mgmt

Answer the following in 250 words each:

a) What is the growth strategy of GE in India? What led to the challenges GE is facing? Critically evaluate the vertical integration and diversification options for GE.

b) How should Raja think about the situation? What are the most important considerations for him to weigh? How should they factor into his course of action?

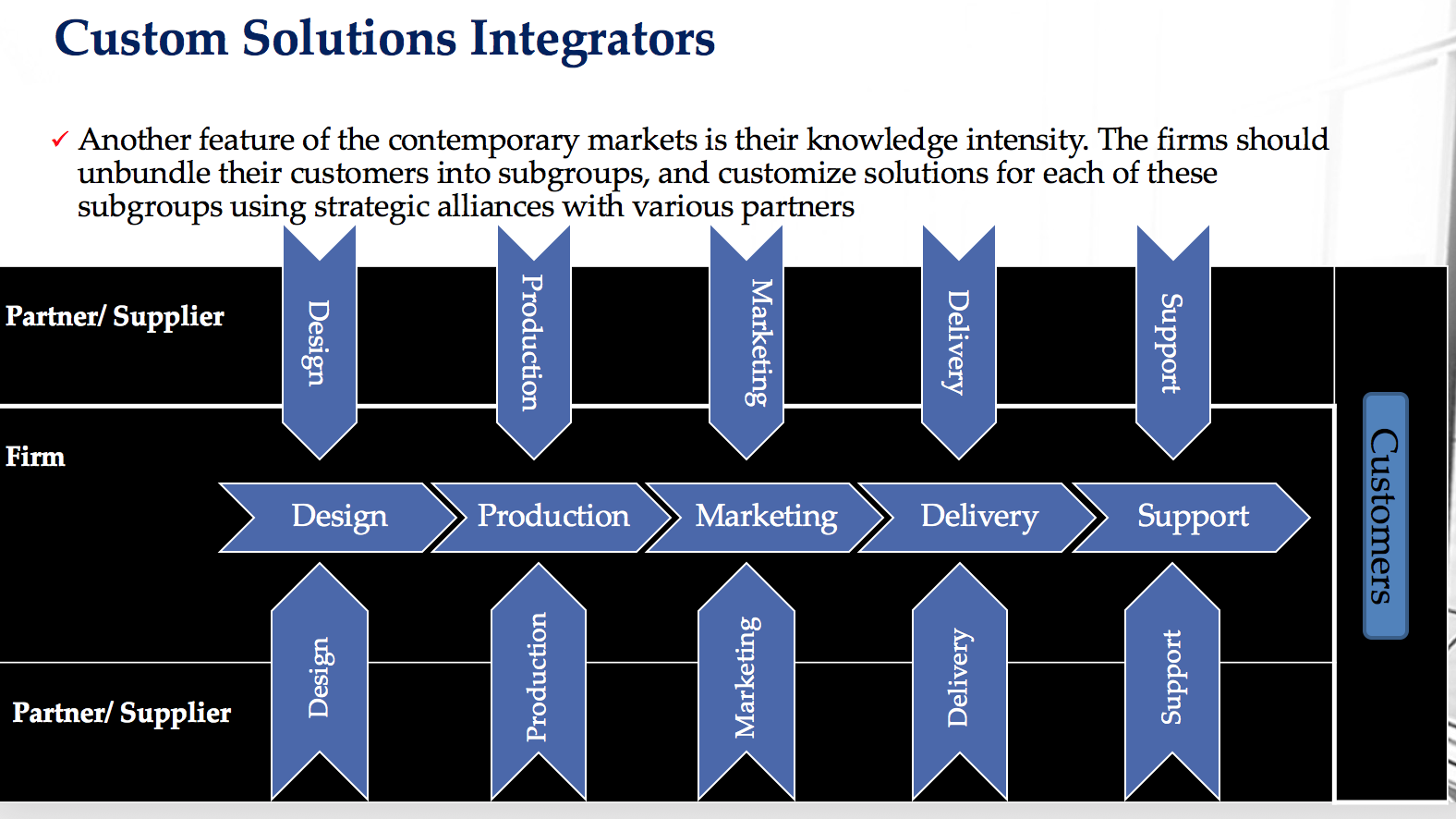

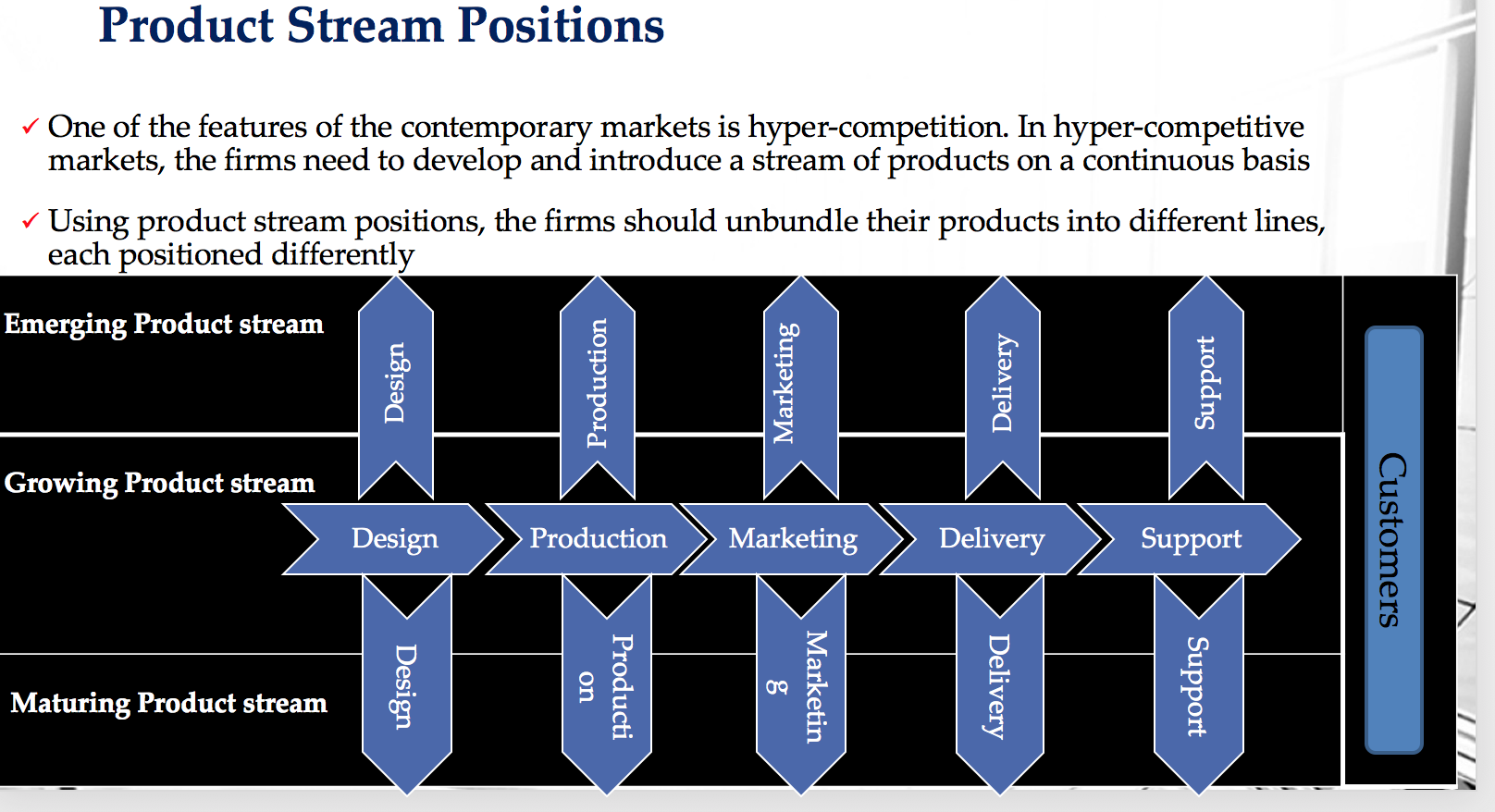

c) Use one of the three value strategies - product stream positions, custom solutions integration, or network exchange system - to identify alternative options for Raja.

Read the case answer the question, here is the Concept you need to use to answer the question. I do not need reference.

Vertical Integration

In an industry value chain, each firm:

Makes its profits

Builds in inefficiencies in the transfer of goods and services from one firm to another

To try saving these transaction costs, firms may vertically integrate

Vertical integration may be

Backward integration: upstream operations closer to the raw materials

Forward integration: downstream operations closer to the customer

Advantages of Vertical Integration

Creates entry barriers for new entrants

Reduces transaction costs (buying, selling, inventory holding, ordering costs)

Offers tighter control and coordination of operations

Allows to spread fixed or overhead costs over a large number of product/ services

Limits of Vertical Integration

Limits flexibility in times of demand/technology shifts; requires innovation and efficiency in each line of business

Requires robust system of organizing, culture building, and performance management, as KSF could vary in different lines of business

E.g., R&D, manufacturing, and marketing in pharmaceuticals have vastly different characteristics

Diversification

Nature of competitive strategies may vary for each business unit

Must create significant value addition by:

Improving core processes (resource capability)

Enhancing structural position (positional capability)

Types of Diversification

Related diversification

Complementary: Entry into new business activity based on shared commonalities in the components of the value chains of the firms

Vertical integration: Entry into the businesses of its suppliers or its customers, to gain control over the supply and delivery systems.

Related (complementary) diversification adds value through economies of scope:

Transferring operational skills or strategic capability from one business to another

Phillip Morris to Miller Brewing

Combining the value chain

P&G’s diaper and power towel businesses

Leveraging strong brand names

Virgin

Stretching core competencies for added value

Terry Berry from graduation rings to corporate incentive programs

Creating stronger capabilities by combining relative strengths of multiple businesses

Daimler and Chrysler

Gaining competitive leverage

For multi-market competition

Unrelated diversification adds value through use of managerial capability when:

Industry is attractive, based on external analysis

Cost of entering the business is lower than the potential benefits, as soft targets for acquisitions exist

Firms with investment constraints in a high growth industry

Firms that are undervalued and could be acquired at low acquisition premiums, and then restructured by breaking them apart and sell off