FOR WIZARD KIM ONLY

Loan Application Process

Assessment cover sheet

In order for your assessment to be marked you must complete and upload all tasks and this cover sheet via the Training Group portal. Your assessment tasks must be uploaded in an electronic format i.e. Word, Excel, PDF or Scan. A maximum of five (5) attachments (maximum 20MB each) can be uploaded for this assessment. Please see the step-by-step instructions in your Member Area on how to upload assessments.

| Student details | |||||||

| Course name | |||||||

| Assessment name | Loan Application Process Assessment | ||||||

| Surname | Given name | ||||||

| Address | Postcode | ||||||

| Phone | Phone (other) | ||||||

| Current occupation | |||||||

| Industry | Years in industry | ||||||

Checklist of attachments:

☐ Task 1 – Case Study ☐ A OR ☐ B

☐ Task 2 – Report/Written Test

☐ Task 3 – Report/Written Test

☐ Task 4 – Activity and Short Answers

Please indicate style of course undertaken:

☐ Face to face Trainer’s name:

☐ Correspondence ☐ Online

Once your assessment has been successfully uploaded it will be pending review with your nominated course assessor. Your assessor will mark your assessment and you will receive an email advising you if you have been assessed as satisfactory. If you are marked as not yet satisfactory you will be contacted and asked to provide additional information or re-visit the assessment and re-upload your amended case study or written tasks.

Please contact our head office if you need assistance with your assessment:

Office: +61 8 9344 4088 Fax: +61 8 9344 4188 Email: [email protected]

| CREDIT TRANSFER You may be able to claim credit transfer for a unit/s of competency that you have previously completed with AAMC Training or another RTO. If you have been awarded a record of result or statement of attainment for any of the units detailed below then please go to the Credit Transfer tab in your Learning Centre and follow the prompts. This assessment relates to the following units of competency:

Please refer to AAMC Training’s full Recognition Policy for further details. |

IMPORTANT NOTES: AAMC Training only wants to see your own work. Please do not upload blank assessment tasks or instructions on how to complete same. When this extra information is uploaded it presents unnecessary work for the assessors and in turn delays our assessment responses.

Task 1: You will notice that there are two options of Case Study within this assessment – the first (A) is more specifically for Mortgage Brokers, the second (B) for brokers in the Plant & Equipment and Motor Vehicle field. Please complete only the stream relevant to you and indicate this on the assessment cover sheet.

Either the Mortgage Finance or Motor Vehicle Equipment Checklist must be submitted with the fully completed assessment. This must encompass all documents from initial contact with the clients until settlement of the loan. Documents must be submitted in a suitable logical order and consist of all relevant NCCP documents.

The documentation required should be consistent for all submissions, however student submissions will vary in regards to outcomes based on the interpretation of the data and “client” responses during the interview process.

Task 4: You are required to have a third party to observe this role play in a simulated environment. You will need to provide the observer/third party declarer with the role play guidelines and marking/sign-off sheets to ensure they are fully conversant with what is being asked of them.

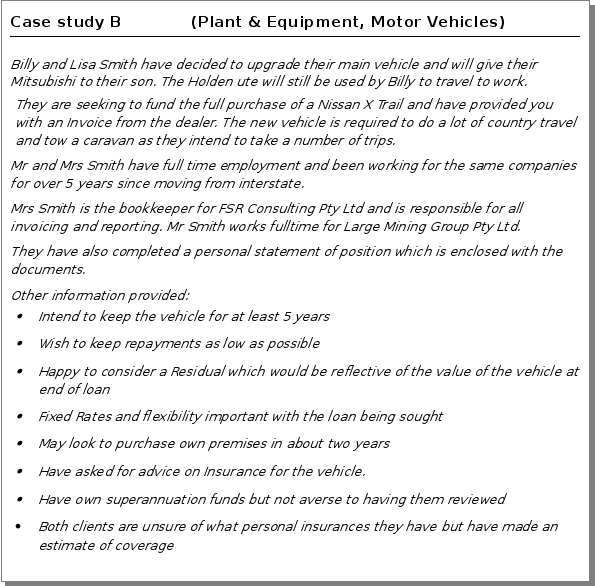

Task 1: Case Study – Loan application preparationYou will notice that there are two options of Case Study within this assessment – the first (A) is more specifically for Mortgage Brokers, the second (B) for brokers in the Plant & Equipment and Motor Vehicle field. Please complete only the stream relevant to you and indicate this on the assessment cover sheet.

Choosing only one of the case studies presented below, prepare a loan file from your initial contact with the clients to preparing the loan application for lodgement with the client’s lender of choice, through to settlement. Please refer to the document checklists in this Task for the relevant steps required.

In completing this task, you need to demonstrate to your assessor that you are competent in the following areas and able to:

communicate ideas and information

collect, analyse and organise information

plan and organise activities

work with others in a team

use mathematical ideas and techniques

solve problems by providing solutions

use technology.

To do this you will need to compile a report (Client Needs Review/Fact Find) indicating your thoughts and processes on different aspects of your application. These may include, but are not limited to:

the choice of loan product for your client and the information about the loan product that you presented to them. Where you located the product information. Remember there is no right/wrong answer to this area, it is always subjective.

the use of technology to compare the product/fees, find information on the products etc.

how you would work in a team situation with your co-workers, lenders, real estate agents, mentor etc.

In areas where you do not have copies of actual supporting documentation, insert a page with the name of the document you would include e.g. copy of driver’s licence for the client.

There are a number of templates in the Member’s Area under ‘Useful Resources’ that you could use in your submission.

Remember there is no right or wrong answer as each client you see presents a new challenge and if you can provide solutions for those challenges you will be well regarded and successful in this industry.

Because this course is taken nationally, we ask that you localise addresses and places of employment so that you can have familiarity with the assessment.

You will have to take into account any necessary adjustment of stamp duty concessions for first home buyers. This will have to be considered when discussing and setting out the fees and costs with your clients. You will have to contact your Office of State Revenue to determine the correct amount of benefits to which your clients are entitled.

Case study A (Residential mortgage)

Background

Henry Leslie from Leslie Accounting Services has referred you his clients Frederick John and Margaret Anne Everybody. He has mentioned that they are looking to purchase their first home. Whilst in their early ‘40s, they have previously not owned a home due to the husband being an engineer with the Australian Defence Forces. Because of this and constant moving they really weren’t in a position to buy in one location. Frederick has since left the services and has been working with BHP Billiton on their mining projects. This entails working on a ‘two weeks on, one week off’ basis. Frederick enjoys an annual income, paid monthly, of $115,000 with a subsidised rent when on location on the job.

Margaret works at the local council child care centre on a permanent/part time basis and earns $29,000 annually, paid weekly. She is a qualified nurse.

They have two children. Joshua, 18, is employed fulltime, lives at home and pays $75.00 per week board. Melanie, 13, is in her first year at high school and is dependent on her parents.

Currently the couple is renting in a suburb near you and paying $420.00 per week to the local Ray White real estate office. Due to diligent saving and being beneficiaries of a family deceased estate they find themselves in a sound financial position and ready to purchase their own home and settle into one area. They are conscious of the current economic times and wish to entrench their current situation by also considering future investment opportunities.

One of the most important questions you will ask when completing your Client Needs Review is about Risk Protection. Have the clients considered the ramifications of financial hardship caused by illness, accident or death? The Q & A component of the CNR covers this adequately. You are made aware their contents are insured but they have no insurance policies covering life, trauma and income protection. This is where you ask what cover they consider is enough in view of the financial commitments they are now planning? Will Margaret have to visit Centrelink if an unforeseen event happens to Frederick? Should they have to change their lifestyle? Just remember your Duty of Care.

They have around $184K plus the FHOG available and are looking to buy land with a purchase price of $240K and construction in the vicinity of $350-360K. (Students in all jurisdictions will have to adjust the land and construction costs to fit in the capped amount criteria.) They estimate they will spend an additional $60K on furnishings and garden. You are to interview the clients and propose a loan structure that will suit their needs. They have indicated that they would like to be provided a minimum of three (3) sound lending strategies acceptable with different providers. They normally clear (swipe) their credit cards monthly with the exception of Mrs Everybody’s Myer 1 account.

It may be to their benefit to clear the car loan account with Esanda. These are the points of discussion that should appear in your interview notes.

CASE STUDY ASSESSMENT OPTIONS:

If you are in a State or Territory that FHOGs are available to both forms of home purchasing, choose either an existing or new home acquisition for your case study (you do not have to complete one of each).

If you are in a State or Territory that only offers a FHOG on new and not established homes, you will have to choose that option for a case study.

If at some later stage the FHOGs rise or fall, please adjust the applicable purchase prices to cater for those changes as this task forms an important part of the assessment process and must be completed.

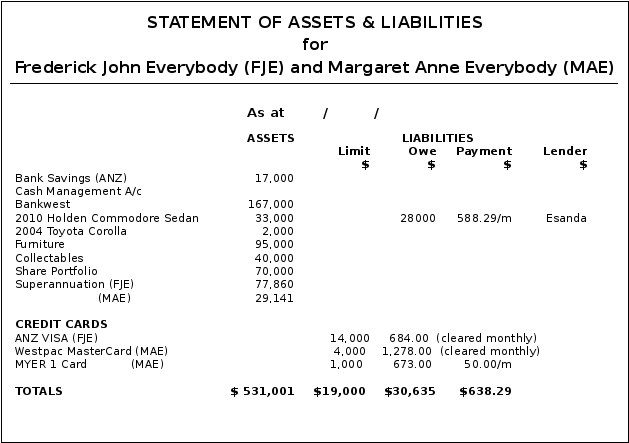

| Client statement of position | |||

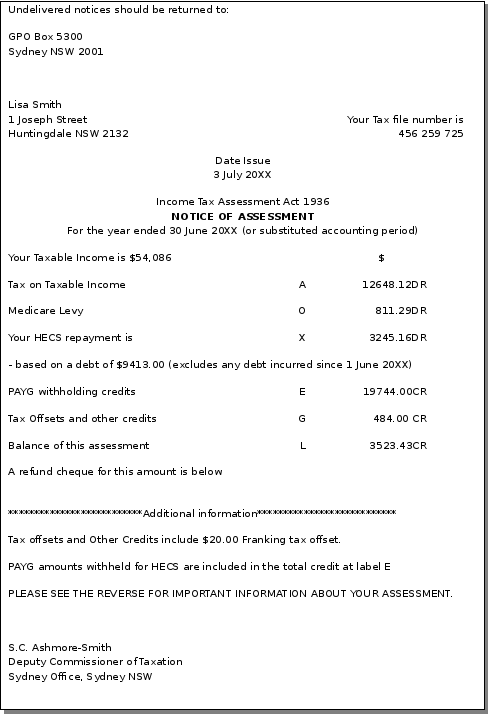

| Referred by: | Peter Michael | Consultant: | Ian Harris |

| Date: | 27/10/20XX | Source: | Accountant- 3 Smith St, Nth Sydney- Ph 02 94250000 |

| Applicant 1: | Mr/ Mrs/ Ms/ Miss | Applicant 2: | Mr/ Mrs/ Ms/ Miss |

| Surname: | Smith | Surname: | Smith |

| First name: | Billy | First name: | Lisa |

| Date of birth: | 21/10/62 | Date of birth: | 13/06/67 |

| Address: | 1 Joseph Street | Address: | 1 Joseph Street |

| | Huntingdale NSW 2132 | | Huntingdale NSW 2132 |

| Phone: | 02 93850000 | Phone: | 02 93850000 |

| Mobile: | 0417000000 | Mobile: | 0418000000 |

| Business: | Large Mining Group Pty Ltd | Business: | FSR Consulting Pty Ltd |

| Occupation: | Storeman | Occupation: | Bookkeeper |

| Business gross profit: | Business gross profit: | ||

| Income-gross-net | $82,003 $54,762 | Income-gross-net | $54,086 $37,381 |

| Current lender: | ANZ | FSR bank detail | Westpac 032 000 123456 |

| Estimated market value: | $540,000 | Mortgage balance: | $100,000 |

| Payment: | $933.00 | | Mthly/Fortnightly/Weekly |

| Years to run: | 4 | Interest rate: | 7.05% |

| Asset values $ | Liabilities amount owing $ | Monthly payments $ | Lender | |

| Existing properties: | | | | |

| 1. | 540,000 | 100,000 | 933.00 | ANZ |

| 2. | | | | |

| Furniture | 100,000 | | | |

| Motor vehicles: | | | | |

| 2002 Holden Ute | 22,000 | | | |

| Credit card (1) Limit $5000 | | 1,000 | 150.00 | ANZ |

| (2) Limit $10000 | | 3,000 | 300.00 | Citibank |

| Overdraft | | | | |

| Personal Loans: | | | | |

| Superannuation: | Mr 160,000 | | | |

| | Mrs 230,000 | | | |

| Insurances: Mr Mrs | | | | |

| Life: y/n 400,000 300,000 | 700,000 | | | |

| Trauma: y/n 100,000 50,000 | | | | |

| Income prot. 61,502 40,564 | | | | |

| Wills: y/n | | | | |

| Power of attorney: y/n | | | | |

ABN: 91 765 432 100

ACN: 7654321

Detailed Balance Sheet

as at 30 September, 20XX

| 30/09/20XX $ | 30/06/20XX $ | |

| Current assets | ||

| Shareholders loans | 111,837 | 89,878 |

| Total current assets | 111,837 | 89,878 |

| | ||

| Non-current assets | ||

| Plant and equipment | 2,197 | 2,197 |

| Less accumulated depreciation | (443) | (350) |

| Total non-current assets | 1,754 | 1,847 |

| | ||

| Intangible assets | ||

| Formation expenses | 1,142 | 1,142 |

| | ||

| Total assets | 114,733 | 92,867 |

| | ||

| Current liabilities | ||

| GST owing | 4,271 | 4,423 |

| PAYG tax payable | 7,040 | 5,031 |

| | ||

| Total current liabilities | 11,311 | 9,454 |

| | ||

| Non-current liabilities | 0 | 0 |

| | ||

| Total liabilities | 11,311 | 9,454 |

| | ||

| Net assets | 103,422 | 83,413 |

| | ||

| Shareholders equity – retained profits | 103,422 | 83,413 |

| Fantastic Nissan ACN: 009 071 444 ABN: 47 009 071 444 | TAX INVOICE | |||||||

| To: Billy and Lisa Smith | For delivery to: Billy and Lisa Smith | |||||||

| | ||||||||

| INVOICE DATE | INVOICE/STOCK NO | NEW/USED | VEHICLE MAKE | MODEL | REGISTRATION NUMBER | |||

| 17/10/20XX | 1425361 | NEW | NISSAN | X-TRAIL T1 AUTOMATIC | TBA | |||

| ENGINE NUMBER | CHASSIS NUMBER | COMPLIANCE DATE | COLOUR | CONTACT | ORDER NUMBER | |||

| QR25230948 | JNITBNT30A0044491 | 2009 | TWILIGHT | CLINT NESBITT | Due on receipt | |||

| | ||||||||

| QUANTITY | DESCRIPTION | AMOUNT | ||||||

| 1 | Nissan X-Trail Window Tint Genuine Tow Bar Dash Mat Floor mats Rear Cargo Tray Full tank Pre Delivery | $34,718.18 450.00 450.00 Included Included 110.00 Included 995.00 | ||||||

| Sub Total | 36,723.18 | |||||||

| GST | 3,672.32 | |||||||

| Stamp Duty | 2,379.00 | |||||||

| Registration | 535.00 | |||||||

| Total Price | $43,309.50 | |||||||

| Total amount payable | $43,309.50 | |||||||

| Make all cheques payable to Magic Nissan | ||||||||

| ABC ACN: 91 987 987 987 | TAX INVOICE Date: October 29, 20XX INVOICE 78 | |||||

| | | |||||

| To: Macquarie Leasing Pty Ltd GPO Box 5435CC Melbourne VIC 3001 | ||||||

| | ||||||

| DESCRIPTION | AMOUNT | |||||

| Upfront broking commission – | $ | |||||

| Sub Total | ||||||

| GST | ||||||

| Total price | ||||||

| Payments/credits | ||||||

| Balance due | $ | |||||

| Make all cheques payable to ABC Financial Services Thank you for your business! | ||||||

NB: Where evidence is required i.e. payslip/offer & acceptance/financials etc., AAMC Training will accept the evidence being typed on a blank piece of paper rather than supplying copies of the required evidence.

For example: “This represents the payslips for Frederick John Everybody for the periods ending 14th and 28th February 2015.”

A sample of the forms mentioned above can be found in the AAMC Members’ Area under “Useful Resources” (www.aamctraining.edu.au)

| AAMC TRAINING DOCUMENT CHECKLIST LOAN APPLICATION PROCESS ASSESSMENT MORTGAGE FINANCE | |||

| EVIDENCE | ENCLOSED | ||

| Y | N | N/A | |

| ☐ | | |

| ☐ | | |

| Case Study - Loan Application Preparation (Task 1)

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| Process Applications for Credit (Task 2)

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

Note: 2 forms of identification is required for each applicant to the loan and a separate AML ID form is required for each applicant. | ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| Completing Customer File (Task 3)

| ☐ | ☐ | ☐ |

You are required to prepare and submit your data-base on contacts made from this transaction by using your internal CRM or a suitable program i.e. Excel. | ☐ | ☐ | ☐ |

| Short Answer Questions (Task 4)

| ☐ | ☐ | ☐ |

NB: Where evidence is required i.e. payslip/offer & acceptance/financials etc., AAMC Training will accept the evidence being typed on a blank piece of paper rather than supplying copies of the required evidence.

For example: “This represents the payslips for Frederick John Everybody for the periods ending 14th and 28th February 2015.”

*Samples of the abovementioned forms can be found under Useful Resources of the Utilities tab at your login Dashboard – either in the Loan Application, Complex Lending or Useful Forms folders.

| AAMC TRAINING DOCUMENT CHECKLIST LOAN APPLICATION PROCESS ASSESSMENT MOTOR VEHICLE & EQUIPMENT | |||

| EVIDENCE | ENCLOSED | ||

| Y | N | N/A | |

| ☐ | | |

| ☐ | | |

| Case Study - Loan Application Preparation (Task 1)

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| Process Applications for Credit (Task 2)

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

Note: 2 forms of identification is required for each applicant to the loan and a separate AML ID form is required for each applicant. | ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| Completing Customer File (Task 3)

| ☐ | ☐ | ☐ |

| ☐ | ☐ | ☐ |

| Create a customer/referrer database (Task 4)

| ☐ | ☐ | ☐ |

| Short Answer Questions (Task 4)

| ☐ | ☐ | ☐ |

NB: Where evidence is required i.e. payslip/offer & acceptance/financials etc., AAMC Training will accept the evidence being typed on a blank piece of paper rather than supplying copies of the required evidence.

For example: “This represents the payslips for Frederick John Everybody for the periods ending 14th and 28th February 2015.”

*Samples of the abovementioned forms can be found under Useful Resources of the Utilities tab at your login Dashboard – either in the Loan Application, Complex Lending or Useful Forms folders.

Settlement File Checklist

The provision of all the information detailed below will ensure prompt issuance of your qualification. Any omissions will cause AAMC Training to seek the missing data which can prove costly to both parties. You must include this checklist in the submission of your assessment.

| DOCUMENTS MORTGAGE (M) AND/OR | ||||

| Type | Data | Enclosed | ||

| Y | N | N/A | ||

| M/PEVC | File Notes from first contact through to Settlement in chronological order | ☐ | ☐ | ☐ |

| M/PEVC | Evidence of loan approval | ☐ | ☐ | ☐ |

| M only | Loan/letter of offer from lender | ☐ | ☐ | ☐ |

| M/PEVC | Borrowers checklist (Document sign-up) | ☐ | ☐ | ☐ |

| M only | Correctly signed home loan contract (including transfer of land and mortgage of land relevant to the State.) | ☐ | ☐ | ☐ |

| PEVC | Correctly signed Consumer Loan contract for the Lender chosen | ☐ | ☐ | ☐ |

| M/PEVC | Insurance details – Home Certificate of Currency or Motor Vehicle Certificate of Currency | ☐ | ☐ | ☐ |

| M only | Borrowers Authority and Instructions | ☐ | ☐ | ☐ |

| M only | Evidence of settlement related communications between all parties. (IE. Broker, Conveyancer, Lender, Client) e.g. a letter or email showing settlement communications between all parties. | ☐ | ☐ | ☐ |

| M/PEVC | Letter of successful settlement from broker | ☐ | ☐ | ☐ |

| M/PEVC | Service Questionnaire or relevant example of feedback from client | ☐ | ☐ | ☐ |

| Other | ||||

| | | ☐ | ☐ | ☐ |

| | | ☐ | ☐ | ☐ |

| | | ☐ | ☐ | ☐ |

Samples of the below-mentioned forms can be found under Useful Resources of the Utilities tab at your login Dashboard – either in the Loan Application, Complex Lending or Useful Forms folders.

| Along with the ACR’s profile this guide is handed to the clients at initial interview and it sets out the services that are offered along with the Privacy Policy of that organisation and the complaints procedure. |

| The authority to act allows the finance broker to act on behalf of the client when dealing with the lender and other related parties to loan. The privacy consent form allows the finance broker to store and use relevant client information to assist in the loan application process without breaching privacy laws. This will most likely be contained in the credit proposal (mentioned below). |

| This form is which sets out the Authorised Credit Representative’s profile and authority to act on behalf of a credit licence holder and what products the ACR can introduce to under that authority. At initial interview the clients must be handed a copy. This may be an addendum to the Credit Guide. |

| By using a Client Needs Review/Fact Find you will have all the information required to form an opinion as to what type of loan best suits the clients’ requirements. At the same time you are acting with due diligence in asking the clients questions about their financial security in the event of an unforeseen circumstance that causes financial hardship. You have a legal obligation to yourself and the clients to make them aware of the ramifications of an unexpected illness, accident or even death. By signing a Client Needs Review they can accept your offer of a referral to an insurance professional or alternatively decline your recommendation, thereby you have documentary evidence of your professionalism. You do not have to sell Risk Products but you have complied with the requirements under the Duty of Care by having adopted the above actions. |

| Estimate of total fees and charges payable to the financier in relation to applying for the finance will form part of the credit proposal. However the broker may want to complete a cost analysis to determine savings or equity versus costs associated with the purchase and finance. This is not a requirement of the submission but may rather be a process you may want to adopt for purchases. |

| A file copy of your interview notes will go a long way to avoid any adverse opinions from any audit that may be undertaken by any aggregator company or ASIC official. Whilst documents required under NCC such as a fact find/client needs review, preliminary assessment and credit proposal will highlight requirements and recommendations they may cover all conversations/ time lines between the broker and client. |

| Based upon your enquiries as to the financial situation, requirements and objectives of your client you are required to conduct a preliminary assessment to determine whether the proposed credit contract/lease is ‘not unsuitable’ for the client. This must be done prior to suggesting the client applies for, or providing assistance applying for a particular credit contract. |

| These forms may be incorporate into the one document. The Credit Quote outlines the maximum fees and charges payable to the credit representative and licensee for credit assistance. Must be provided before credit assistance is provided. The Credit Proposal document outlines the fees, charges and commissions relating to the particular credit contract or consumer lease and to whom/by whom they are payable. |

| This is the document the client signs giving the Authorised Credit Adviser authority to act on the client’s behalf and also give privacy consent for the personal details to be passed onto the lending institution. It also advises the amount of commission a broker will receive as well as the costs involved in taking out the loan. A copy of this appointment must be given to the client and a copy kept on your file. This document may be a combination of industry known documents as stated above and not required if you have completed credit proposal and credit quote |

| Lenders require documentary evidence of income to support a loan application. Verifying employment may be in the form of two or three consecutively dated payslips plus a PAYG summary that indicates regular overtime or allowances/commissions. A letter or employment contract from the employer will also suffice in the absence of payslips. Other income will require documentary evidence as determined by the lender. |

| A copy of the last two years individual’s and company tax returns/financial statements along with a serviceability assessment for self-employed individual/partner. |

| This information allows lenders to readily ascertain the financial standing of the applicants. |

| When you are arranging funding for the larger type loans, whether it is for plant and equipment or say, a commercial factory unit a Cash Flow Forecast is essential as it will assist the lender in appreciating where the business is headed. But remember it will have no bearing on the lender’s decision-making as it will look only at anecdotal evidence. |

| When submitting an application you are to include a Serviceability Assessment sheet which shows the lender you have ensured the clients can afford the loan. You will find these assessment tools form part of the lenders’ online broker toolkit and are relatively simple to use. When you undertake your accreditation training each lender will provide the facility or you will have access to all the tools through your aggregator. |

| Lenders need a copy of the completed O&A or COS to verify the purpose of the loan and for the ordering of valuations, if required. You will be advised of their requirements when you complete the accreditation courses. It is also worth noting that some lenders will only carry out a kerb-side valuation when the LVR is 80% or less. |

| Whilst the Federal Government provides the funding for these concessions each State and Territory Government administers the schemes. Therefore so your clients can get the maximum benefits available, your task is to research this area of funding thoroughly by visiting the Office of Revenue in the jurisdiction in which you operate. These forms are to be completed to accompany your case study files. |

| As explained above there are variances in what concessions are available. However notwithstanding the fact that in some areas solicitors/conveyancers or settlement agents handle this aspect of the transaction, we at AAMC believe it is up to the Broker to ensure that there is a smooth settlement transition. This will happen if the Broker provides the clients with the necessary paperwork, has it completed correctly and keeps it on file for presentation to the correct parties when settlement is due to take place. |

| Let us first accept that all lenders require the same information, however with the layout of their application forms it just appears in different places. You are not only expected to provide the clients’ full personal details, but you are obliged to be honest and frank about the information you are submitting. As a Broker you are also obliged to inform either the lender or the client of any information of which you become aware that may have a material effect on the transaction. If you do not follow this principle you could well become the subject of legal action from either party. The application forms are quite simple to complete provided, however, you have gathered all the information to make it a simple task. There is one area on confusion and that is the completion of the “Declaration of Purpose”. By completing this incorrectly you may jeopardise your clients’ rights under the National Consumer Credit Protection ct 2009. |

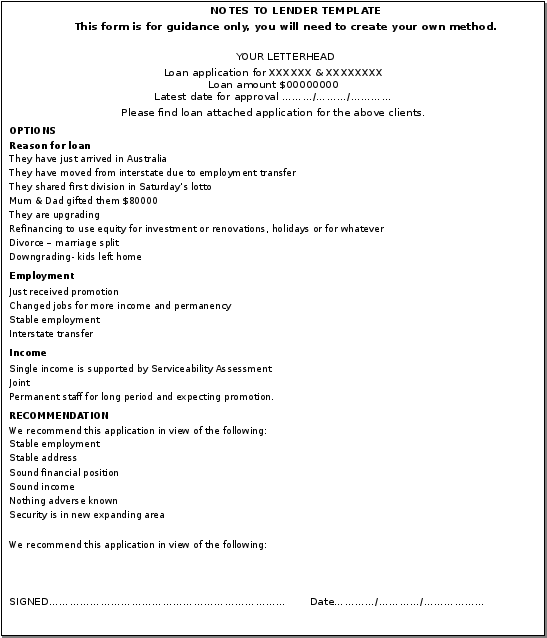

| Lenders when assessing a loan rely heavily on information provided. They do not have the privilege of sitting down and interviewing the clients. As you have already learnt, Brokers must provide as much information as possible when submitting a loan application, of any nature, to ensure a fair and reasonable decision can be made by the lender. Therefore it is in everybody’s interests to highlight valid points in a Cover Sheet. Shown below this table are two options that tell a tale. Please do not just copy these examples and submit – use your initiative and present a cover sheet along similar lines as we have demonstrated. There will be many and varied reasons why you think an application should be approved so let the lender share your reasons. Don’t make them second guess. If you follow this path, it will stand you in good stead with the lenders and exhibit a standard of professionalism that unfortunately not enough Brokers take seriously. Half measures or the attitude “Close enough is good enough” does not wash in today’s competitive economic climate. Lenders that receive half-baked applications will put them to one side and get on with the fully detailed ones to acknowledge the correct presentation. |

| All lenders have a checklist to ensure you have submitted the application correctly with all the supporting documentary evidence. Please ensure this is completed. |

| Due to criminal activities and money laundering you have to provide the necessary identifying documents to support the application. Where you are dealing with a client’s existing lender, note on your cover sheet that you haven’t supplied the information because client is known to the lender. Some lenders carry out their own verification through their branch network. |

| Business registration legitimises the authenticity of the applicant. The Constitution and/or Trust Deed reflect the authority of those able to act for and on behalf of the company. |

Process Applications for Credit (Mortgage Loans Only)

You are required to demonstrate that you understand the lenders policy and procedures for processing an application for credit i.e. from the point of view of a lenders credit analyst. Once your loan application is ready to be submitted you must provide supporting evidence that you have:

Checked and verified application details including all information to support the application are in accordance with the lenders credit policy and procedures.

Your assessment decision to recommend the credit application refers to/is within the lenders policy and procedures.

Maintaining application records and completing necessary documentation are according to the lenders legislative requirements and lenders organisational policy and procedures.

Overall, to support your understanding of how an application for credit is processed by the lender; you are required to complete research and provide the following information which is also covered in the learning material:

Detailed notes regarding the lender’s organisational approval policy and procedures for the chosen product in your selected case study. Briefly explain why the loan met the policy guidelines and how you researched the product and the guidelines. Including maximum LVR, serviceability ratio, minimum loan etc. If you are unable to access the lenders information readily the alternative is to access the Lender Mortgage Insurers (i.e. Genworth/QBE) guidelines which are readily available on their web pages. Although the case studies provided did not require LMI it is helpful to understand policy guidelines as many types of lenders and loans require LMI cover.

Explain the approval guidelines i.e. who can approve/delegation; timeframes etc.

Ensure you are adherence to relevant legislation with reference to checking and verifying application/client details and maintaining records i.e. how file and records are maintained, how movements/milestones are monitored etc.

You are to submit a fully completed loan application form as well as:

A lenders cover sheet detailing the background of the applicants, structure of the loan, loan product applied for, serviceability criteria.

Supporting documents for the loan submission as requested by the lender

Finally as a result of your client interview, completing relevant client documents and loan application for the lender; you are now required to complete the remainder of customer file supporting several of your obligations and responsibilities as a Finance Broker. These important steps being the approval process, documentation, settlement and ongoing relationship management. In areas where you do not have copies of actual supporting documentation, insert a page with the name of the document, an explanation of the document and its purpose. You would include e.g. copy of formal/unconditional approval stating conditions of settlement.

There are a number of templates in the Member’s Area under ‘Useful Resources’ that you could use in your submission.

You are required to submit your customer as determined by the chosen case study. Therefore your file information must contain the following:

Adding to your Interview Notes - Customer Contact Sheet/Record

You should have already documenting regular communication pre your loan submission. These interview notes incorporate all the correspondence from initial contact to loan preparation and submission. You are now required to provide interview notes from loan submission to post loan application process; with all parties specifically including:

- Customer

- Bank/s

- Referrer/s

- Government bodies, i.e. Stamp Duty, FHOG/ Revs

- Property Valuators

- Settlement Agent

Advice of Loan Approval

Evidence of communication with customer and other relevant parties regarding:

Communication of formal/unconditional approval to customer i.e. lender letter of offer;

Letter to client regarding documentation/settlement expectations;

Communication with Real Estate Agent, Settlement Agent, etc.

Document Sign-Up/Settlement Preparation

Document sign-up checklist and covering letter /communication;

Correctly signed mortgage documents;

Insurance details;

Authority to disburse funds;

Settlement checklist.

Advice of Transaction Completed/Finalised

Communication of successful settlement;

Letter/survey to client asking for client satisfaction feedback on services/support provided. You may wish to ask for referral to friends and family.

Task 4: Activity and Short Answers

Create a customer/referrer database

The relationships built in Task 1 Case Study were the clients, referrer, settlement agent and real estate agent.

Prepare a database on contacts made from this task by using your internal customer record system or suitable program, i.e. Microsoft Excel spreadsheet. You will be required to submit the Excel file (or PDF/screenshot if other software is used), showing your database layout.

Please answer the following questions in relation to your database and building/managing your business contacts:

Why is important to build a database of clients/referral sources?

Click here to enter text.

Why is it important to develop professional relationships?

Click here to enter text.

When is it not appropriate to contact a person and why?

Click here to enter text.

Why is it important to have effective interpersonal styles and methods when dealing with clients/referrers? Why is it important to consider special needs, culture, race, religion, origin, demographics?

Click here to enter text.

Explain why you think it would be important to follow up any business referrers as quickly as possible.

Click here to enter text.

What methods could you use in developing new business i.e.; advertising and promotion of your services?

Click here to enter text.