Due Week 7 and worth 80 points---- respond---

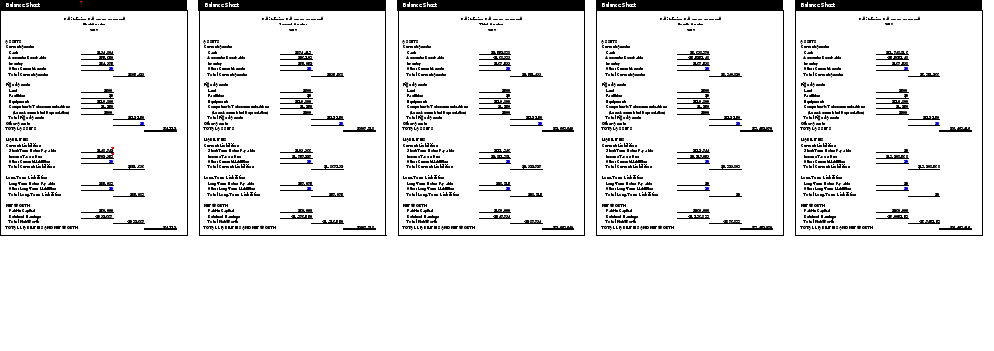

Revitalizing Beverage Company will be getting it funding from combination of capital loans and investment. The total capital loan and investment comes to a total of $380,000. The company use of funds will come from the following: Melinda Cates ($40,000), Personal investment ($20,000), Family and Friends ($20,000), Private funding 1 ($100, 000), Private funding 2, and Bank loans from bank of America ($100, 000).

Sources of Funding

Melinda Cates - 40,000

Personal investment - $20,000

, Family and Friends - $20,000

Private funding 1- $100, 000

Private funding 2- $100, 000

| Capital Investments and Loans |

|

|

|

|

| |||

| Item | Amount | Date | Loan Period | Interest Rate | ||||

|

|

|

|

|

| ||||

| Equity Capital Investments |

| Month | Year |

| ||||

| Melinda Cates | $40,000 | Apr | 2017 | Capital investments are not paid back on a loan schedule. | ||||

| Personal investment | $20,000 | Apr | 2017 | |||||

| Investment Source Name | $0 | Apr | 2017 | |||||

| Investment Source Name | $0 | Apr | 2017 | |||||

| Investment Source Name | $0 | Apr | 2017 | |||||

| Investment Source Name | $0 | Apr | 2017 | |||||

| Investment Source Name | $0 | Apr | 2017 | |||||

| Investment Source Name | $0 | Apr | 2017 | |||||

| Investment Source Name | $0 | Apr | 2017 | |||||

|

| Investment Source Name | $0 | Apr | 2017 | ||||

|

| Investment Source Name | $0 | Apr | 2017 | ||||

|

| Investment Source Name | $0 | Apr | 2017 | ||||

|

| Investment Source Name | $0 | Apr | 2017 | ||||

|

| Investment Source Name | $0 | Apr | 2017 | ||||

|

| Investment Source Name | $0 | Apr | 2017 | ||||

|

| Total Capital Investments | $60,000 |

|

|

|

| ||

|

|

|

|

|

|

| |||

| Loans |

|

|

|

|

| |||

| Family and Friends | $20,000 | Apr | 2017 | 24 | 5.00% | |||

| Private funding 1 | $100,000 | Apr | 2017 | 24 | 5.00% | |||

| Private funding 2 | $100,000 | Apr | 2017 | 24 | 5.00% | |||

| Bank of America | $100,000 | Apr | 2017 | 2.80% | ||||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

|

| Loan Source Name | $0 | Apr | 2017 | 24 |

| ||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

| Loan Source Name | $0 | Apr | 2017 | 24 |

| |||

|

| Total Loans | $320,000 |

|

|

|

| ||

|

|

| |||||||

|

| TOTAL INVESTMENTS AND LOANS | $380,000 | ||||||

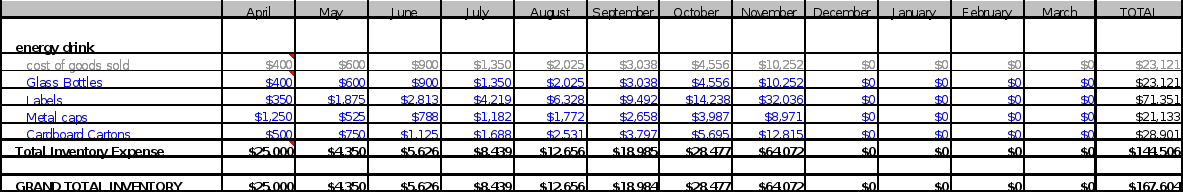

The company use of funds will include the following: inventory purchases, capital purchase equipment including manufacturing and delivery equipment and funding of working capital.

Inventory Purchases -$167,604

Capital Purchases- $91,750

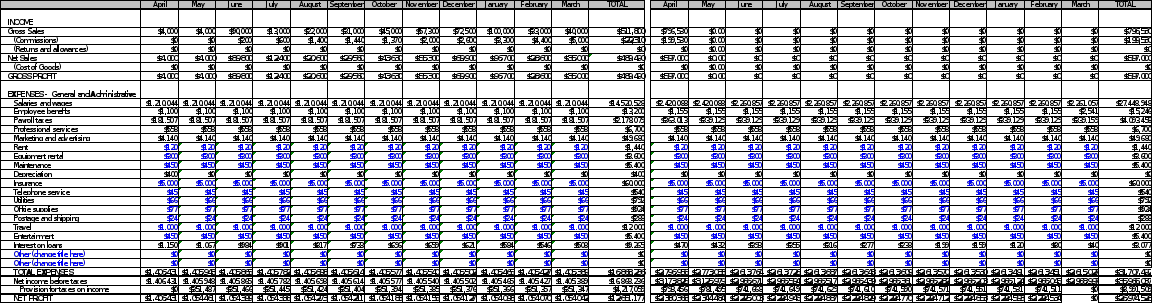

Primary Assumptions

Number of Product Lines: 3

% of Sales on Credit: 55%

Days Credit: 30Annual Benefits Cost (Full-time):$4,5005

Annual Benefits Cost (Part-time): 1,2501

Annual Benefits Cost Increase: 3%

Annual Wage Increase: 3%

Payroll Tax %: 12.5%

Opening Bank Account Balance: 16,5004

Tax rate: 56%Bank Interest Earnings Rate: 1%

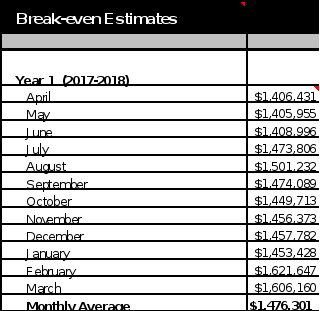

The break-even analysis for the first year is 41,476,301

| Variable Costs | Year 1 | Fixed Costs | Year 1 |

| Salaries and wages | $1,210,044 | Professional services | $558 |

| Employee Benefits | $1,100 | Marketing and Advertising | $4,140 |

| Commissions | $181,507 | Rent | $120 |

| Returns and Allowances | $489,490 | Equipment rental | $300 |

| Maintenance | $450 | ||

| Total Variable Costs | $793,141 | Depreciation | $400 |

| Insurance | $5,000 | ||

| Projected units Sold Yr 1 | $145,631 | Telephone service | $45 |

| Variable Cost per Unit | $4.78 | Utilities | $66 |

| Avg unit selling Cost Per unit | $32.41 | Office supplies | $77 |

| Postage and shipping | $24 | ||

| Travel | $1,000 | ||

| Entertainment | $450 | ||

| Breakeven Point | $793,141 | Interest on loans | $1,150 |

| Total Fixed Costs | 12,790 | Total Fixed cost | 14180 |

| Breakeven Units Sold | 805931 | ||