Power point Slides

Running Head: MARKETING PLAN 25

Team B – Virum Marketing Plan

Ronald Phillips

Shawn Fields

Grace Koyama

Bhumi Shah

Megan Wilke

Keller Graduate School of Management

MGMT 600 – Business Planning Seminar

Professor: Gerard Becker

May 27, 2017

Marketing Plan

Product Concept

The Virum customer is a male, between the ages of 20 to 40 years of age. They are a professional, distinguished, fashionable, trendsetter that carries a sophisticated and corporate/business mentality. They are a mature business professional, lawyer, doctor or celebrity. They live life to the fullest and value their success in work and in their personal life. The Virum customer lives in a metropolitan, city or urban area. They need finding the perfect style of clothing to match their profession that gives them the confidence and feeling that they are in control of their own destiny.

While young men age 16 years are also motivated to keep up with the latest trends too, more of them are also opting for classic styles. The renewed appetite for classic is being driven by an uncertain economic climate, which has resulted in a rise in men who are mainly buying clothes when they need to replace worn out ones (Marano, 2008). The young generation which can be referred as digital generation is a good market as they have high utilization of social media which is one of the company’s marketing strategies. This young age will be an added target market as the business grow.

Virum offers to the market an upscale, online store where they can find top brand, business oriented garments in the latest styles at a reasonable price. Virum is a men's apparel retailer that is based in Houston, TX. They offer the male consumer a premium quality, brand name clothing such as Armani, Calvin Klein, Ralph Lauren and Kenneth Cole. IBISWorld's industry analyst, Will McKittrick, notes that "Men are more in tune and more interested in looking good and sharp." Younger generations are entering the workforce and beginning to spend a lot more on fashionable clothing. (Li, 2015) Virum’s strategy is to capitalize on the increased male interest in online shopping. Their online store offers choices of men’s suits, sportscoats, pants, shirts, hats, shoes, and accessories. The target market segment consists of males between the ages of 20 and 40 years of age. The company objectives are to create, a high profile, online men’s store that delivers excellent quality apparel; positioning Virum as a leading online shopping retailer for the male market segment, over the next ten years. They will generate a 225% annual revenue growth for first five years and achieve a net income of $500,000 in the first 12 months, $1,125,000 for the 2nd year, $ 2,531,250 for the 3rd year, $5,695,312 for the 4th year and $12,814,453 for the 5th year. Virum's mission is to maximize online sales, provide top quality products and bestow excellent service onto their customers.

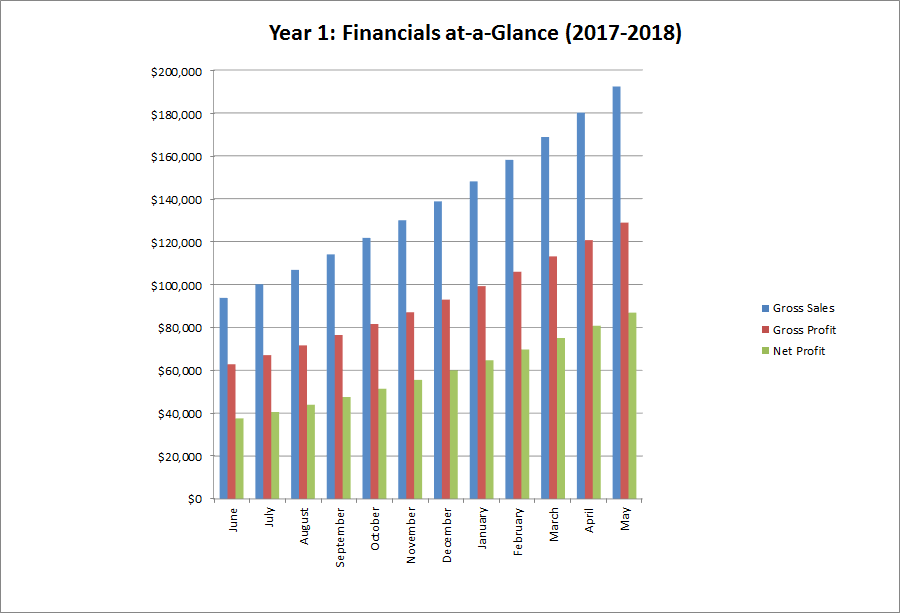

Fig.1: financial at glance of 2017-2018

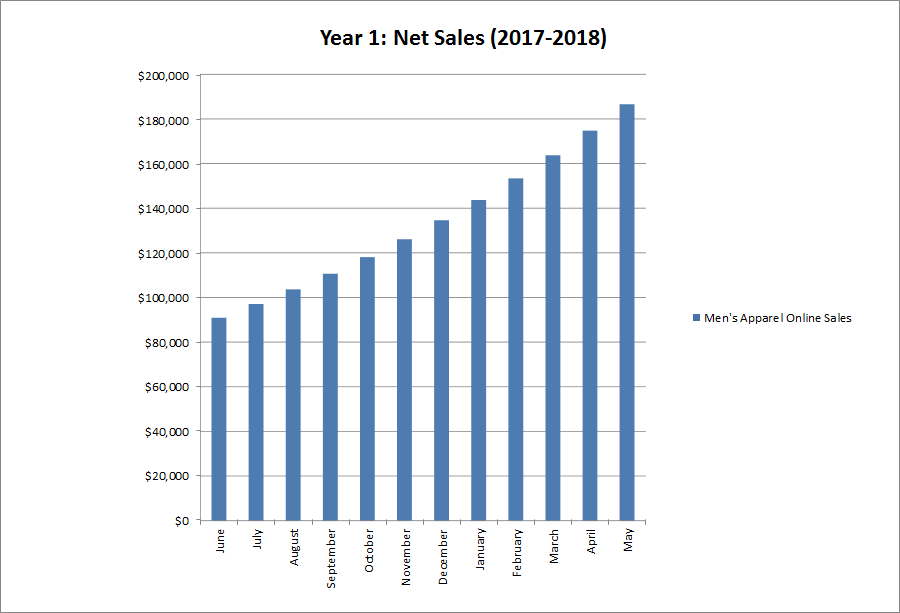

Fig. 2: net sale

Virum product presentation and selection provides men with stylish clothing alternatives for their professional, business oriented and casual lifestyles. Their product positioning aims for upscale, high quality, premium clothing at a reasonable price which enables the male consumer to develop a wardrobe that inspires confidence and promotes success; to build a sturdy foundation of self-assurance and a sense of inner power. Virum as a selling retail apparel dealing with men clothing and accessories is projected to be a multibillion dollar company in five years. Virum not only provides upscale name brands for the business oriented male consumer, but they also provide engaging and dynamic advertising and promotional campaigns.

Market Description

Virum Company aims to be a large, well-braded retailer of apparel market. The online retail industry for men's clothing is driven by a combination of sales, pricing, demographic trends and economic conditions (Stephen N, 2014) therefore, making the online clothing industry sensitive to the economic recession. As the economy goes down, the unemployment rate increases, consumer confidence decreases along with the per capita of disposable income furthermore effecting the downward direction for demand on apparel (Wang, 2014). Nonetheless, as the economy recovers, the industry will see consumer spending and product demand increase. The clothing industry in men's apparel consists of clothing companies that design, manufacture and sell clothing, footwear, and accessories. Other categories include basic undergarments, pants, t-shirts, luxury coats, and suits. "On the back of growing market demand, fashion brands have moved to expand their menswear offerings, introducing broader product range offerings from names like Hermès, Lanvin, Gucci, Ralph Lauren, Dolce & Gabbana, Calvin Klien, Elie Tahari, and Prada." (Wang, 2014)

Male consumers are becoming more interested in investing in themselves. They purchase apparel in many varieties, ranging from standard business suits and dress shirt to cashmere sweaters and top coats. In the US, men’s apparel sales grew 5 percent in 2013 to over $60 billion, outperforming growth in womenswear. (Group, 2012) in recent studies, men's clothes shopping has outranked that of the female clothes market. Website purchases, which represented 14 percent of men’s clothing sales, saw some of the highest growth for the year, increasing 19 percent over 2012. (Group, 2012) Virum carries a global perspective and competitive edge over the traditional brick-and-mortar, high-end retailers by developing more dynamic pricing points, disregarding antiquated marketing and sales strategies, and adjusting their tactics to accommodate the needs of business professionals who shop online.

Virum will provide a comprehensive line of men clothes from well-known brand names for men aged between 20-40 years. Since a typical customer seeks medium quality equipment’s and excellent service for his money, the apparel will focus on providing brands from Armani, Calvin Klein, Ralph Lauren and Kenneth Cole and excellent services at an affordable and competitive price. The company brand names have a widespread reputation as mid-to-high-level quality compared to some of our competitors.

Service Concept

The message conveyed by the style of clothing, the wearer primarily directs its brands and choice. “Style is more character than clothes, more attitude than affluence. It's you making visible your inner self.” (Marano, 2008) People dress as a way of expressing themselves and as a member in a class or group. A group whom they feel a certain connection with, therefore expressing it to themselves and to whomever may be looking. “Through clothes, we reinvent ourselves every time we get dressed. Our wardrobe is our visual vocabulary. Style is our distinctive pattern of speech, our individual poetry” (Marano, 2008) Male fashion has evolved from the traditional 3 piece suits to high fashion, trendy, form fitting clothing styles. Male consumers are focusing more of their attention on appearance and style. “Men’s apparel profited from strong interest in overall appearance, as millennials' earning power increases. Younger men are choosing tighter fitting clothing which is designed to closely fit the body. This change in style drove men to make more purchases, updating their wardrobes to fit this new style.” (Menswear in the US, 2014) The correlation between style and inner confidence is significant and has become influential in the men's apparel market. Menswear is expected to take fashion cues from feminine styles in this regard, and bold choices are expected to become more common. “Michael Kors, another predominantly womenswear brand in the “accessible luxury” space, has set a similar target.” (Wang, 2014)

The Millennial generation ranges from 18 to 34 years of age and rely heavily on the use of technology and social media. Virum's sales strategy will target the millennial market segment using social media and internet advertising. Statistics Millennial consumers want to control their own image, and are turning to fashion to do so. Men are expected to keep expanding their color palates and their use of unconventional patterns. Understanding their social behaviors and shopping habits will provide a better understanding of this segment's buying potential. Using and understanding the power of social media platforms is one of the essential marketing component for Virum. They will use social platforms to expand-online sales and provide customized product lines for teams, clubs and businesses.

Virum’s business vision is to create, monitor, maintain and cultivate a strong relationship with their customers. The company relies heavily on a personal approach with their suppliers and customers, such as personal contact with the suppliers to establish the products in the stores and carrying a lucrative inventory. This sales and marketing strategy is in alignment with the ever-changing online retail environment. As the market develops and grows, access to consumer and their purchases improve, along with innovation in technology. The use of mobile devices for online shopping has grown and become another convenient avenue for shopping. Interest in men’s fashion is unlikely to decrease in the future, on the contrary, the expectation of men's shopping is growing rapidly; as younger consumers are among the strongest drivers of this trend. Menswear is expected to take some cues from feminine styles in this regard, and bold choices are expected to become more common. “Michael Kors, another predominantly women’s wear brand in the “accessible luxury” space, has set a similar target.” (Wang, 2014)

Marketing Mix - Four Marketing P’s

Product:

Men's clothes. Suits, pants, sport coats, overcoats, shirts, t-shirts, sweaters, shoes, accessories.

Affordable top brand clothes.

Virum products and styles emit the look and feeling of prestige and success.

Place:

Products will be sold online/e-commerce.

Products sold via website and various online distribution channels.

Price:

Products sold at a minimum price of $20, with an average of $ 45 to $75 per product.

It is a good value for what the customer will be getting.

Prices will be comparable to competitors’ due to the inventory and selection we offer.

Promotion:

We will promote via internet and social media.

Products will be promoted through Facebook, Instagram, Twitter and Virum website.

Customers will find us via newsletters and social feeds.

Ads will be on the website, social media accounts, emails to customer database and inserts within the orders that ship to customers.

Table 1: SWOT Analysis

| Strengths |

|

| Weakness |

|

| Opportunities |

|

| Threats |

|

| Competitors |

|

Virum apparel management will ensure teamwork philosophy is upheld. The team members will be able to work together collaborating to ensure company’s strengths and opportunities are achieved and any shortcoming is dealt with successfully. The company will be able to provide opportunities for growth through workshops and continuing education programs to ensure our employee are adequately equipped with skills and knowledge to move this apparel to the next level.

Market Segmentation

There are several segments in retail such as gender, age, geographic behavior, and lifestyle. Virum will target adult males between the ages of 20 to 40. Diversity among consumer backgrounds are a critical factor for the success of the organization. This target market holds no ethnic barriers and lands in this broad-based niche of business oriented male adults. They are the target market persona that is the versatile consumer who adapts in any environment, desires upscale high-quality clothing and carries enough disposable income to pay and look great in every setting.

Market Analysis

The growth in e-commerce that is due to increased internet penetration, offers online retailers the ability to identify products and services, along with consumers, that drive sales and revenue growth and profitability. Plunkett’s demographic group table below, offers a solid understanding that Virum’s concentration on their target market will take advantage of the highest percentage of internet users and demographic groups.

| Internet Users by Demographic Group, U.S.: 2015 | |

| Demographic Group | Use Internet |

| All Adult Americans | 84% |

| Sex | |

| Male | 85% |

| Female | 84% |

| Age | |

| 18-29 | 96% |

| 30-49 | 93% |

| 50-64 | 81% |

| 65 and older | 58% |

| Race/Ethnicity | |

| White, Non-Hispanic | 85% |

| Black, Non-Hispanic | 78% |

| Hispanic | 81% |

| Annual Household Income | |

| < $30,000 | 74% |

| $30,000-$49,999 | 85% |

| $50,000-$74,999 | 95% |

| $75,000+ | 97% |

| Education Attainment | |

| Less than High School | 66% |

| High School Graduate | 76% |

| Some College | 90% |

| College Graduate | 95% |

| Community Type | |

| Urban | 85% |

| Suburban | 85% |

| Rural | 78% |

Table 2: Source: Pew Internet & American Life Project. Plunkett Research, Ltd.

Industry Statistics & Market Size

Per the NPD Group, Inc., a global information company, men’s apparel in U.S. retail sales reached $60.8 billion in 2013, a 5 percent increase over the $57.8 billion generated in 2012. This is large part to double-digit gains in sales of men’s outerwear, pants, and socks. In contrast, the U.S. women’s apparel market grew 4 percent with total sales of $116.4 billion dollars. Of the 13 categories tracked by NPD in men's apparel, 12 experienced dollar sales increases in 2013, including pants, with sales increasing 12 percent to $4.8 billion, and socks, which grew by 14 percent to $2.8 billion. The only category to experience dollar sales declines was men's tops, which experienced a drop-in sale of 2 percent. “Innovation and men’s perception of fashion contributed to an increase in spending in 2013,” said Marshal Cohen, chief industry analyst, The NPD Group. “Another notable reason for the rise included colder than usual weather conditions, which helped the sales of men's outerwear grow 12 percent.” “Most channels benefitted from total men’s apparel sales in 2013. Strong sock and pants sales influenced the increase at specialty stores, while outerwear trended sales upward at department stores and mass merchants.” (Group, 2014)

Table 3: U.S men’s apparel sales

Apparel Sales Online

Virum will have five men’s apparel distributions channels: 1. iOffer.com; 2. Amazon.com; 3. Rakuten.com; 4. eBay.com; and Virum website via Shopify.com. The company will also utilize Facebook and Twitter to build name recognition and drive sales. High-end brand names like Joseph Abboud, Hugo Boss, Michael Kors, Ralph Lauren, and Elei Tahari, draws the attention of the company’s target market. High resolution of images of the products that customer intend to order help them visualize their preferred professional image. Virum uses multiple online tools that help drive consumer engagement in the apparel category. Online marketplaces like eBay.com, Amazon.com, iOffer.com, Shopify.com, Rakuten.com, and Sell.com have all launched a number of new tools that are proving to improve the apparel shopping experience.

Using such sites as eBay, Amazon, iOffer, Facebook, Instagram and Twitter for advertising, promotion, and giveaways, the company can develop its presence in the online market. Although the company uses multiple online marketplaces to sell men’s apparel, the long-term strategy is driving new and repeat customers to the company website. This will reduce cost, increase profits, and promote the Virum name and brand.

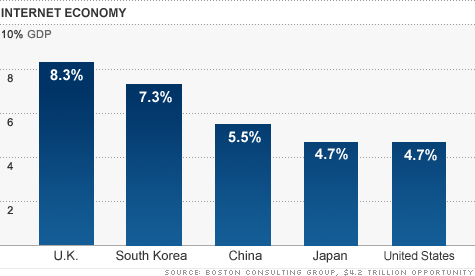

Virum is focused on promoting its name and brand in the fast-growing men’s apparel e-commerce market. Their e-commerce distribution channels will continue to develop as companies such as Amazon and eBay reach their 23 and 22 year anniversaries and new companies enter the cyber market. E-commerce is the process of Transacting or facilitating business over the internet and is the new standard for how retail companies manage and conduct their business. Per the Boston Consulting Group, the internet is a contributor to more of the American economy than that of the entire federal government.

Fig. 3: internet economy

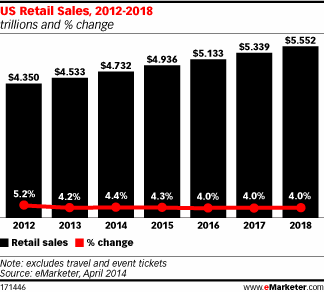

The internet accounted for $684 billion, or 4.7% of all U.S. economic activity in 2010, Boston Consulting Group found. By way of comparison, the federal government, contributed $625 billion, or 4.3%, to the nation's output. (Censky, 2012) According to eMarketer’s forecast of retail sales in the U.S. ecommerce accounted for a significant portion of that growth and future forecast put retail sales at $ 5.339 trillion, a 4.0% growth by 2017 and $ 5.552 trillion in 2018.

Fig. 4: U.S retail sales

Value Proposition

Virum’s target group has an average annual salary of $42,000. “Millennials are now earning a median-wage income at age 30. They may be currently struggling, but Gen Y is still very optimistic about their financial future. Nearly 90% of those 18-34 believe they have enough money now and expect that they will have even more in the future.” (Stephen Nikitas, 2014) According to Javelin Strategy and Research, in 2015, Gen Y income will exceed that of Baby Boomers. “By 2020, their income is projected to exceed that of both Baby Boomers and Gen X. By 2025, Gen Y’s combined income is expected to account for 46% of the nation’s income. Gen Y consumer spending is expected to grow to $1.4 trillion annually and represent 30 percent of total retail sales by 2020. So, while Gen Y might not have assets or a lot of spending power today, they will. And unless you go after this crowd now and get them firmly entrenched, you’ll miss a huge opportunity” (Stephen Nikitas, 2014).

The disposable personal income of the target group is expected to increase within the next 5 years. The expenditures on men’s apparel will be directly related to the increase in disposal income. The target group has the desire and income to look great in every situation. To improve profitability, many companies are restructuring to create leaner organizations and adopt new technologies.

Virum marketing model is focused on quality, service, and price. As mentioned throughout this marketing place, Virum’s target market of men ages 20 to 40 choose to shop online because of: increasing time-poverty, changing lifestyle, convenience, flexibility of shopping and because the company offers free home delivery. Virum offers brands which are an increasingly significant factor in men’s apparel. The target customer does not have time to drive to the local store or department store. They are looking for time-saving ways to spend their disposable income. Th exposure to online shopping and established brand names, with their quality image, make the shopping experience convenient, simple and faster for many consumers.

Virum offers these brand name, new apparel at heavily discounted prices with free home delivery. Their focus builds on consumer loyalty, which translates into repeat business.

Virum purchases new close out, job out, and store stock from major department stores and manufactures at $0.10 to $0.16 on the dollar of the retail price from their suppliers. Virum’s low-cost purchase savings creates a diverse competitive edge, giving the customer the opportunity to purchase Virum products at less than 50% off of the retail department store price.

Promotions begins with the discount of 10% off the customer’s first purchase; therefore, encouraging and increasing the potential of return customers. The use of social media platforms such as Facebook, Twitter and Instagram helps the increase in sales, productivity and increase in advertisement tactics and expansion. Pricing strategies include the cost of production where all products are purchased from suppliers with the option to purchase custom apparel for business teams, i.e., embroidered company logos on business shirts or sweaters. The price point is listed reasonably which translates to a reasonable and promising selling advantage.

Pricing Strategies

Virum uses both the value pricing which incorporates both budget and luxury segments. Their value pricing strikes an important balance between cost and quality. The Virum customer want products that are made of high quality material at a reasonable price. They do not sacrifice quality for extremely low prices or sacrifice cost for poor quality products. The pricing of Virum apparels compared to its competitor’s price is ranged averagely and may also reflect a high price based on unique designs. Virum as a large apparel retailer will have an advantage over smaller competitors as the company will be able to get a better pricing from suppliers and manufacturers because the company can buy large quantities of apparel at a lower price which will be reflected at the company’s product prices.

Price has been described as the most important factor affecting the online purchasing decision by about sixty percent of all online shoppers globally (Prasad and Aryasri, 2009). Being an ecommerce company, Virum will apply various pricing approaches which will be used as marketing weapon and a conversion rate optimizer. The pricing of various products was based on the competitive landscape, the product type and consumer preferences. The company will be flexible in pricing the product, in cases where a luxury product is in demand and customers are ready to pay out a premium fee, the company may increase the price but at a rate which will still maintain its competition. The company will also use its market intelligence and analysis skills through automated price tracking solutions to ensure it doesn’t drop prices all the time but the company can adjust various prices to be competitive while still maintaining profitability.

Sales and Marketing Strategy

Through the social media channels, Virum undergoes constant updates and newsfeeds to help regulate the current trends in fashion. Marketing is currently done through online channels of using Facebook, Twitter and Instagram to showcase all its designs and products. Facebook and Twitter are meeting the requirements for online sourcing while Instagram helps with the tagging and hash tags. The collaboration of internet and social media will guide most of the marketing and advertising efforts. Along with the use of social media, within the Virum website, a company newsletter will be offered to every customer at the company landing page as well as within the checkout and order confirmation page where the customer will have the opportunity to subscribe to weekly, monthly, and yearly updates and product clearance and seasonal promotions. The delivery tool of choice will be by email. This tool will also feed the customer database for potential questionnaires and surveys to assist in performance measures and customer satisfaction metrics.

Market Communication Plan

“The new wave of consumerism coupled with increasing urbanization and burgeoning middle class with paradigm shifts in their demographic and psychographic dynamics have driven consumers frequently to use retail websites to search for product information and/or make a purchase of products.” (Prasad & Aryasri, 2009) Virum intends to use a broad-based internet marketing campaign that includes search engine optimization, pay per click marketing, and affiliate marketing programs that will drive traffic and sales to Virum's multiple online distribution channels. They will develop continuous online advertising and promotional campaigns throughout the year. Virum plans to increase its use of e-commerce sites to achieve market penetration and name recognition.

As with all businesses, Virum relies on conventional and electronic communication to reach all new and existing customers. A strategy for combining conventional and electronic communication used by Virum will be advertising via industry newsletters and published industry-wide clothing magazines. Publications, such as magazines and newsletters are considered tangible media. Tangible, visual advertising serves as an instrument to enforce intangible influences such as believability, prestige and quality. These forms of media are considered non-intrusive; hence, customers will appreciate them above more aggressive in your face media advertising.

The growing competition in e-commerce is inducing more and more companies to seek the satisfaction of consumers, which, in turn, reflects the continuity of the relationship, in loyalty, favorable attitudes and positive word-of-mouth advertising (Bachion, Rodrigues Da Silva Tamashiro, & Monforte Merlo, 2017). Virum online has a customer service center that deals with queries or problems regarding their products, orders, and returns. The sales are also managed on this site via a shopping cart, where the customers can place their orders 24 hours a day, 7 days a week. Payment of the products is done online through debit cards, credit cards and PayPal. All orders will be automatically confirmed via email, back to the customer; which also fulfills revenue recognition. On the confirmation of the payment the order will be processed and delivered to the customer destination within 3 business days.

References

Bachion, Ceribeli, H., Rodrigues Da Silva Tamashiro, H., & Monforte Merlo, E. (2017). Online Flow and E-Satisfaction in High Involvement Purchasing Processes. Base, 14(1), 16-29. doi:10.4013/base.2017.141.02 (pg. 16)

Censky, A. (2012, March 19). Internet Accounts for 4.% of U.S. economy. Retrieved May 16, 2017, from CNN Money: http://money.cnn.com/2012/03/19/news/economy/internet_economy/ (pg. 12)

eMarketer, Total US Retail Sales Top $4.5 Trillion in 2013, Outpace GDP Growth. (2014, April 10). Retrieved from https://www.emarketer.com/Article/Total-US-Retail-Sales-Top-3645-Trillion-2013-Outpace-GDP-Growth/1010756 (pg. 13)

Group, T. N. (2014, May 01). The NPD Group Reports 5 Percent Growth in U.S. Men’s Apparel Market. Retrieved from https://www.npd.com/wps/portal/npd/us/news/press-releases/the-npd-group-reports-5-percent-growth-in-us-mens-apparel-market/ (pg. 4,10,11)

Li, S. (2015, March 15). Millennial guys keen on style are reshaping the fashion trade. Retrieved from http://www.latimes.com/business/la-fi-menswear-boom-20150315-story.html.

(Pg. 2)

Marano, H. E. (2008). The STYLE Imperative. Psychology Today, 41(5), 78. (pg. 5)

Menswear in the US. (2014, March 11). Retrieved http://www.live-pr.com/en/us-menswear-market-reported-3-growth-r1050496870.htm (pg. 5)

Plunkett, Jack W., Plunkett, M. B., Steinberg, J. S., Faulk, J., & Snider, I. J. (2016). Internet Users by Demographic Group, U.S.: 2015. E-Commerce & Internet Industry. Retrieved May 27, 2017, from http://www.plunkettresearchonline.com. (figure 3, pg. 9, 10)

Prasad, C. S., & Aryasri, A. R. (2009). Determinants of Shopper Behaviour in E-tailing: An Empirical Analysis. Paradigm (09718907), 13(1), 73-83. (pg. 16)

Stephen Nikitas, S. S. (2014, February 13). Generation Y Millennials: Why They’re Worth a Second Look. Harland Calrke: (pg. 13)

Wang, L. (2014, June 17). No Sings of Slowing in the Global Menswear Maket. Retrieved May 16, 2017, from Businessoffashion.com: https://www.businessoffashion.com/articles/fashion-show-review/signs-slowing-global-menswear-market

(pg. 5, 6)