ratios and analyze

Financial Management BFIN2302

Ms. Najwa Aldardeer

Student Name:

ID:

Section: A,B,C,D,E&F

Total: 15 points

Learning Outcomes:

Upon completion of this project, the students should be able to:

Explain the environment within which the financial manager operates as well as the role of financial markets and institutions.

Evaluate financial performance using financial ratios.

Define, quantify, and interpret risk measures.

Identify components of working capital and how to manage them.

Describe ethical issues of financial management.

The project is following the Bloom’s Taxonomy

Evaluating : Critiquing, rating , grading, examining, assessing , inferring, drawing conclusion , and forming opinion

Synthesis: linking new information with previous information

Analysis: Examining, breaking down

Application: using knowledge and comprehension; solving problems

Comprehension: Understanding, paraphrasing, and interpreting

Knowledge: naming ,recognizing , identifying , recognizing , and reciting

Content

Chapter 1&2------------------------------------------------------------------------------- Section A

Chapter 4-----------------------------------------------------------------------------------Section B

Chapter 8-----------------------------------------------------------------------------------Section C

Chapter 15---------------------------------------------------------------------------------Section D

Select a company from Tadawul.com

Use the following video to help you to find a company in Tadawul .

https://www.youtube.com/watch?v=tirZooaTRhs

Use the university lab to get the full information about a company that listed in Tadawul.

The university lab has access to Thomson Reuter’s database.

Fill up the following

Chapter 1 and 2

Name of the company: Jarir Marketing Co.

Sector: Consumer Discretionary

CEO/ Name : Abdulkareem Abdulrahman Nasser Al Akil

CFO/ Name: Mohamed Abdulkhalik

Major shareholders: Mohammed Abdulrahman Nasser/ Abdulsalam Abdulrahman Nasser Al Akil /Abdullah Abdulrahman Nasser Al Akil / Nasser Abdulrahman Nasser Al Akil / Abdulkareem Abdulrahman Nasser Al Akil.

Definition of Tadawul market:

Tadawul market: Tadawul, is the sole entity authorized in Kingdom of Saudi Arabia. Mainly it is the Saudi stock exchange Therefore, is it is managed by CML (Capital Market Law). Tadawul is a primary and secondary market, however it is considered secondary. It performs listing, trading in securities, deposit, clearing transferring, settlement, and registry of ownership of securities trading on the Exchange. The CEO of Tadawul is Khalid Abdullah Al Hassan.

Market data

| Last trade | 136.50 | Day’sRange | 135.00 -136.50 |

| Trade time | 2:15 pm | 52wk Range | 81-141 |

| Change | Increase in 7.69% | Volume | 326,411 |

| Prev Close | 126.75 | No of shares outstanding | 90.00 Million |

| Open | 135.00 | Authorized capital | 51.08Million |

| Bid | 136.25 | P/E(ttm) | 15.46 |

| Ask | 136.50 | EPS(ttm) | N/A |

| Beta | 0.80 | Div& Yield | 5.76% |

Source: Tadawul.com,

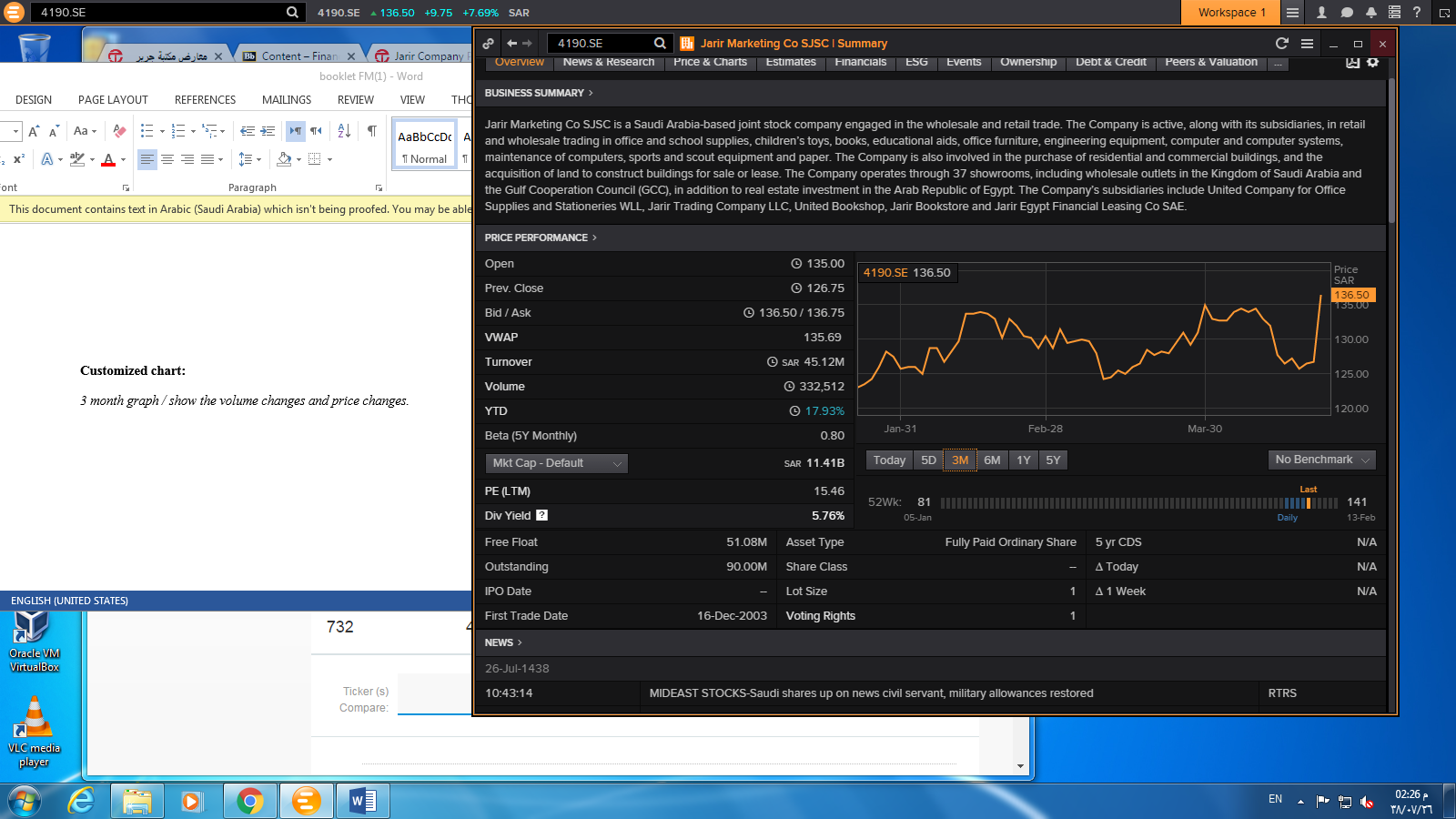

Customized chart:

3 month graph / show the volume changes and price changes.

Explanation of the Graph:

Financial ratios

TO WRITE A PROPER ANALYSIS

Describe what is happening in the two years (high, low)

Write what the ratio tells you

Reason why the second year went up or down

*Your grades will be on your analysis

Use these steps to analyze I will post PowerPoint slide that I want you to use while you are analyzing to guide you

Provide the analysis of financial indicators of the chosen company and compare them with the previous year performance. Conclude your analysis with an overall analysis of the company financial situation.

| Name | Year 1 | Year 2 | analysis |

| Current ratio | 1.36x | 1.57x | 1) In the two years current ratio increased by 0.21, 2) Current ratio indicates the extent to which the amount of current liabilities is covered by current assets therefore, current assets expected to be converted to cash in the near future. 3) 2016 increase because current assets increased |

| Quick ratio | 0.47x | 0.55x |

|

| Inventory turnover | 6.3x | 6.7x | |

| DSO | |||

| Fixed assets turnover | 5.19x | 5.93x | |

| Total assets turnover | |||

| Debt ratio | |||

| Times-interest-earned | N/A | N/A | |

| Operating margin | 11.4x | 12.7x | |

| Profit margin | 13.0x | 12.1x | |

| Return on total assets | 29.8x | 35.7x | |

| Basic Earning power | |||

| Return on common equity | 48.7x | 57.9x | |

| Price/ Earning | |||

| Book value per share | |||

| Market/ Book |

Conclusion of analysis:

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Grading Criteria

FOLLOWING THE STRACTURE AND FILLING UP THE REQUIRMENTS

| Section | Maximum points | Points earned |

| Section one table / Filling more than half of the requirement | 3 | |

| Graph along with explanation | ||

| Section two/ providing 6 financial ratios and analysis | ||

| Overall conclusion of company analysis | ||

| Using Thomson Reuter’s database | ||

| On time submission and professional presentation | ||

| Total | 15 |

Comment

Najwa Aldardeer, spring 2016-2017, financial Management/ BFIN2302