Company analysis

Business analysis for Sports Direct

Introduction

Sports Direct International plc, the largest sporting goods retailer in the UK market, showed a decline in 2016, while it showed a strong increase before that. The company revenue includes its sports retail (86% of total revenue with upping 3.9%, £2,491m) which includes cooperated brands and its own brands, brands which took 8% of total revenue with upping 2.3% to £231.5m, and premium lifestyle, a luxury brands retailer, that decrease 12.7% with £181.2m revenue (Sports Direct, 2017). And the development of the company in aboard market is majorly depended on acquisitions, as well as diversify its product portfolio by acquiring LA fitness (Sports Direct, 2016). The acquisitions aboard are market development and the acquisitions of LA fitness is product development. The analysis is trying to figure out the reason why Sports Direct decreased by analysing macro and micro environment as well as resources and capabilities of the company in the UK market. Although the company tend to be global, its major market is the UK. And the SWOT analysis is followed to draw a whole picture of the company with suggestions attached.

Macro Environment Analysis

Political

The result of the EU referendum makes lots of uncertainties surrounds the UK market. Although the long-term impact is unclear, some negative short-term influences happened.

IBISWORLD (2016b) reported that the Brexit will raise the competitive level of clothing retailing market in the short term. Firstly, the consumer confidence index of the British market is expected to fall, which could make the consumers’ demand for clothing shows a decline and the customers may more interest on low price (Trading Economics, 2016). Furthermore, the profit margins of the British clothing retailers may be shrunk, because the depreciation of the pound, which will affect the competitiveness in the market.

Economic

The Office for National Statistic (2016) reported that the gross real household disposable income recovered to pre-downturn in 2015, though the economic downturn has affected the performance of the market as well as has already sharped the consumer behaviours in the market. Due to the weak demands which are decreased by the downturn, the British retailers applied lots of heavy promotions to drive the sales growth, which increases the competitive level (Mintel, 2015). Hence, it is the main threat of SportsDirect in the UK market, because it gives lots of stress for SportsDirect to maintain its profit margin.

Social

The 55-64s, the major part of the British population, becomes more willing to buy clothing online, which could be an opportunity in the market (Office for National Statistics, 2015, Mintel, 2015).

In addition, the overweight population, others a major part of the population, has little interest to buy new clothing in the last year (Office for National Statistic, 2015, Mintel, 2015). It is a threat in the market, especially for SportsDirect, due to those people show little willing to do some sports.

However, the concern about health lifestyle increased in the UK, which make the demands of the relevant markets, such as gym or exercise accessories, show good performance (Mintel, 2015). It is an opportunity for SportsDirect.

Technology

Online shopping is an important technological change in the market. Although the online market increases the market scale significantly, the major strategy of the British clothing retailers competing is by using promotion, which increases the competitive level of the market (Mintel, 2015; IBISWORLD, 2016a). It is a threat for SportsDirect.

Environment

The unseasonal weather, warm temperature in March and April in the UK in 2015, harms the sales of clothing (Mintel, 2015). It would be a threat to the market, which requires the retailers to update their stock management. However, due to the weather is hard to forecast, it should belong to an uncertainty of the market.

Legislation

The new National Living Wage (NLW) increases the wage costs, which could be a threat of the market, especially for the retailers who own manufactories in the UK (GOV.UK, 2016).

Microenvironment Analysis

The bargaining power of suppliers

Due to the SportsDirect is an agent of clothing retailer for many famous brands, those brands are suppliers of SportsDirect who enjoy high bargaining power. And for SportsDirect’s brands, the cotton suppliers may have medium bargaining power, due to their brands did not show good performance.

The bargaining power of consumer

The bargaining power of the consumer is high in the British market. Firstly, the switching cost of the consumers is low, due to a large number of competitors existed. Secondly, the consumers focus on discount, which means the retailers gave the power to the consumer.

Threat of New entrants

The level of market concentration is low and is hard to concentrate because the bargaining power of the consumer is high with the customers usually purchased clothing from different retailers (IBISWORLD, 2016a; Mintel, 2015). And the level of capital intensity of the British clothing retailing is moderate. The wage costs took 15.1% of the revenue with the number of the cost of depreciation was 3.5% (IBISWORLD, 2016a). In conclusion, the market has a low level of market concentration, technology change and barriers of legislation, with a medium level of capital intensity, hence, the barriers to new entrants are low. In addition, as the development of the online shopping and delivery system, foreign clothing retailers can enter the market easily (IBISWORLD, 2016a).

Competitors and industry rivalry

Firstly, SportsDirect faces the national competitors as well as global competitors. Secondly, the supermarkets, like M&S or Selfridges, which take large parts of the market share, are major competitors of SportsDirect. Thirdly, SportsDirect meets the competitiveness from the widespread online shopping competitors. Fourthly, the brands, Adidas and Nike, also are competitors of SportsDirect.

The clothing retailers compete in those areas. Firstly, fashion trends are vital in the market, which means the retailers need to adopt and produce it as fast as they can to take the market share. Secondly, the ranges of products of the retailers impact their profitability, because the vertical and horizontal product types they offered could satisfy consumers’ different requirements which could make consumers spend more time in stores and attract different segmentations of consumers (Cooper, Edgett and Kleinschmidt, 2001). Thirdly, the price is an important factor in the market. Fourthly, the reputation of brands is important to catch consumers, due to well-known brands represents good quality (Jobber and Ellis-Chadwick, 2013). Fifthly, the effective marketing increases sales significantly, especially to launch a new fashion or discount sales. Sixthly, the quality of customer service can raise the chance of consumers’ return, because the friendly service could send impressive brand messages to consumers (Jobber and Ellis-Chadwick, 2013). 57% of British women consumers are willing to receive clothing recommendations based on their fit from the retailers (Mintel, 2015). Last but not least, the online shopping breaks down the limitation of geographic, though the locations of clothing retailing are still important (Jobber and Ellis-Chadwick, 2013). In a brief conclusion, all those conditions are limit, hence, the competitive level of the market is high.

H&M’s customers’ Analysis

According to IBISWORLD (2016a) report, the contribution to the market revenue of different ages segmentations is almost at the same level. But, the shopping behaviours of those groups are different. Mintel (2015) reported that the British age 55 and over tend to purchase clothing from one or two retailers, while the British aged 35 and under are more likely to purchase clothing from five or more retailers. It means that the older consumers are more loyal.

The young women contributed large parts on the sales, with major shopping behaviour fit struggling (Mintel, 2015). The dissatisfaction of fit is the main reason that harms consumers for returning shopping (Mintel, 2015). Hence, it is required the available clothing sizes and the solutions to solve the fit issue.

And the British retailers have competed in menswear increasingly. The major shopping behaviour of the group is that they purchase what they favour regardless of sizes (Mintel, 2015). It means British men face fewer issues than the women.

In general, British women have five or more retailers as their alternatives, while the men tend to shop at one retailer (Mintel, 2015).

H&M’s Resources and capabilities

The Capabilities of SportsDirect

Resources

Physical resources

As it is analysed before, the locations of stores are important for retailers to attract consumers. SportsDirect’s stores have good commercial locations are a threshold resource. However, SportsDirect closed 15 stores annually, which means the company should improve the ability of its store management (SportsDirect, 2017)

Financial Resources

The sales SportsDirect shows a decline in recent years while the operating margin of H&M has increased, (SportsDirect, 2016). And the cash flow shows some issues, due to SportsDirect’s investment strategy. It is a weakness for SportsDirect to develop its company in healthy.

Human Resources

Although SportsDirect had 29,000 employees in 2016, the workforce turnover increased to 22.0%, due to the bad salary SportsDirect offered (SportsDirect, 2017). It is an important weakness of SportsDirect. The lack of employees means it is hard to offer good services to consumers. Meanwhile, it shows a stress to the company’s reputation and performance.

Intellectual Capital

SportsDirect has developed many its own brands, although the revenue (mainly for licensing) is small (SportsDirect, 2017). It could be a strength for SportsDirect to diversity its product portfolio to compete in this market, however, it also could be a weakness. A large number of brands means lots of investment and may result in shortage of workforces with conflict in the system.

Competences

Although SportsDirect offer Incentive Program, Employee Bonus Share Scheme, to increase its employees’ commitment and loyalty, the turnover is higher, as well as the company hire employees paid below the medium wage (SportsDirect, 2017). It may result in low commitment and loyalty of its employees, which means the competencies of its employees is low. And for its own brands, the design is a weakness. SportsDirect shows little investment in in-house design or cooperating with famous designers.

Corporate governance

The conflict between SportsDirect and its internal shareholders could be moderate. There is no dominate shareholders as well as no individual or no group can control the Board’s decision making (SportsDirect, 2017). In addition, the conflict with external shareholders could be high, due to its salary system breaks the law and harms employees’ expectance.

SWOT

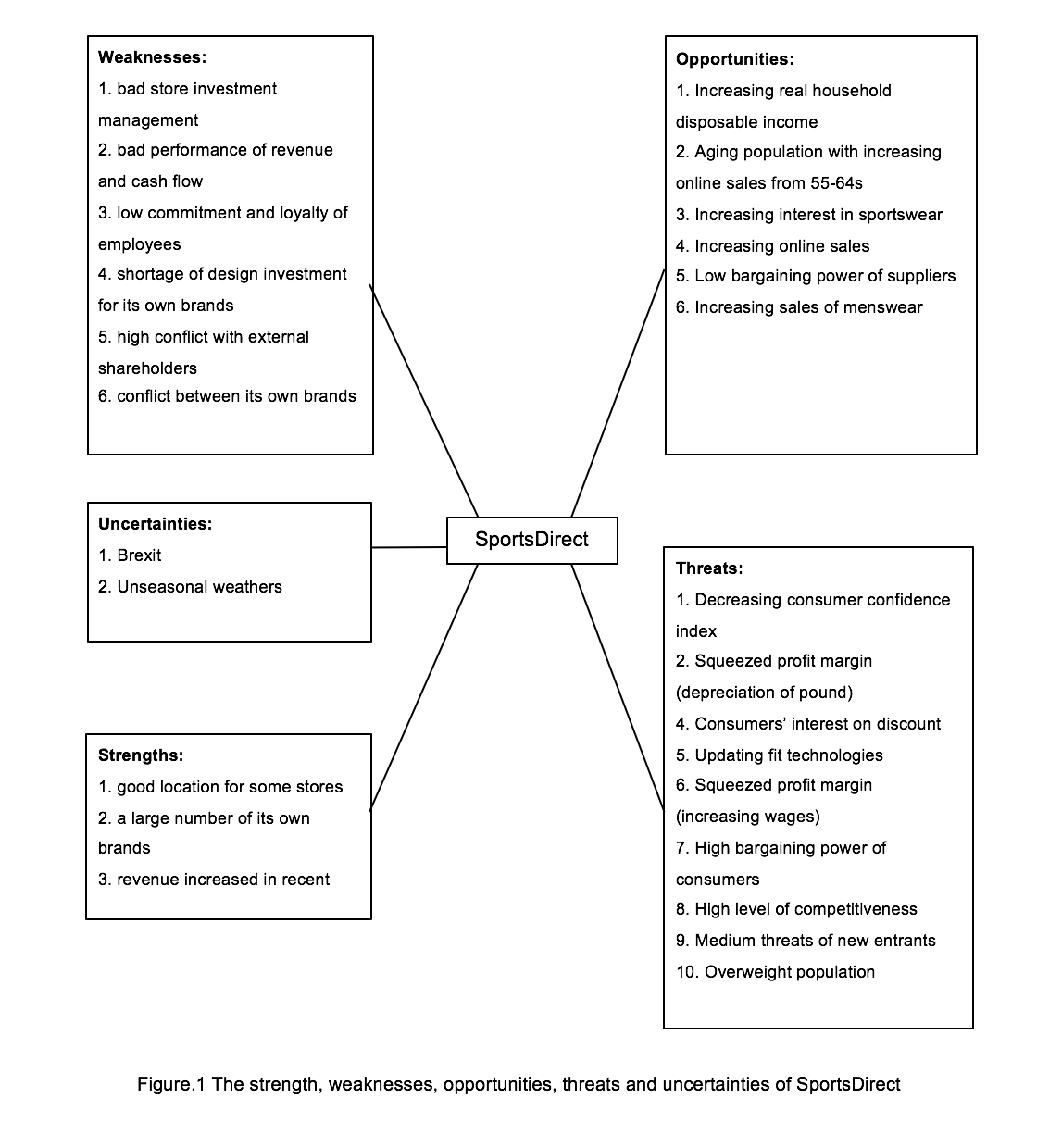

The analysed conditions are showed in the Figure. 1. The company meets lots of opportunities, however, the strengths are hard to cover weaknesses and threats, which means the company may locate in a crossword situation.

Strengths with opportunities

Firstly, the Sports Direct meets the opportunities of increasing demands of sportswear, which could be a powerful revenue generator for the company. Secondly, the investment and development of Sports Direct online website and mobile applications support the company to meet the increasing online market. It is important for to maintain Sports Direct its market share.

Strengths with threats or uncertainties

The strengths are hard to cover the threats. It means the threats may show a significant impact on company’s development. Although the strategy is same as before, the revenue decreased, due to the company does not hold the competitiveness strengths.

Weaknesses with opportunities

The weaknesses make Sports Direct is hard to catch the opportunities. The consumers more likely to receive good services or suggestions from store staffs, however, due to the low commitment and loyalty to the company, the consumers may have unsatisfied shopping experiences which have a negative impact on its repetition sales. In addition, the conflict between brands also harms the market scale supported by the opportunities.

Weaknesses with threats

The combing effect of weakness with threats could be a vital challenge for Sports Direct, which requires careful marketing decisions and strategies to hold its market share.

It means the company should reconsider its strategies. Firstly, the store management should update. The company closed 15 stores annually due to the bad locations which are also be considered as a main reason for the downfall for premium lifestyle (Sports Direct, 2017). As it analysed before, the location is vital for clothing retailing. The wrong locations not only make the company miss the market, but also waste lots of investment to build and replace. Hence, it should analyse carefully before making decisions. Secondly, the development of brands. Although the diversity of products is a suitable strategy for a mature market, the one of a critical successful point is a large investment in innovation with consistent between brands. However, lots of Sports Direct brands have same market segmentations, as well as the number of those brands are supplied into the UK market largely. It could result in the conflict inside brands and resources wasted. The company should make a detailed analysis for those brands to classify which are cash cows or starts, and identify reasons for some question marks and dogs with improving or harvest strategies (Donald, Ian, and Dlana, 1982). Thirdly, the company should reconsider about the premium lifestyle. As it analysed early, the macro economic environment is not good, which means the luxury markets may shrink, especially for new entrants or small retailers in this market. Last but not least, the company should focus on its employees’ development and benefits, to maintain a good relationship with employees and external shareholders. The employees are vital for a company, especially for the service company. Sports Direct should improve the salary and benefits to its employees to increase their commitment and loyalty to help the company to maintain the market share with fierce competition and threats.

In conclusion, the downfall of Sports Direct is inevitable, due to it holds little competitive resources and capabilities while the threats and uncertainty surround the market. Sports Direct should make an exhaustive and deep analysis for its investment and product strategies to optimise its sources when the scale of the market is shrunk.

Limitations

The major statistics are from Sports Direct annual report, which is not independent and accuracy. And it lacks some important statistics. the sales of its own brands, for instance, is included in the total sales with others brands. It makes hard to give a specific analysis for its brands’ strategies.

(Word account: 2392)

References:

Cooper, RG., Edgett, SJ. and Kleinschmidt, EJ. (2001) Portfolio management for new products, Oxford: Perseus Publishing.

Donald, C., Ian, C. and Dlana, L. (1982) Strategic Attributes and Performance in the BCG Matrix – A PIMS-Based Analysis of Industrial Product Businesses. Academy of Management Journal, 25(3): 510-531.

Ghose, S., Liu, J., Bhatnagar, A. and Kurata, H. (2005) Modeling the role of retail price formats, and retailer competition types on production schedule strategy. European Journal of Operational Research, 164(1): 173-184.

GOV.UK, (2016) National Living Wage (NLW). https://www.gov.uk/government/publications/national-living-wage-nlw/national-living-wage-nlw Accessed 21st April 2017.

IBISWORLD, (2016a) Clothing Retailing in the UK.

IBISWORLD, (2016b) Clothing Retailing in the UK – Brexit impact statement.

Jobber, D. and Ellis-Chadwick, F. (2013) Principles and Practice of Marketing, Maidenhead: McGraw-Hill.

Met Office, (2016) Understanding variations in the rate of global warming. http://www.metoffice.gov.uk/research/news/2015/variations-rate-global-warming Accessed 21st April 2017.

Mintel, (2015) Clothing Retailing – UK.

Office for National Statistics, (2015) Population Estimates for UK, England and Wales, Scotland and Northern Ireland: mid-2015. https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationestimates/bulletins/annualmidyearpopulationestimates/mid2015 Accessed 21st April 2017.

Trading Economics, (2016) United Kingdom Consumer Confidence. http://www.tradingeconomics.com/united-kingdom/consumer-confidence Accessed 21st April 2017.