problem sets

Prepare in Microsoft® Excel® or Word.

•Ch. 1: Questions 3 & 11 (Concepts Review and Critical Thinking Questions section)

•Ch. 2: Questions 4 & 9 (Questions and Problems section): Microsoft® Excel® template provided for Problem 4.

•Ch. 3: Questions 4 & 7 (Question and Problems section)

•Ch. 4: Questions 1 & 6 (Questions and Problems section): Microsoft® Excel® template provided for Problem 6.

Show all work and analysis.

Format your assignment consistent with APA guidelines if submitting in Microsoft® Word.

3. Corporations [LO3] What is the primary disadvantage of the corporate form of organization? Name at least two advantages of corporate organization.

11. Goal of the Firm [LO2] Evaluate the following statement: Managers should not focus on the current stock value because doing so will lead to an overemphasis on short-term profits at the expense of long-term profits

3. Dividends and Retained Earnings [LO1] Suppose the firm in Problem 2 paid out $95,000 in cash dividends. What is the addition to retained earnings?

4. Per-Share Earnings and Dividends [LO1] Suppose the firm in Problem 3 had 90,000 shares of common stock outstanding. What is the earnings per share, or EPS, figure? What is the dividends per share figure?

9. Calculating Additions to NWC [LO4] The 2014 balance sheet of Steelo, Inc., showed current assets of $4,630 and current liabilities of $2,190. The 2015 balance sheet showed current assets of $5,180 and current liabilities of $2,830. What was the company’s 2015 change in net working capital, or NWC?

4. Calculating Inventory Turnover [LO2] The Green Corporation has ending inventory of $417,381, and cost of goods sold for the year just ended was $4,682,715. What is the inventory turnover? The days’ sales in inventory? How long on average did a unit of inventory sit on the shelf before it was sold?

7. DuPont Identity [LO4] If Roten Rooters, Inc., has an equity multiplier of 1.15, total asset turnover of 2.10, and a profit margin of 6.1 percent, what is its ROE?

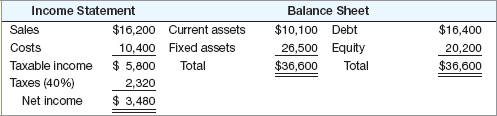

1. Pro Forma Statements [LO1] Consider the following simplified financial statements for the Yoo Corporation (assuming no income taxes):

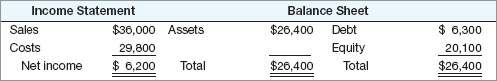

6. Calculating Internal Growth [LO3] The most recent financial statements for Schenkel Co. are shown here: