detail instructions are in the file. Dont give offer unless you completely understand

FIN 5545 Project:

Learning Objective: Apply Currency Futures to Hedge Exchange Rate Risk

Due date: 12/2/2018 (end of week 7)

Submit 1 Excel file (or 1 Excel + 1 Word together) in Canvas

The sample period for this project is from 10/22/2018 (today) to 11/16/2018 (4 weeks). You will need to collect real-time data starting from 10/22/2018.

On 10/22/2018, at 4pm, your company receives 11,250,000 Euros. If you convert this Euros to USD now, it will be worth about $12,295,000. You are extremely happy with this current exchange rate and would take this US dollar value. But if you convert now, you have to pay a high tax today.

Instead, you decide to convert to USD in 2 months and delay paying the tax. This delayed action comes with a big risk. Since EUR/USD exchange rate fluctuates every day, the US dollar value of your Euros in 2 months will no longer be the same dollar amount. This risk is called currency risk, aka foreign exchange rate (FOREX) risk.

The objective of this project is to design a strategy such that the conversion value stays close to $12,295,000 throughout the whole sample period. The financial instrument for this project is Euro FX futures contract expiring in “December 2018”.

10 Questions (each is worth 1 point, consider each as a rubric):

1. To hedge against the exchange rate risk in your scenario above, should you “long” or “short” Euro FX futures today? Explain. (Hint: converting one currency to another currency is equivalent to buying or selling a foreign currency.)

Go to https://www.cmegroup.com (official futures exchange) and locate the Euro FX December 2018 futures.

2. What is the contract size of the Euro FX futures contract? Is the British Pound futures contract size the same as Euro FX futures? How many Euro FX futures contracts do you need to long/short today? (Hint: Look for “Contract Specs”)

The rest of this project will prove whether your answer to Q1/Q2 is the correct position. If you don’t find a sufficient evidence of risk hedging later, it’s likely that your answer to Q1/Q2 is incorrect.

3. For every trading day (no holiday/weekends) during the sample period, collect the EUR/USD exchange rate (using either Bloomberg, Yahoo, Google, Fed, etc) and Euro FX futures price (using CMEgroup).

The above screenshot is what the Euro FX futures quotes look like at cmegroup.com. The price you need to collect is “Last” price (not Open, High, Low).

(Hint: https://youtu.be/UebE35PUdp4 demonstrates how to look up past price history. If you use this method, you don’t have to collect the futures price every day.)

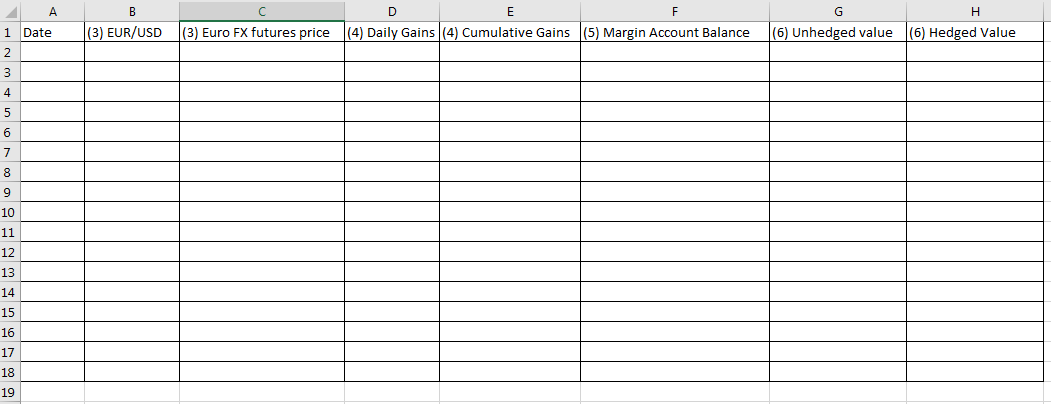

Prepare a spreadsheet and create 3 columns for

Date

EUR/USD rate

Euro FX futures price

(Hint: The above screenshot is what your spreadsheet will look like.)

(Hint: Futures price and FOREX will not be identical to each other. But they should be very similar. If your FX futures price is 0.80 and FOREX is 1.20, then it’s most likely an error.)

4. In columns D and E, calculate “Daily Gains” and “Cumulative Gains” for your Euro FX futures position from Q1 and Q2. Calculate these values in Excel. Do not manually enter the values. If I don’t see Excel calculation behind your answers, I’ll assume you copied someone else’s answers, which is not acceptable for an individual project. (hint: module 1)

5. Assume the initial margin requirement is $10,000 per contract and the maintenance margin requirement is $8,000 per contract. In column F, calculate the “Margin Account Balance” for each trading day. Is there a margin call at any time? If yes, add the required cash to the margin account to avoid liquidation.

6. In column G, calculate the USD value of your 11.25 mil Euros for each day (“Unhedged value”) using the prevailing EUR/USD rate from Q3. In column H, calculate the values of your “Hedged Value”. (Hint: hedged value = unhedged value in G + futures cumulative gains in E).

At this point, your spreadsheet should have the columns (A - H) in the screenshot above.

7. Plot the unhedged values and hedged values in Q6 over time. Calculate the standard deviations of the unhedged values in G. In addition, calculate the standard deviation of hedged values in H.

8. Based on your Q7 answers, did your strategy in Q1 and Q2 successfully lower the exchange rate risk? (Hint: standard deviation is a measure of risk.)

9. Euro FX futures is an example of currency derivative. In Module 3, we learned Eurodollar futures. Is Eurodollar futures also a currency derivative? Describe a scenario when companies would use Eurodollar futures.

10. If EUR/USD FX increases in future, the USD value of your Euros will become higher, which benefits you. Suppose you want to benefit this positive payoff opportunity but still want to limit the loss against FX drop. To achieve this objective, Euro FX futures will not work. Instead, which financial derivative should you use? Be as specific as you can. (hint: module 7)

Submission instructions

You must start from a fresh new Excel file. Do NOT share your file or copy other’s answers. If I find 2 students submitting almost identical files, I’ll give F to both students. I am aware the solutions for previous projects are available online. I changed the questions for this semester. If you submit a project answering old questions, you will get F.

For any calculation question, you must do all the calculations in Excel. If I can’t see your calculations, I’ll assume you copied someone else’s answers.

Submit 1 Excel file with all your answers/tables/plots (preferably in 1 tab). You can submit multiple times to Canvas. Only the last submission will be graded. If you prefer to answer qualitative questions in MS Word, submit both Word and Excel files together in 1 submission.

If you send me your Excel file and ask whether your answers are correct, I can’t help you because it’s unfair to other students. Instead, if you need help, go to Slack #currency-project and explain how you solved the problem. We can guide you to the right direction.