Cost / Expected units

→ $41,140 / 200 units = $205.7 per unit

Actual cost per unit = Actual Total Cost / Actual units

→ $38,148 / 180 units = $211.93 per unit

Question i

What substantive issues were raised?

Answer

Production problem:

Danshui Plant No.2 was not able to fulfill the demand for the contract.

It needs to produce 200,000 units per month of Apple iPhone 4 , but the actual produce of 180,000 units iPhone per month.

A shortage of 10% has result them to face loss about 672,000 rather than profit of 100,000.

Lack of qualified labor force:

There is difficulty in finding enough people to match their production despite raising wages by almost 30%.

Higher chances of errors as the assembly process was handled by different workers with different skills and working styles.

Cause a lot wastes in term of cost time due to the carelessness and the lack of skill of the workers.

Problem with Samsung flash memory installation:

Samsung flash memory was too damaged 1000 flash memories during installation process.

Samsung has begun to install a shield to prevent some of the damage.

Samsung raised the price of each unit by 2.00.

Question ii

Student analysis of the case should include the Danshui Plant 2 context and some of the problem it is facing.

Answer

Breakeven point:

Price per unit = Revenue / units

= 41,240,000 / 200,000 = 206.20 $

Variable costs per unit = Variable costs / unit

= 40,411,000 / 200,000 = 202.06 $

Contribution margin = price per unit – variable cost per unit

= 206.20 – 202.06 = 4.14 $

Breakeven point = fixed costs / contribution margin

= 729,000 / 4.14 = 176,087 units

Cost per unit:

| Total expected cost per unit | Actual cost per unit | |||

| Total costs | 41,140,000 | Total costs | 38,148,000 | |

| Budget production units | 200,000 | Actual production units | 180,000 | |

| Total expected cost per unit | 41,140,000 / 200,000 = 205.70 $ | Total actual cost per unit | 38,148,000 / 180,000 = 211.93 $ | |

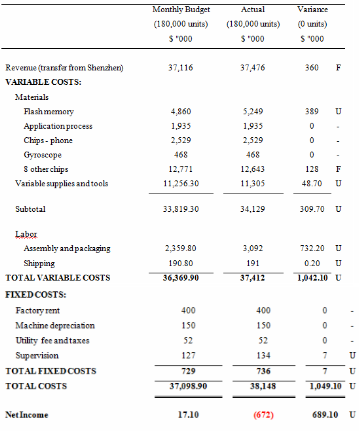

Flexible budget:

Variance analysis:

| Monthly budget | Actual | Flexible monthly budget | Flexible variance | F / U with reasons | |

| Units | 200,000 | 180,000 | 180,000 | ||

| Revenue | 41240 | 37476 | 37116 | 360 | F |

| Variable costs materials: | |||||

| Flash memory | 5400 | 5249 | 4860 | -389 | U |

| Application process | 2150 | 1935 | 1935 | ||

| Chips-phone | 2810 | 2529 | 2529 | ||

| Gyroscope | 520 | 468 | 468 | ||

| 8 other chips | 14190 | 12643 | 12771 | 128 | F |

| Variable supplies and tools | 12507 | 11305 | 11256.3 | -48.7 | U |

| Subtotal | 37577 | 34129 | 33819.3 | -309.7 | U |

| labor | |||||

| Assembly and packaging | 2622 | 3092 | 2359.8 | -732.2 | U |

| Shipping | 212 | 191 | 190.8 | -0.2 | U |

| Total variable costs | 40411 | 37412 | 36369.9 | -1042.1 | U |

| Fixed costs: | |||||

| Factory rent | 400 | 400 | 400 | ||

| Machine depreciation | 150 | 150 | 150 | ||

| Utility fee and taxes | 52 | 52 | 52 | ||

| Supervision | 127 | 134 | 172 | -7 | U |

| Total fixed costs | 729 | 736 | 729 | -7 | U |

| Total cost | 41140 | 38148 | 37098.9 | -1049.1 | U |

| Net income | 100 | -672 | 17.1 | -689.1 | U |

Question iii

What type of information has been provided in the Exhibit 1,2& 3.

Answer

Question iv

Budgeted and Actual Cost for each iPhone 4

Answer

| Budgeted | Actual | |

| Variable Costs: | ||

| Materials | 187.89 | 189.61 |

| Labor | 13.11 | 17.18 |

| Shipping | 1.06 | 1.06 |

| Total Variable Costs: | 202.06 | 207.85 |

| Fixed Costs | 3.65 | 4.09 |

| Total Cost Per Unit | 205.71 | 211.94 |

Total Fixed Cost = Monthly Fixed Cost / Number of Units

729.000 / 200.000 = 3.65

736.000 / 180.000 = 4.09

Question v

Calculate the budgeted selling price per unit, the gross margin per unit, and the gross margin percentage.

Answer

| Total Cost Per Unit | 205.71 | 211.94 |

| Selling Price | 206.20 | 208.20 |

| Gross Margin | 0.51 | 3.74 |

| Gross Margin Percent | 0.2 | 1.8 |

Questionvi

Why the gross margin per unit and the gross margin percentage are low?

Answer

Question vii

Calculate budgeted or expected break-even point. Is it higher than 180,000 units? Why losses of $672,000?

Answer