4 questions within 8 hours

Problem 1

The one-year LIBOR rate is 10% with annual compounding. A bank trades swaps where a fixed rate of interest is exchanged for 12-month LIBOR with payments being exchanged annually. Two- and three-year swap rates (expressed with annual compounding) are 11% and 12% per annum. Estimate the two- and three-year LIBOR zero rates when LIBOR discounting is used.

The two-year swap rate implies that a two-year LIBOR bond with a coupon of 11% sells for par. If is the two-year zero rate

so that The three-year swap rate implies that a three-year LIBOR bond with a coupon of 12% sells for par. If

is the three-year zero rate

so that The two- and three-year rates are therefore 11.05% and 12.17% with annual compounding.

Problem 2

Company A wishes to borrow U.S. dollars at a fixed rate of interest. Company B wishes to borrow sterling at a fixed rate of interest. They have been quoted the following rates per annum (adjusted for differential tax effects):

| Sterling | US Dollars | |

| Company A | 11.0% | 7.0% |

| Company B | 10.6% | 6.2% |

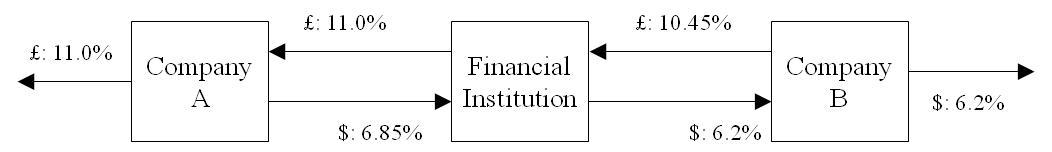

Design a swap that will net a bank, acting as intermediary, 10 basis points per annum and that will produce a gain of 15 basis points per annum for each of the two companies.

The spread between the interest rates offered to A and B is 0.4% (or 40 basis points) on sterling loans and 0.8% (or 80 basis points) on U.S. dollar loans. The total benefit to all parties from the swap is therefore

It is therefore possible to design a swap which will earn 10 basis points for the bank while making each of A and B 15 basis points better off than they would be by going directly to financial markets. One possible swap is shown in Figure S7.3. Company A borrows at an effective rate of 6.85% per annum in U.S. dollars.

Company B borrows at an effective rate of 10.45% per annum in sterling. The bank earns a 10-basis-point spread. The way in which currency swaps such as this operate is as follows. Principal amounts in dollars and sterling that are roughly equivalent are chosen. These principal amounts flow in the opposite direction to the arrows at the time the swap is initiated. Interest payments then flow in the same direction as the arrows during the life of the swap and the principal amounts flow in the same direction as the arrows at the end of the life of the swap.

Note that the bank is exposed to some exchange rate risk in the swap. It earns 65 basis points in U.S. dollars and pays 55 basis points in sterling. This exchange rate risk could be hedged using forward contracts.

problem 3. 5

Consider an option on a stock when the stock price is $41, the strike price is $40, the risk- free rate is 6%, the volatility is 35%, and the time to maturity is 1 year. Assume that a dividend of $0.50 is expected after six months.

a. Use DerivaGem to value the option assuming it is a European call.

b. Use DerivaGem to value the option assuming it is a European put.

c. Verify that put–call parity holds.

d. Explore using DerivaGem what happens to the price of the options as the time to

maturity becomes very large. For this purpose assume there are no dividends. Explain the results you get.

DerivaGem shows that the price of the call option is 6.9686 and the price of the put option is 4.1244. In this case

c + D + Ke-rT = 6.9686 + 0.5e-0.06 ́0.5 + 40e-0.06 ́1 = 45.1244

min(V,D) = D-max(D-V,0)

Also As the time to maturity becomes very large and there are no dividends, the price of the call

p+S =4.1244+41=45.1244

option approaches the stock price of 41. (For example, when T = 100 it is 40.94.) This is because the call option can be regarded as a position in the stock where the price does not have to be paid for a very long time. The present value of what has to be paid is close to zero. As the time to maturity becomes very large the price of the European put option becomes close to zero. (For example, when T = 100 it is 0.04.) This is because the present value of the expected payoff from the put option tends to zero as the time to maturity increases.

Problem 4 9

A stock price is currently $30. During each two-month period for the next four months it is

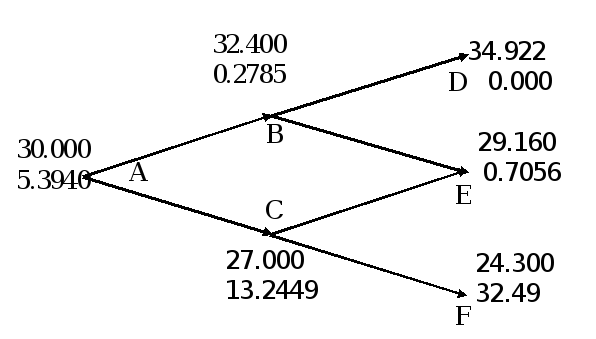

Figure S12.5

expected to increase by 8% or reduce by 10%. The risk-free interest rate is 5%. Use a two- step tree to calculate the value of a derivative that pays off [max(30 - S , 0)]2 where S is the

stock price in four months? If the derivative is American-style, should it be exercised early?

This type of option is known as a power option. A tree describing the behavior of the stock price is shown in Figure S12.6. The risk-neutral probability of an up move, , is given by

Calculating the expected payoff and discounting, we obtain the value of the option as

The value of the European option is 5.394. This can also be calculated by working back through the tree as shown in Figure S12.6. The second number at each node is the value of the European option. Early exercise at node C would give 9.0 which is less than 13.2449. The option should therefore not be exercised early if it is American.

Figure S12.6 Tree to evaluate European power option in Problem 12.19. At each node, upper number is the stock price and the next number is the option price