Recommendations

MOS Burgers

Globally, the fast food industry has annual revenues of over $600 billion. In 2015, fast food stores in the United States generated $200 billion which marks a significant growth over the last decade. Moreover, the industry has an expected annual growth rate of 2.5% for the coming years (Sena, 2017). Fast food consumers primarily focus on the taste, price, and quality and consistency across outlets. While these restaurants utilize highly processed ingredients, they focus on affordability, speed, and maintaining a consistent experience.

The US has over 250,000 fast food restaurants with estimates showing approximately 50 million daily consumers. The industry also provides plenty of employment opportunities employing approximately 4 million people (Sena, 2017). The industry is dominated by fast food giants such as Domino’s Pizza, Panera Bread, and Burger King all of whom have outlets all over the country (Nestle, 2013). In the United States, due to lobbying in Congress, fast food is increasingly cheaper than healthier alternatives which account for the popularity of quick-service restaurants.

MOS Food Services, Inc, commonly known as MOS Burger, is a quick service restaurant chain with roots in Japan. MOS’s name derives from “Mountain Ocean Sun,” with mountain meaning strong and noble, Ocean representing wide and vast operations, and Sun representing vibrancy. Although it originated in Japan in the 1970s, the franchise follows McDonalds Japan as the second largest fast-food franchise in the country (MOS, 2017). MOS Burgers have expanded their operations to numerous countries including Singapore, Australia, Taiwan, Hong Kong, South Korea, and Indonesia. MOS has headquarters in Osaki, Shinagawa, Tokyo and operates several GREEN GRILL, AEN, and Chef’s V outlets.

MOS differentiates itself as producers of fast food catering to a Japanese cuisine with their ‘Cook to order’ ideology where the chefs only prepare food after the customer has ordered to ensure freshness. They have the rice burger and Takumi burgers as some of their signature products. The MOS rice burger has buns made of a combination of rice, millet, and barley. While McDonald's has imitated the rice burger in Taiwan, it remains an exclusive item for MOS in other markets. Another product in MOS’ lineup is the Takumi Burger introduced in 2003 and expanded in 2004. The product features Tasmanian beef with a variety of gourmet seasoning ingredients including wasabi, and avocado.

As the Franchise system is currently popular in the US, MOS Burgers has a slight advantage as they already have experience in entering other less competitive international markets through that model either through joint ventures or wholly owned subsidiaries. For expansion into the US, all foreign franchisers must understand the Franchise Rule of the U.S. Federal Trade Commission in addition to the requirements for a Franchise Disclosure Document (Khan, 2014). The FTC rule mandates that a franchisor must have a reasonable basis and written proof for representing financial performance. Non-US franchisors must also conform to section 482 of the Internal Revenue Code which grants the IRS jurisdiction to reallocate a business’ gross income, deductions, credits, and allowances between organizations which are under common control (Khan, 2014). These procedures ensure organizations report their revenue and prevent tax evasion.

The increased regulations on both franchising and the fast food industry in the US have made it difficult for businesses to expand in the country. Even for US based franchises, the increased regulation regarding financial reporting increases the challenges associated with participating in the fast food industry. Provisions such as complying with GAAP and accounting principles set out by the Securities and Exchange Commission (SEC) (khan, 2014). Moreover, due to Obamacare and other federal welfare policies, retailers have to pay their workers a mandated minimum wage in addition to employee health benefits which increases the operational cost for businesses. The reduced profitability has led some restaurant chains to prefer expanding internationally rather than locally.

Since MOS has no prior business in the country, the trade policies make an entrance into the US market a challenging experience. They have to form a wholly owned US subsidiary which will handle the handing out of franchise license. Furthermore, some states may require financial assurance conditions on the company’s franchising registration. Most of the regulations adopted by states give them the power to examine the ability of a franchisor to provide the promised services to their franchisees to begin operations. These laws increase the initial capital required to establish operations in addition to disclosure laws that mandate estimating the potential performance of a franchise.

For customers, the trade policies have both advantages and disadvantages. The FDA’s rule on food safety ensures that consumers get quality products which do not affect their health adversely. Additionally, the compliance regulations regarding financial reporting protect investors and the government by making sure that companies do not overstate or understate their revenues. Therefore, compliance with these laws increases confidence in the company's operations and product line thus facilitating improvements in product choices. However, the rising cost of doing business means that fast food franchises prefer expanding to overseas markets rather than developing additional local markets. The reduced competition reduces the number of products available for purchase thus reducing consumer choice. Additionally, businesses pass part of the financial burden to the customers through increasing product prices which reduces the purchasing power of consumers.

Entry Barriers in US Fast Food

Mos Burgers entry into the US fast food industry faces several barriers among them increased regulations, fierce competition, and lower profit margins. While there are no laws barring entry of foreign firms, the current structure makes it necessary for them to collaborate with local franchisers to increase the chances of business success. The fierce competition in addition to increasing regulation makes it a challenging experience even for well-funded firms.

Franchising in the US has its particular set of regulations which help to ensure proper financial reporting and advertising. In expanding to US markets, all franchisers must conform to the Franchise Rule of the U.S. Federal Trade Commission in addition to preparing a Franchise Disclosure Document (Khan, 2014). Under the FTC, all franchisors must have reasonable costs centers and written proof of financial performance. Moreover, foreign franchisors must also consider rule 482 of the Internal revenue code which gives the Internal Revenue Service powers to reallocate credits, gross income, deductions, and allowances between firms with common ownership. While these regulations ensure that organizations report their financial performance accurately, they increase the challenges of entering the market as the non-US franchisor can either collaborate with local firms or establish a wholly owned subsidiary in the country.

The U.S. Department of Agriculture enforces extensive regulatory control on agricultural products. While some regulations promote safety and reduce incidences of disease, others restrict commodity supply thereby raising prices. As a result of the World Trade Organization Uruguay Round Agreement, the US has a system of tariff rate quotas for beef imports. The system allows a specified volume of beef imports at lower duty rates and higher tariff rates for volumes exceeding the quota. While Canada and Mexico have unlimited tarrif-rate quotas, other importers face a charge of 4.4cents/kg for in-quota and 26.4% for out quarter (USDA, 2017). The importation of seafood falls under the regulatory purview of the Food and Drug Administration. Currently, the US has banned shrimp imports from most countries except a list of approved harvesters composed of the largest suppliers. Malaysia has import duties ranging from 10.8% to 54.5% while China faces 18.6% and India from 5.54% to 6.16%. Ecuador faces duties of 10.13% to 13.51% while shrimp imports from Vietnam attract a duty of 7.88%. Dairy products and most vegetables face import tariffs of 20%.

The US food sector also enjoys government subsidies for several products. Most of the $25 billion spent annually on subsidies goes to five major crops; wheat, soybeans, rice, and cotton while other crops remain ineligible. Existing subsidies take the form of counter cyclical payments which subsidize farmers to the government-set price, fixed payments based on historical farm production, and ‘marketing loans’ which refund farmers for differences between a crops minimum price as set by Congress and the market price. While these policies were meant to protect farmers from low prices. Moreover, sugar has a mandated minimum price as set by the government thereby influencing local prices.

Tariff Changes

Increasing tariffs would hurt both consumers and producers in the long run. With the already thin margins in the quick service industry, an increase in tariffs increases the cost of raw materials thereby raising the sale price of products. Therefore, consumers would suffer from decreased purchasing power as businesses would pass on the costs to their clients (Rutten et al., 2013). Consequently, this would reduce demand for those specific products. On the other hand, suppliers would enjoy reduced competition thereby producing less at higher prices. Companies relying on these raw materials would face decreased demand for their products.

Quota Changes

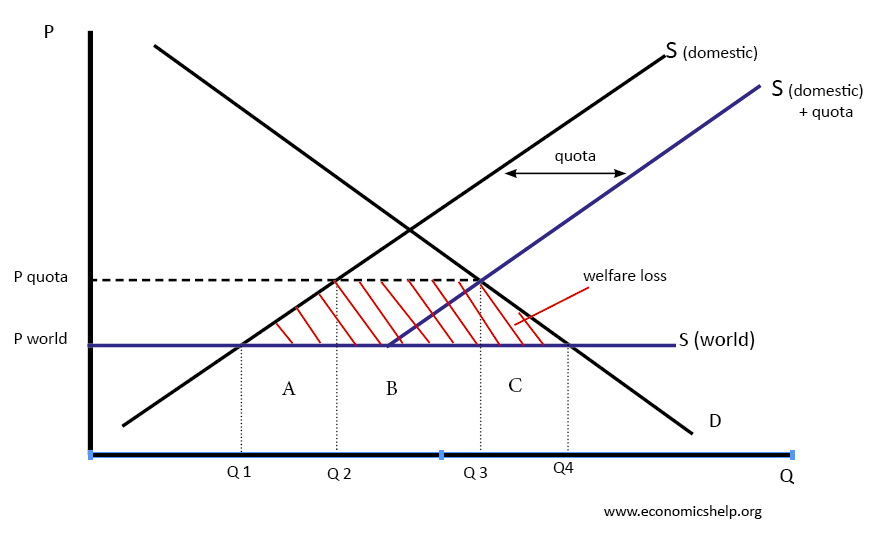

A removal of quotas would facilitate increased imports of raw materials. Therefore, companies such as MOS burgers would enjoy reduced expenses which would pass on to the consumers. Since the average product prices would fall from cheaper imports, demand would increase for industry products thus raising profits. The graph below highlights the effect of quota changes. Higher quota limits reduce prices thereby increasing demand and industry profitability.

Subsidy Changes

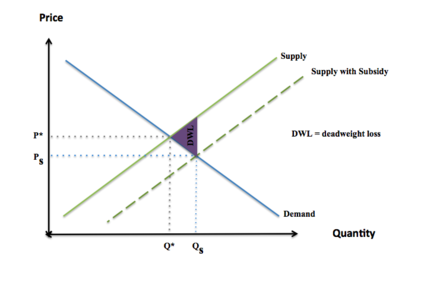

An increase in subsidies would hurt the domestic economy and reduce GDP. Increased subsidies would encourage farmers to shift production to the subsidized products to enjoy the additional profitability. However, since subsidies are funded by government revenue from taxes, it would increase the tax burden on consumers thereby reducing their purchasing power (Rutten et al., 2013). As shown in the graph below, subsidies shift the supply curve to the right while the demand curve remains constant as they can produce more for less. Subsidies do attain the desired effect of increasing demand for a product from the reduced prices. Decreased subsidies have the reverse effect of decreasing demand and reducing supply.

Trade barriers make it difficult for new firms to enter an industry. They can take the form of quotas, tariffs, and subsidies. Governments usually enforce these barriers to protect domestic industries from international competition. However, they have the net effect of reducing the purchasing power of consumers either through increased prices or heavy taxation. MOS Burgers faces a heavily regulated food industry which may affect their estimated profitability.

MOS Burger operates in the fast food industry of the Japanese market. The company has been operating locally in the Japanese market but through its current growth and development strategies, it wants to stretch its legs into the international market. The global market MOS Burger is targeting is the US fast food market. Before launching its business in the US market, the Company will first look into some of the aspects that would affect its business in the international market. These aspects include trade agreements, free trade zones and the market competition.

Free Trade Agreements and Free Trade Zones in the Japanese Market

The government of Japan has put in place certain trade agreements with countries such as the US. The Free Trade Agreements include the reduction in trade tariffs for exports and imports e.g. on dairy products, meat products, vegetable and fruits, manufactured goods and other services (http://www.foodstream.com.au/news/free-trade-agreements/). The Country has also totally removed tariffs on certain goods traded in the international market. Trade barriers have been eliminated and the investment activities in the country has been made more efficient even to the foreign investors.

Japan’s Free Trade Zones are meant to encourage foreign investors to invest and locate their businesses in the Japanese market. The Free Trade Zones’ features include the exempt duties and reduced consumption taxes. These are the tactics used by the country to attract the foreign investors. Free docking and warehouse services at the country’s ports also make it cheaper for other countries to venture in the Japanese market. Some of the Free Trade Zones that exist include the Naha FTZ, Nigata Free Port and the Okinwa SFTZ (Susan and Tiefenbrun, 2012)

The Free Trade agreements Japan has with US will greatly be of benefit to the MOS Burger strategic investment plan in the US market. These agreements will be reciprocated and the Japanese businesses who venture into the US market will also benefit from them. The benefits that come with these trade arrangements include increase in economic growth due to increase in foreign investments, increase in business dynamism in the US market, there will be transfer of expertise and technology in doing business and existence of competitive advantage in case the Company has better resources and techniques in producing fast foods.

Free Trade Agreements however, usually has the following setbacks: complains from locals since these arrangements at some point derail local industries in cases where the foreign businesses are the best performers, most foreign companies are prone to availing poor working conditions to locals, reduced tax revenues to the US government, degradation in natural resources and interference with the native country’s culture. The advantages of Free Trade Agreements will boost the Fast Foods Industry due to the entrance of new players with more, unique and dynamic resources. The Agreements will however lead to stiff competition in all business aspects due to more players introduced thus flooding the industry.

The Free Trade Zones in US will enable the company to fulfil less complex formalities in order to do business in US, the trade payment requirements such as taxes, duties and tariffs will be extremely subsidized thus it would be cheaper for the Company to operate in such a market, the cost of settling in the US market will also be cheaper to the company and the company would benefit from free docking and warehouse services at the ports. The disadvantages that come with Free Trade Zones include excess participation into such industries or markets, depletion of resources for production, scarcity in the free docking cites and free warehouses at the ports and reduced tax revenues to the US government. Existence of Free Trade Zones will lead to increase in competition in the US fast foods industry due to more players participating in the market, depletion of resources and transfer of negative practices in the market (Akinci and Farole, 2011).

The US fast foods market is one of the most competitive markets in the word. Investing in such a market would require MOS Burger to up its game so as to fit in well. Statistics favour Japan to be one of the leading exporters of goods and services to the US. Therefore, this performance levels will at least boost the Company’s entrance in such a market. In 2014, Japan was the second largest source of Foreign Direct Investment in the US. The market competition will be neutralised by the introduction of Japanese unique modes of producing fast foods.

All in all, the Fast Foods industry will however be a tough nut to crack for the company since the fast foods products have not made it into the top 6 category US imports from Japan. The US fast food industry seems to have more Free Trade Agreements and Free Trade zones that has invited more players. This aspect has really triggered competition by increasing it. The local business have also improved their performance as they have the benefit of being the host producers are more poised to be in control of raw materials.

Recommendations