E705-A5

Running Head: TESLA INC. FINANCIAL ANALYSIS AND FUNDING PLAN 0

Tesla Inc. Financial Analysis and Funding Plan

Introduction

This paper is an analysis of factors affecting Tesla Inc.’s project. In the analysis, projected cost incurred in funding the project is outlined. The paper also sheds light on the revenue streams of the project. The paper comes to an end with a detailed analysis of the Net Present Value of the project and outlines valuable information such as sales forecasts, cash flow statements and income projections of the project.

Main Elements and Critical Thinking

The main elements include the financial details and analysis about the project strength if suitable to pursue in favor of Tesla Company. The projections and forecasts details show that the project has potential of growth and development.

Financial Analysis

Implementation of the project is projected to generate revenue from different platforms. The project leads to the production of four main vehicle components. The battery pack, gearbox, control software and the powertrain system are the pillars to production. Extensive research and analysis done by Tesla Inc. have finally paid off. The quality of battery packs and powertrains systems guarantee reliability and durability. This provides a competitive advantage over others and manufactures prefer building their electric vehicles based on this foundation. Tesla Inc. is one the few corporations that solely focused on production of electric vehicles. Experience gained over the years has enabled the company to develop reliable control software and gearboxes that are not prone to failure. This innovation has received a positive reception by vehicle manufacturers and is in the process of becoming the standard in the industry. The above four components provide the main streams for revenue generation in the project. The Net Present Value of the project stands at 15.6 billion dollars taking into account capital investment (U.S Securities and Exchange Commission, 2015).

Analysis Parts

Budget

The new project of vehicle component production by Tesla Inc. is an intrapreneurship approach. This is deemed so since the company has never indulged in such a production ever. In order to establish the projected cost of the project, the company did an evaluation. The evaluation involved internal and external analysis that outlined resources to be used and money to be spent in research and development. The evaluation estimated that the project would cost slightly above 834 million dollars (The Statistics Portal, 2017). The high cost involved was attributed to the fact that the company needed to acquire new machinery and technology in order to facilitate its production.

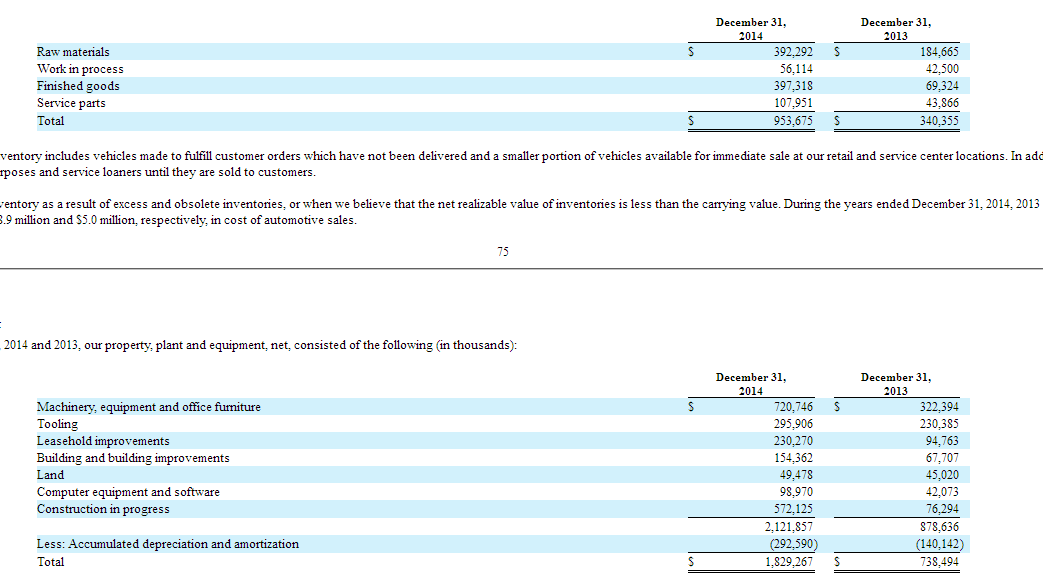

Assessment of Assets and Liabilities

Assessment can be described as the process of that tries to establish the nature, quality or viability present in a situation (Jan, 1998). Before Implementation of the project, Tesla Inc. needed to do a detailed assessment in order to establish its assets and liabilities. Assessment provides the opportunity to value its assets such as machinery, technology, human resource and information relating to customers. Through this assessment the company was able to project cost involved in implementation of the project. Liabilities can be described as obligations that the company has towards other external entities in the organization in addition to internal expenses such as salaries. Assessment helped to outline liabilities the company had. Information generated from assessment, helps the company to restructure itself in order to accommodate the new project and ensure its success in implementation.

Anticipated Sources Of Funding

Implementation of the project requires a capital intensive approach. Capital generation is involved with process of securing funds that is used to fund the project (Karl, 2001). Tesla Inc. has employed various innovative strategies and techniques to generate capital. As stated by the Chief Executive Officer, Elon Musk, capital will be raised from the sale of earlier luxurious electric models. This will partly provide funding for the project (Elon, 2009). This approach is a commonly used strategy that has been employed in industries such as mobile phone and television panels manufacturing. It is effective as it allows for internal capital generation that saves the company from interests costs charged on loans. The company generates part of its capital through sponsorship programmers and donations. Sponsorship involves the company’s ability of marketing its vision to other companies that see the importance and benefit of the project. Toyota Motor Corporation is one of the sponsors that Tesla Inc. has been able to secure in its vehicle component production unit. The sale of shares is a technique for capital generation. The concept works by selling part of the ownership of the company to the public. Subsequently, the public may enjoy dividends associated with profit generation in the company. The approach is a compromising approach as it involves sale of ownership. Although this may be true, shares is a fast effective way of raising capital.

Associated Costs of Attaining That Capital

Capital generation does involve cost. This cost arises from activities involved in capital generation. Tesla Inc. may incur up to 10% of the value of capital generated. This percentage translates to about 83 million dollars (U.S Securities and Exchange Commission, 2015). The amount is used in practices such as setting up meetings to showcase the project to potential investors. The amount is inclusive if transportation cost incurred by representatives of the company as they travel to meet investors. A large chunk of the cost is concerned with marketing of earlier developed vehicle models. This is because marketing is an extensive process. It involves different activities such as advertising, selling and follow-up practices.

Financial Reports

Financial reports are helpful in determining the health of a company or project. Financial reports indicate whether a company is making profits or losses. They also show if there is balance in assets and liabilities that help in avoidance of bankruptcy. In the financial reports of Tesla Inc. sales forecast of vehicle components was to increase as more manufacturers produced electric vehicles. In the year 2014, the company recorded that revenue generated from research and development projects amounted to 990,440 million dollars (U.S Securities and Exchange Commission, 2015). This was inclusive of sale of vehicle components. From the trend set from earlier years, sales are expected to increase and generate more than 1.2 billion dollars.

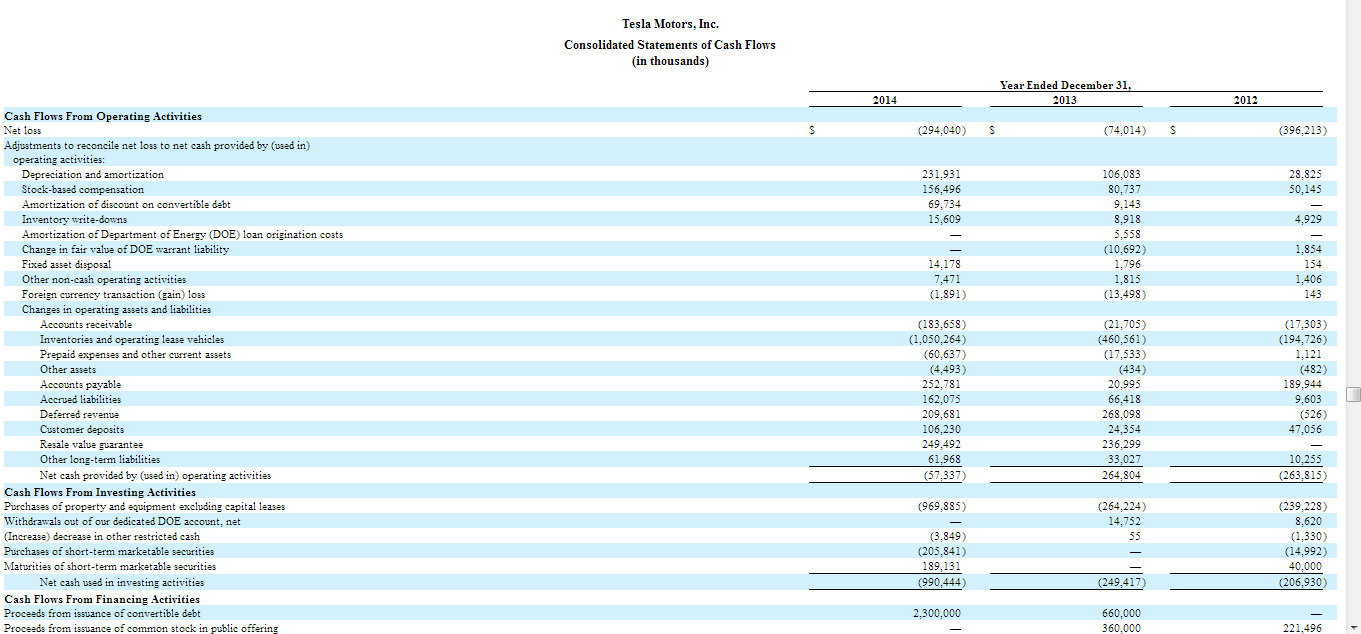

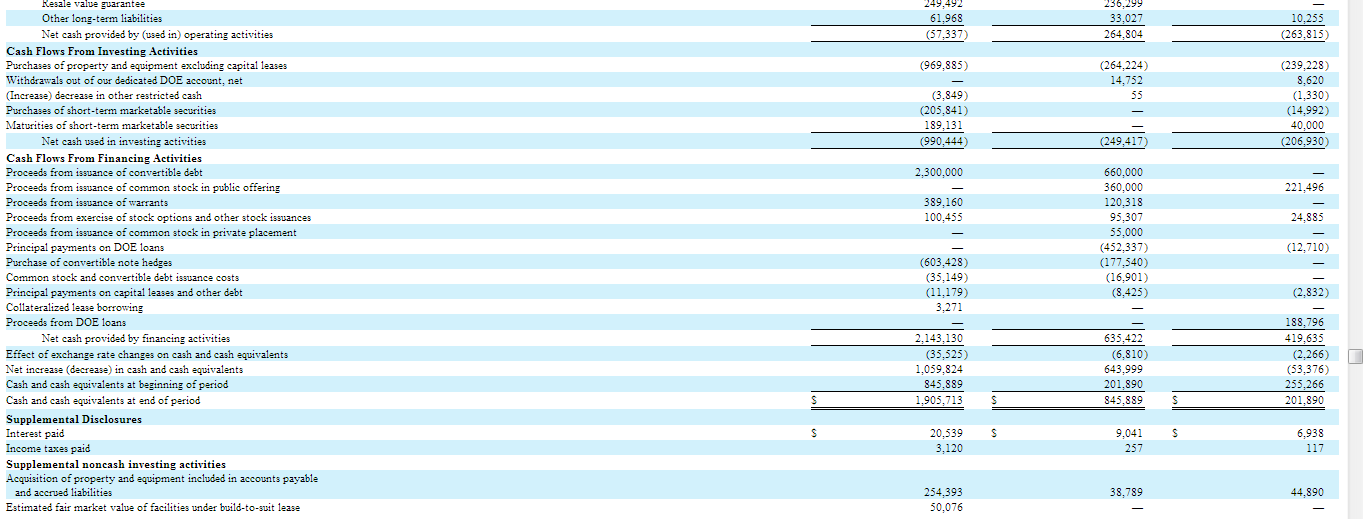

Cash flow statements are statements that show the inward and outward flow of cash in a company. It depicts how much revenue is generated from operations and how much of it goes out as expenditure. Tesla Inc.’s cash flow statement shows that in 2014, the company was able to generate 1,905,713,000 billion dollars after the deduction of expenditure (U.S Securities and Exchange Commission, 2015). This implies that the company is able to generate profit and the company can be termed as profitable. The sale of vehicle component is one of the major activities that made it possible for the company to generate profit.

Appendix I: Cash Flow Statements

From the above information, it is predicated that income projection is involved with determining the amount of income a company will be able to get in the future. It is a much wider scope than sale forecasting and incorporates all other sources of income such as incentives given by the government. Tesla Inc.’s income projection shows that the company was able to record over five billion dollars as income which showed a steady increase. In relation to this the project of vehicle components contributed to more than 20% of the income. It is projected that the project will be able to generate slightly above the 1.2 billion targets (U.S Securities and Exchange Commission, 2015).

Appendix II: Balance Sheet

Conclusion

The project is a viable business opportunity for Tesla Inc. to pursue. It provides an opportunity to traverse into unchartered waters and increase profitability of the company. The projections and forecasts above show that the project has potential of growth and development. Strategies of funding and developing the business should be put in place to ensure growth.

References

Elon, M. (2009). IEEE Spectrum. Risky Business.

Jan, J. (1998). Econometric Business Cycle Research. Boston, MA: Springer US.

Karl, M. (2001). Capital. London: Electric Book Co.

U.S Securities and Exchange Commission. (2015). FORM 10-K: Tesla Motors, Inc. Retrieved from https://www.sec.gov/Archives/edgar/data/1318605/000156459015001031/tsla-10k_20141231.htm

The Statistics Portal. (2017). Tesla's research and development expenses from FY 2010 to FY 2016 (in million U.S. dollars). Retrieved from https://www.statista.com/statistics/314863/research-and-development-expenses-of-tesla/