I have attached the assignment I need help with. I live in Texas for time reference.

Application Assignment #3 – Lesson 4

Please note that there are multiple questions in this assignment. Questions 1 – 5 are worth 10 points. Questions 6 & 7 are each worth 25 points.

Casey Cordell is the owner of a digital photography service in Madison, Wisconsin. The company has been profitable every year of its existence. Its debt ratio is currently 68 percent, its current ratio is 1:1, and its debt-to-equity ratio is 72.2 percent. Do these financial numbers cause any reason to be concerned? Why or why not?

Suppose that a vertical analysis of the income statement shows an item to be 18% of net sales. How would this information be used in order to make it meaningful? With what would it be compared?

In 2016, the cost of goods sold was 66% of net sales. For 2015, the same item was 63 percent, and for 2014 it was 60 percent. What recommendations would you make about items or activities that should be investigated further?

Your company's income statements reveal that its net income after taxes has been 4.3% of net sales for each of the past three years. During that time, the industry average has been about 7%. What types of questions should you ask and get answered in seeking an explanation for this difference?

A company's net sales increased by 35% from one year to the next year. During that period, selling expenses increased by 41%. Is this desirable? What would explain this change?

Vertical analysis of comparative financial statements can indicate the success or failure of a business. A bank loan officer must evaluate the health of a business and then choose the company that will receive a $50,000 loan. To help make the decision:

Create a vertical analysis of the two companies shown in the table below.

Based on the results of the vertical analysis who should receive the loan? Explain why you consider one company better able to repay the loan. Defend your decision in your answer.

Julia’s Junk Store

Laura’s Lost Loot

Cash

30,000

30,000

Accounts Receivables

2,000

3,500

Total Current Assets

40,000

50,000

Total Assets

100,000

100,000

Current Liabilities

20,000

50,000

Total Liabilities

50,000

70,000

Common Stock

20,000

20,000

Retained Earnings

30,000

10,000

Total Stockholder’s Equity

50,000

30,000

Net Sales

10,000

7,000

Cost of Sales

7,000

3,500

Operating Expenses

2,000

1,500

Net Income

1,000

2,000

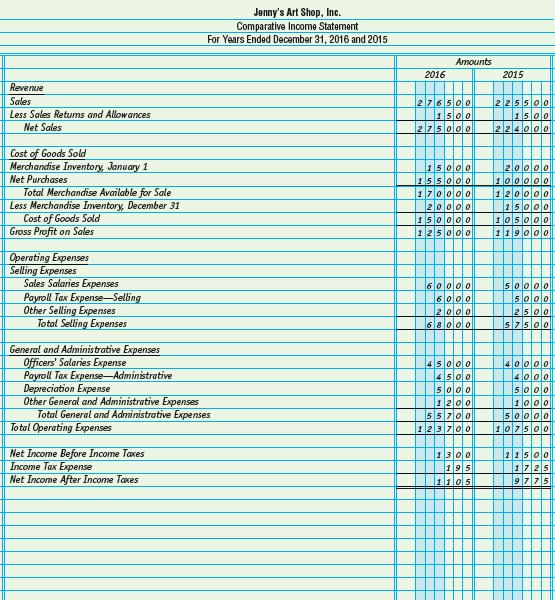

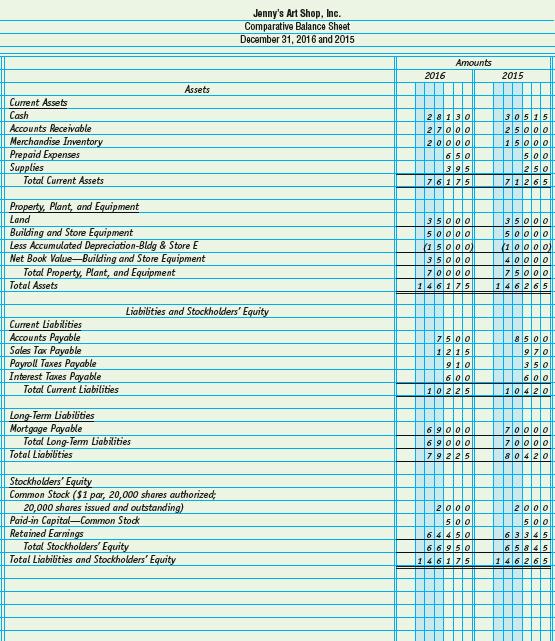

Jenny's Art Shop, Inc., sells vintage books. The firm's comparative income statement and balance sheet for the years 2015 and 2016 follow:

Prepare both a vertical and horizontal analysis. Carry both calculations two decimal places. After your analysis tell me which accounts should be investigated further and why?

If Jenny's Art Shop experiences the same growth in net sales in 2017 as was reported in 2016, what net sales can be projected?

Calculate the following ratios:

Current ratio

Acid-test ratio

Inventory turnover

Return on sales

Return on total assets

Selected industry ratios are given below. Compare the ratios of Jenny's Art Shop, Inc., with these ratios. Tell us how well her business is doing in comparison to the industry? What recommendations would you make to this business based on the comparison between the business and the industry ratios?

Rate of return on sales, 8%

Return on total assets, 10%

Merchandise inventory turnover, 6 times

Current ratio, 2.5 to 1

Ch. 1 – Accounting Decision Case; S1-12, P1-44B - Ch. 15 – Accounting P15-29 & 30A and P19-29B