sets

Use question 1,2 and 3 to answer 4

1. Building a Balance Sheet [LO1] KCCO, Inc., has current assets of $5,300, net fixed assets of $24,900, current liabilities of $4,600, and long-term debt of $10,300. What is the value of the shareholders’ equity account for this firm? How much is net working capital?

2. Building an Income Statement [LO1] Billy’s Exterminators, Inc., has sales of $817,000, costs of $343,000, depreciation expense of $51,000, interest expense of $38,000, and a tax rate of 35 percent. What is the net income for this firm?

3. Dividends and Retained Earnings [LO1] Suppose the firm in Problem 2 paid out $95,000 in cash dividends. What is the addition to retained earnings?

Answer 4. Per-Share Earnings and Dividends [LO1] Suppose the firm in Problem 3 had 90,000 shares of common stock outstanding. What is the earnings per share, or EPS, figure? What is the dividends per share figure?

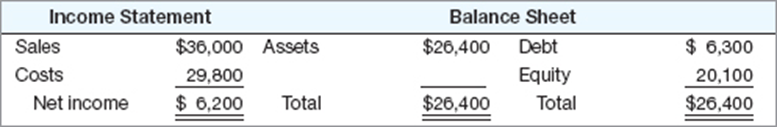

1. Pro Forma Statements [LO1] Consider the following simplified financial statements for the Yoo Corporation (assuming no income taxes):

The company has predicted a sales increase of 15 percent. It has predicted that every item on the balance sheet will increase by 15 percent as well. Create the pro forma statements and reconcile them. What is the plug variable here?

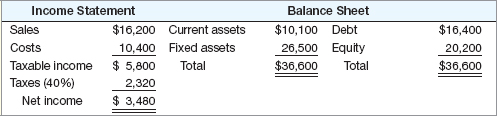

6. Calculating Internal Growth [LO3] The most recent financial statements for Schenkel Co. are shown here:

Assets and costs are proportional to sales. Debt and equity are not. The company maintains a constant 30 percent dividend payout ratio. What is the internal growth rate?

Prepare in Microsoft® Excel® or Word.

Show all work and analysis.

Format your assignment consistent with APA guidelines if submitting in Microsoft® Word.