economics final 2012 Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 1. The existence of a...

economics final 2012

Multiple Choice

Identify the choice that best completes the statement or answers the question.

____ 1. The existence of a universal law of scarcity creates pressures on societies to

| a. | use their resources according to government plans. |

| b. | economize in the use of their resources. |

| c. | allocate their resources equitably. |

| d. | exploit their resources. |

____ 2. Inefficient allocation of resources occurs when

| a. | no one can be made better off without having someone else give up something. |

| b. | it is possible to make some people better off without making others worse off. |

| c. | society is operating at a point high on the production possibilities frontier. |

| d. | society is operating at a point low on the production possibilities frontier. |

____ 3. When a shortage occurs in the market for a good, quantity

| a. | demanded exceeds quantity supplied and the market mechanism pushes the price up, which in turn encourages more production and less consumption. |

| b. | supplied exceeds quantity demanded and the price falls, which encourages more production and less consumption. |

| c. | demanded exceeds quantity supplied and the market mechanism pushes the price down, which encourages more production and less consumption. |

| d. | supplied exceeds quantity demanded and the price rises, which encourages more production and less consumption. |

____ 4. Society might argue that there are cases in which it is appropriate to resist price increases in situations where scarcity is serious. Included would be the case of

| a. | unrestrained monopoly that would otherwise succeed in gouging the public. |

| b. | taxes imposed on products capriciously and inappropriately. |

| c. | rising prices falling so heavily on the poor that rationing becomes preferable. |

| d. | All of the above are correct. |

____ 5. Questions of what to produce, how much to produce, and who will get the output must be faced by

| a. | market economies. |

| b. | centrally planned economies. |

| c. | the economies of underdeveloped countries. |

| d. | all economies. |

____ 6. A factory in a centrally planned economy produces 1,000 left shoes and no right shoes. No corresponding factory produces only right shoes. This outcome is an example of inefficiency in

| a. | output selection. |

| b. | production planning. |

| c. | product distribution. |

| d. | market segmentation. |

____ 7. In a free market, a given unit of an input will be used by the firm that

| a. | earns the largest addition to total profit from the use of that unit of input. |

| b. | has the lowest marginal cost of producing another unit of output. |

| c. | sells its output for the highest price. |

| d. | earns the largest total profit. |

____ 8. The selection of particular products' production processes

| a. | determines the output of other products made with those inputs at the same time. |

| b. | is part of the distribution problem in an economy. |

| c. | is accomplished without regard to profit in a laissez-faire economy. |

| d. | depends upon plans for distribution of the products. |

____ 9. The market allocates goods to individuals according to the individuals'

| a. | desire for the good. |

| b. | ability to pay for the good. |

| c. | desire and ability to pay for the good. |

| d. | political influence. |

____ 10. Input-output analysis is rarely used because

| a. | it requires tremendously complex calculations. |

| b. | it requires large amounts of data. |

| c. | market economies can instead rely on the price mechanism to organize production. |

| d. | All of the above are correct. |

____ 11. In order for the price system to have satisfied the exacting requirements for efficiency,

| a. | MU must equal MC for each and every commodity. |

| b. | the average cost of producing each good must be equal to its MU. |

| c. | the maximum possible of total economic profit must be produced. |

| d. | every consumer's MU will be equal to marginal physical product |

____ 12. Free market economies have led to

| a. | very high rates of growth, but low efficiency. |

| b. | high efficiency and low growth. |

| c. | low growth and high efficiency. |

| d. | low growth and low efficiency. |

____ 13. If the production of a good generates a detrimental externality, then at that level of production of the good under perfect competition,

| a. | MSC > P. |

| b. | MPC > MSC. |

| c. | P > MU. |

| d. | MPC > P. |

____ 14. It is true of externalities that they

| a. | arise when all costs, social and private, are included in production cost. |

| b. | are always beneficial. |

| c. | are always detrimental. |

| d. | None of the above are correct. |

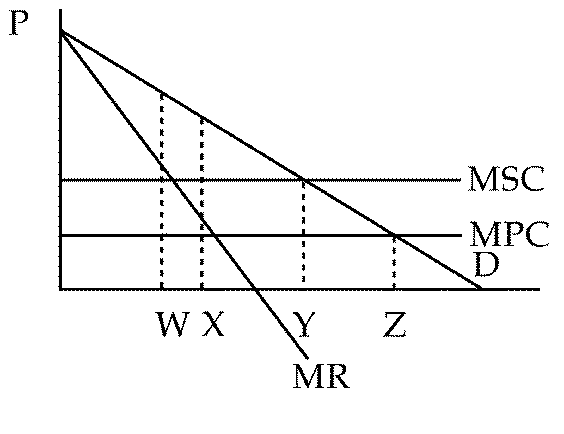

Figure 15-1

____ 15. Figure 15-1 describes conditions in the monopolized weezil industry. In the absence of government intervention, the monopolist will produce an output equal to

| a. | W. |

| b. | X. |

| c. | Y. |

| d. | Z. |

____ 16. In the case of a beneficial externality

| a. | marginal private cost is below marginal social cost. |

| b. | marginal social cost is above marginal private cost. |

| c. | marginal social cost and marginal private cost are equal. |

| d. | the free market price is below the socially efficient price. |

____ 17. A local flower grower grows products in a plot of land which is exceptionally colorful, and is admired by many passersby. There is no way to charge for this in the price of the flowers. We can safely conclude that

| a. | the florist produces too many flowers. |

| b. | the florist produces too few flowers. |

| c. | the florist produces the right amount of flowers. |

| d. | society pays the socially optimal amount for the flowers. |

____ 18. Which of the following statements is correct?

| a. | Marginal social cost is the share of marginal cost caused by an activity that is paid for by the persons who carry out the activity. |

| b. | Marginal private cost is the share of marginal cost caused by an activity that is borne by persons other than those who carry out the activity. |

| c. | Marginal social cost is the sum of marginal private cost and incidental cost. |

| d. | Marginal private cost and incidental cost are one and the same. |

____ 19. Where a firm generates beneficial externalities, society would be better off if

| a. | the firm produced a larger output level. |

| b. | the firm reduced its output level. |

| c. | a tax were levied on the firm equal to the dollar amount of the externalities. |

| d. | price were reduced below marginal private cost. |

____ 20. An appropriate government policy toward negative externalities is to

| a. | subsidize the activity that creates the negative externality. |

| b. | impose a tax or fine on the activity that creates the negative externality. |

| c. | pay money to the party that creates the negative externality. |

| d. | impose a tax on recipients of the negative externality. |

____ 21. The economic justification for public subsidies to university research is based on

| a. | the value of this research to the university. |

| b. | the higher salaries graduate students earn as a result of working with professors involved in research. |

| c. | the external benefits of research and development to, in particular, high rates of economic growth. |

| d. | higher incomes earned by those who provide services to university researchers (equipment, supplies, etc.). |

____ 22. A public good is

| a. | always depletable and excludable. |

| b. | always depletable and often excludable. |

| c. | never depletable and always excludable. |

| d. | never depletable and often nonexcludable. |

____ 23. The cable and subscription TV business is plagued with the problem of "signal theft." People use illegal receivers to capture the company's signal without paying. Enforcement of the company's property right is very expensive. This problem emerges because TV signals are basically

| a. | economic goods. |

| b. | invisible goods. |

| c. | depletable goods. |

| d. | public goods. |

____ 24. In what way does private risk differ from social risk?

| a. | Persons are afraid to take risks, while society prefers to take chances. |

| b. | Society prefers to take risks, while persons prefer not to do so. |

| c. | A failed investment for a person may still leave a functioning asset for society. |

| d. | A failed investment for a society may still leave a functioning asset for a person. |

____ 25. A free market may produce a misallocation of resources over time because

| a. | the Fed manipulates interest rates. |

| b. | people have a "defective telescopic faculty." |

| c. | private risk usually exceeds social risk. |

| d. | All of the above are correct. |

____ 26. Part of the reason why barely used cars sell for much less than new cars is that

| a. | buyers and sellers have symmetric information about cars and both have less information about used cars than about new cars. |

| b. | buyers and sellers have symmetric information about cars and both have more information about used cars than about new cars. |

| c. | buyers have more information about used cars than sellers do. |

| d. | sellers have more information about used cars than buyers do. |

____ 27. Asymmetric information will lead to

| a. | higher prices for some used cars, lower prices for others. |

| b. | "lemon" prices for good used cars. |

| c. | new cars selling for prices lower than good used cars. |

| d. | old cars selling for more than new cars. |

____ 28. A car sells at different prices at different dealerships in an oligopolistic market. If a consumer has imperfect information about the price of a car at each dealership, he should

| a. | always gather all available information about prices. |

| b. | gather information about prices until the expected marginal utility of more information equals the marginal cost of gathering it. |

| c. | gather information about prices only if it can be gathered without cost. |

| d. | ignore information about prices because it is irrelevant to making an "optimally imperfect" decision. |

____ 29. Rent-seeking behavior refers to

| a. | the offering of goods on a for-rent rather than for-sale basis. |

| b. | profit maximization by producers. |

| c. | unproductive activity in the pursuit of economic profit. |

| d. | illegal manipulation of prices. |

____ 30. The cost disease of the service sector is evidenced by

| a. | a failure of the market mechanism. |

| b. | increased quality of public and private services. |

| c. | dramatic increases in municipal budget burdens for education, health care, and police and fire protection. |

| d. | the increased productivity in the services area. |

____ 31. Increasing productivity in a society

| a. | always results in a better quality of life as society views it. |

| b. | can never make a nation poorer. |

| c. | guarantees that personal services will cost less. |

| d. | makes improved personal services available to everyone. |

____ 32. Profit-maximizing firms will choose a level of spending on research and development, in the short run, where the

| a. | marginal revenue from R&D is maximized. |

| b. | total revenue from R&D is maximized. |

| c. | marginal revenue from R&D is greater than its marginal cost. |

| d. | marginal cost of R&D is minimized. |

| e. | marginal revenue from R&D is equal to its marginal cost. |

____ 33. Under a proportional tax, the fraction of income paid in taxes

| a. | rises as income rises. |

| b. | is unchanged as income changes. |

| c. | falls as income rises. |

| d. | is proportional to the change in income. |

____ 34. The main difference between direct and indirect taxes is that

| a. | indirect taxes are automatically deducted from workers' paychecks and direct taxes are not. |

| b. | direct taxes are paid to state and local governments and indirect taxes are paid to the federal government. |

| c. | direct taxes are taxes levied on people and indirect taxes are taxes levied on activities undertaken by people. |

| d. | direct taxes are usually proportional and indirect taxes are usually progressive. |

____ 35. A head tax is

| a. | always regressive. |

| b. | an indirect tax on the value of property. |

| c. | the primary tax used by U.S. municipalities to raise revenue. |

| d. | All of the above are correct. |

____ 36. Which is the correct order of importance in terms of revenue collected among the following federal taxes?

| a. | (1) corporate income taxes (2) value-added taxes (3) excise taxes |

| b. | (1) personal income taxes (2) corporate income taxes (3) sales taxes |

| c. | (1) payroll taxes (2) personal income taxes (3) federal excise taxes |

| d. | (1) personal income taxes (2) payroll taxes (3) corporate income taxes |

____ 37. The federal income tax is an example of a

| a. | progressive tax. |

| b. | regressive tax. |

| c. | proportional tax. |

| d. | value-added tax. |

____ 38. The payroll tax appears to be a proportional tax. In reality it is

| a. | highly progressive. |

| b. | actually proportional. |

| c. | highly regressive. |

| d. | regressive on low-income persons and progressive on high-income persons. |

____ 39. The corporate income tax is

| a. | an indirect tax. |

| b. | a regressive tax. |

| c. | the second largest source of revenue for the federal government. |

| d. | a direct tax. |

____ 40. An excise tax on gasoline is regressive if

| a. | rich people buy more gasoline than poor people. |

| b. | the demand for gasoline is elastic. |

| c. | the tax causes people to buy less gasoline. |

| d. | poor people spend a larger portion of their incomes on gasoline than rich people. |

____ 41. Officially, the payroll tax is referred to as

| a. | the trust fund tax. |

| b. | Social Security tax. |

| c. | contributions for social insurance. |

| d. | investment in Social Security. |

____ 42. Horizontal equity is a difficult concept to implement because

| a. | it is difficult to determine how unequally unequals should be treated. |

| b. | it is difficult to measure ability to pay. |

| c. | it is difficult to determine which people are equally situated. |

| d. | people object to the use of absolute tax liability instead of percentage of income. |

____ 43. The concept that describes the situation where the economy has used every available opportunity to make someone better off without making someone else worse off is

| a. | economic efficiency. |

| b. | the benefits principle. |

| c. | horizontal equity. |

| d. | vertical equity. |

Figure 18-2

____ 44. Figure 18-2 shows the widget market before and after an excise tax is imposed. The revenue collected by the tax is ____.

| a. | $8,000 |

| b. | $50,000 |

| c. | $100,000 |

| d. | $150,000 |

____ 45. Economists generally think that the ____ tax is among the best ways to raise revenue.

| a. | property |

| b. | personal income |

| c. | sales |

| d. | value-added |

____ 46. The basic principle that explains the demand for a factor of production is the

| a. | principle of marginal productivity. |

| b. | Hotelling principle. |

| c. | principle of opportunity cost. |

| d. | Ramsey pricing principle. |

____ 47. The distribution of income in a market economy is determined by

| a. | the level of employment and prices of the factors of production. |

| b. | the prices of factors of production. |

| c. | largely unknown forces which economists seek to discover. |

| d. | decisions of government offices related to distribution. |

____ 48. Interest is the payment for the use of

| a. | borrowed funds. |

| b. | natural resources. |

| c. | labor. |

| d. | any factor of production. |

____ 49. Suppose that the rate of interest increases. What will happen to the discounted present value of an investment?

| a. | It will increase. |

| b. | It will decrease. |

| c. | It will remain unchanged. |

| d. | It depends on the magnitude of the change. |

____ 50. If the rate of interest increases, firms will most likely respond by

| a. | increasing investment. |

| b. | decreasing investment. |

| c. | not changing investment. |

| d. | increasing capital stock. |

____ 51. On January 1, 1996, a homeowner borrowed $5,000 for a term of six months to complete some home improvements, paying an annual interest rate of 8 percent. How much principal and interest will the homeowner pay back on July 1, 1996?

| a. | $2,500 |

| b. | $2,900 |

| c. | $5,200 |

| d. | $5,400 |

____ 52. The demand for borrowed funds is

| a. | directly related to the interest rate. |

| b. | inversely related to the growth in gross domestic product. |

| c. | a derived demand. |

| d. | leads to derived demand for capital goods. |

____ 53. In the United States, the money for loans to businesses comes mainly from

| a. | corporate profits. |

| b. | the federal government. |

| c. | savings held in lending institutions. |

| d. | state and local governments. |

____ 54. Equilibrium in the market for funds occurs when the

| a. | lenders and borrowers are mutually satisfied at some interest rate. |

| b. | marginal revenue product of investment using the funds equals the interest rate. |

| c. | demand curve for funds and the supply curve for funds intersect. |

| d. | All of the above are correct. |

____ 55. Usury laws that set maximum interest rates

| a. | are designed to protect the consumer. |

| b. | interfere with the market allocation process. |

| c. | are effective only if the market rate is higher than the legal maximum. |

| d. | All of the above are correct. |

____ 56. If the demand for land shifts upward, rents will be

| a. | earned by some land that was formerly unprofitable. |

| b. | lost to many landowners. |

| c. | diminished for society as a whole. |

| d. | taxed away to help pay the costs of government. |

____ 57. All the land in a California valley is owned by one person. The supply of land is fixed and is rented each year to farmers who bid for it in an open auction. Given the rents they must pay, the farmers barely earn subsistence. Sympathy for the poor farmers leads the state to bring in irrigation facilities to raise the productivity of the farms and raise the farmers' income. The most likely outcome is

| a. | the farmers will prosper. |

| b. | the farmers and the landlord will share the new prosperity. |

| c. | only the landlord will prosper. |

| d. | no one will prosper. |

____ 58. If mining companies are indifferent between operating and not operating a quarry, that quarry is

| a. | discounted. |

| b. | usurious. |

| c. | marginal. |

| d. | nonexcludable. |

____ 59. Marginal land is land

| a. | that is unprofitable under any circumstances. |

| b. | that is the most productive in the area. |

| c. | that is on the borderline of profitability. |

| d. | of average productivity. |

____ 60. When an economist says a change in the market for land causes a farmer to use his land more intensively, he means that the farmer

| a. | produces more output than before, so the marginal product of his land falls. |

| b. | produces less output than before, so the marginal product of his land rises. |

| c. | uses greater amounts of nonland inputs than before, so the marginal revenue product of his land rises. |

| d. | uses smaller amounts of nonland inputs than before, so the marginal revenue product of his land falls. |

____ 61. A landlord will supply her land for rental only if in equilibrium

| a. | she receives economic rent on the land. |

| b. | she is paid at least the opportunity cost of using the land herself. |

| c. | her land is marginal. |

| d. | her rate of return on her investment in the land is zero. |

____ 62. The cost of production on the "bottom forty" is $100,000 for a given size crop. On the "north forty," due to erosion of the soil, the cost is $150,000. Both are being farmed by tenants, but the rent on the "bottom forty" is

| a. | $50,000 below the rent on the north forty. |

| b. | $50,000 above the rent on the north forty. |

| c. | different from that on the north forty by an indeterminable amount. |

| d. | $50,000, and the rent on the north forty is $50,000. |

____ 63. The theory of land rent holds that

| a. | capital invested on any plot of land must yield the same return as capital invested on any other plot of land. |

| b. | the difference between the costs of producing on any two pieces of land must equal the difference between their rents. |

| c. | marginal land earns no rent. |

| d. | All of the above are correct. |

____ 64. Profits

| a. | are the residual. |

| b. | accrue to entrepreneurs. |

| c. | are lower than most people think. |

| d. | All of the above are correct. |

____ 65. No economist today would claim that

| a. | marginal productivity analysis is either just or unjust. |

| b. | the marginal productivity theory of distribution is a theory of the demand side of the pertinent market. |

| c. | payments are made not to factors of production but to the people who happen to own them. |

| d. | a productive input's MRP depends in part on how much of it is employed. |

____ 66. The income effect of a wage increase is expected to increase

| a. | supply of labor. |

| b. | supply of goods and services. |

| c. | demand for leisure. |

| d. | demand for labor. |

____ 67. The labor supply curve starts to bend backward at the point where

| a. | the total utility of leisure exceeds the total disutility of labor. |

| b. | the marginal utility of additional income becomes zero. |

| c. | the income effect comes to dominate the substitution effect. |

| d. | the substitution effect comes to dominate the income effect. |

____ 68. High-wage workers are

| a. | more likely than low-wage workers to supply more labor when the wage rate rises. |

| b. | about as likely as low-wage workers to supply more labor when the wage rate rises. |

| c. | less likely than low-wage workers to supply more labor when the wage rate rises. |

| d. | The available evidence does not indicate how high-wage workers and low-wage workers differ in responding to changes in the wage rate. |

____ 69. Many experts on the nursing shortage insist that, in addition to higher money wages, other ways will have to be found to make the nursing profession more attractive, including, for example, more respect from physicians and administrators, more flexible schedules, and more secure parking lots. These facts illustrate the concept of

| a. | exploitation. |

| b. | pecuniary principles. |

| c. | economic rent. |

| d. | compensating differentials. |

____ 70. The demand for education is determined by the

| a. | demand for human capital. |

| b. | demand for nonhuman capital. |

| c. | supply of human capital. |

| d. | supply of nonhuman capital. |

____ 71. In which labor market would one most likely find decent wages, attractive fringe benefits, and long-term career prospects?

| a. | the elementary labor market |

| b. | the primary labor market |

| c. | the secondary labor market |

| d. | the exceptional labor market |

____ 72. The dual labor market theory says that

| a. | there are two very different types of job markets. |

| b. | minorities will always hold a minority of the jobs. |

| c. | rising rates of inflation have required dual job holding. |

| d. | workers move easily from one market to another type of labor market. |

____ 73. The primary labor market is the market where

| a. | one finds his or her first job. |

| b. | low-skilled jobs are prevalent. |

| c. | most of the economy's good jobs are found. |

| d. | education simply does not pay. |

____ 74. Labor unions in the United States

| a. | tend to be more outspoken politically than those in Europe. |

| b. | have experienced steady declines in membership since the 1950s. |

| c. | tend to be more powerful in deregulated industries (for example, airlines) than in regulated industries. |

| d. | universally support socialist principles. |

____ 75. Economists would describe a labor union as a

| a. | trade organization. |

| b. | necessity for competitive labor markets. |

| c. | labor monopoly. |

| d. | pure monopsony. |