HCA312 Healthcare Finance- Break Event

Running head: CAPITAL INVESTMENT PLAN 0

Capital Investment Proposal Plan

Altonice Cox

HCA312: Health Care Finance

INSTRUCTOR'S NAME: Paula Arceneaux

June 26, 2017

Executive Summary

Summerdale Medical Center has been offering a range of specialized medical facilities for the last ten years. In light of the integration of national insurance medical framework, the center would like to expand its range of services and facilities. At the moment, the Summerdale offers inpatient and outpatient services to patients but with a limitation in cash and limited insurance payment modes. The center would like to integrate additional payment modes. In addition, Summerdale is seeking investment so that it expands its bed capacity from the current 850 to 2000. This will call for investments from different avenues.

Service/ Equipment Description

At the moment, Summerdale Medical Center has a bed capacity of 850 with the Intensive Care Unit (ICU) limited to 15, equipped with life supporting machines at estimated cost of $1.2million. Outpatient services are available to those who pay cash and are limited to specific medical services. Specialized in-patient care has been outsourced to a private practitioners who are paid on-demand basis. Surgical procedures are also done on-demand and this are very expensive at Summerdale. Some services such disease mapping, management and control have become a challenge in the recent past. The medical center has also found it very hard to employ specialists in corrective, restorative, symptomatic and screening procedures, and as result outsources (Berwick, Nolan & Whittington, 2008).

Summerdale is planning for an overall in service provision. First, hiring of specialists in general screening operations as well as advanced imaging will boost medical service delivery at the hospital. Increase in number of specialists hired on permanent basis from 8 to 25 will ensure a better response to emergencies within the medical center. The plan also includes an increase in surgery rooms from 3 to 6, doctor facilities from 10 to 25, bolster allocations to 20 and increase in drug stores from 6 to 13. ICU bed capacity will be doubled by this plan to enable the hospital handle the emergency. The expansion plan also considers the expansion of the number of general wards from 6 to 11. This expansion at Summerdale seeking to increase the bed capacity from 850 to 2000 at a cost of $4.5 million.

Booking, reservation and appointment system at Summerdale will be overhauled as well. Investment of medical services and appointment system will be done at the tune of $0.5 million. This system will allow the patients to book and get appointment services from the different medical practitioners in Summerdale Medical Center (Berwick, Nolan & Whittington, 2008). In addition, the system will enable the patients view the medical tests that they can undertake a specific time. Allotment of doctor appointments will enable the full-time and part-time specialists to have access to the patient queue system. This system will optimize allocation of specialists and patients depending on the demand. Once a patient has gone through the process of appointment, doctor assessment and having medical tests done, payment processing will be done. Summerdale Medical Center is getting a payment processing system that will link the patient database with the modes of payments. With the medical insurance platform rollout, the medical center is partnering with a number of insurance companies in making quality and specialized healthcare easily available. The overhaul of the appointment, booking, medical assessment and the payment processing system will make streamline the provision of services at Summerdale Medical Center.

Establishing the Team

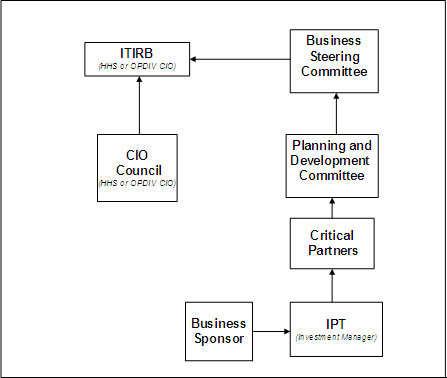

Creation of a capital investment team is integral for the development, implementation and monitoring of the investment progress. With that said and done, there are there are three levels of investment team and each level is concerned about specific elements of the investment plan (Berwick, Nolan & Whittington, 2008).

At the strategic business level, decisions of nature of business and the direction that the business are made. At this level. The Chief Investment Officer (CIO) oversees the team and is responsible for the investment portfolio. The CIO makes all the financial decisions supported by data derived from the investment plans. With the help of investment team, the CIO develops a strategic asset-allocation plan for the investment program. In addition, the CIO also makes further recommendations of investment opportunities depending on resources the Summerdale Medical Center makes available (Bromiley, 2009).

The business steering team is made of consultants from inside the Summerdale Medical Center and outside. This team collects information about the variables in the investment plan and works an asset-allocation plan. Presence of medical specialist with some financial background will steer this team into success. Planning, implementation and actual monitoring of the progress of investment is carried out by internal financial practitioners, external consultants and medical specialists from Summerdale Medical Center (Bromiley, 2009).

Summerdale Medical Center has business sponsors and partners. This group of stakeholder funds the project that the medical center wants to invest in. Sponsors avail the funds once the capital investment plans have been approved by the managers at the company (Bromiley, 2009). Business partners play an important role of balancing the executive and non-executive powers within the investment team.

References

Berwick, D. M., Nolan, T. W., & Whittington, J. (2008). The triple aim: care, health, and cost. Health affairs, 27(3), 759-769.

Bromiley, P. (2009). Corporate Capital Investment. Cambridge Books.