Class: Financial Management for Health Information Management Written Assignment - Resource Needs Analysis For hospitals, the most important assets are not the buildings or investment portfolios, it's

Week 8-Rubric, Written Assignment, & Lesson Content

Rubric:

| Criteria | Points | Student |

| Complete a resource needs analysis:

| 8 |

|

| Memo to CFO outlining the resource needs analysis to support a recommend hiring plan. | 5 |

|

| Grammar, spelling, format, etc. | 2 |

|

| Total | 15 |

|

Written Assignment - Resource Needs Analysis

For hospitals, the most important assets are not the buildings or investment portfolios, it's the workforce. The recruitment, management and retention of the hospital workforce has a direct impact on the cost and quality of patient care. Wages and benefits account for about two-thirds of every dollar spent by hospitals, according to the American Hospital Association. And that cost is expected to increase. The AHA reports that labor costs are the single most important driver of spending growth for hospitals, accounting for about 35 percent of overall growth.

You were just employed as the new HIM director for your community hospital. After meeting with members of your department as well as internal and external customers, you have identified the need to hire more employees. To hire more employees, you need to provide a resource needs analysis and proposal to your CFO. Write a 1 - 2 page memo to your CFO outlining the analysis that you conducted and the benefits the organization will achieve based on the hiring plan that you are recommending.

Save your assignment as a Microsoft Word document

Tips: For this assignment, the instructor was say that we could do our assignment on like hiring a coder, release of information clerk, or even a transcriptionist. We could make the memo on one are all of the positions. Also, she was stating to help you not to forget a category that we could use any Resource Analysist Tool just Goggle “Resource Analysist Tool” a lot of them will pop up and you can use anyone you want to use. She said placing things in a table form help her out a lot. This part is up to you.

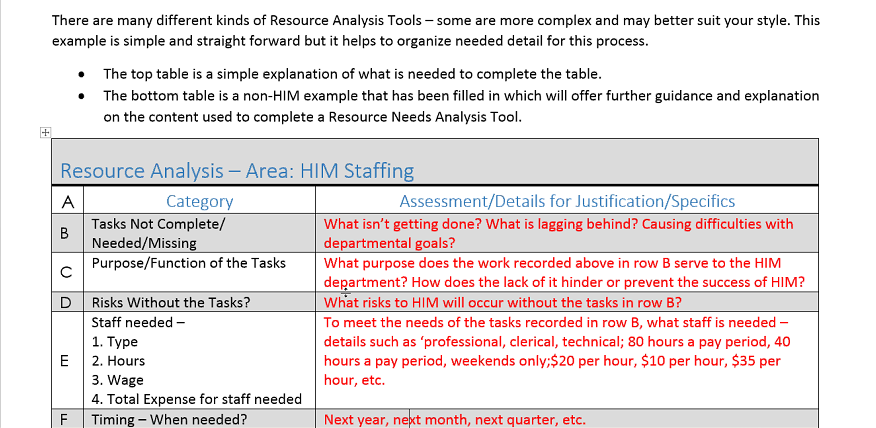

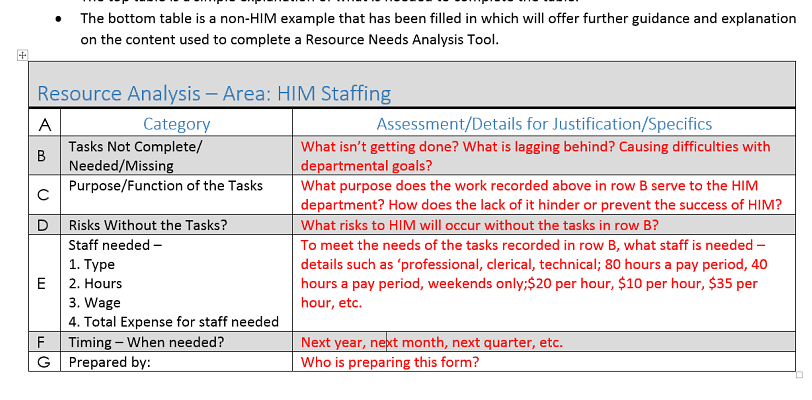

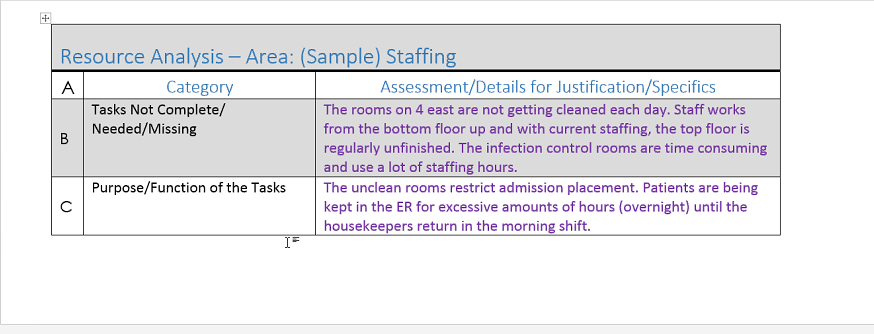

Below is a Question Table and Example Table she provided for the class. But at the end we will take the information in the table and place it in a Memo format to turn into the CFO. Like the comment above Using the table format you strictly up to you. We do not have to turn in this part only the Memo Format, but I need all of the categories in the table documented within the Memo to the CFO.

On this example above for the Benefits she was trying to say we could add Benefits to our Memo for the hiring position, which would be Benefits $30,368+30%= $39, 478.40 for the Total Expense for recommendation.

Lesson Content

Accounting Methods

The last decade has seen a growing rate of development, adoption, and implementation of computerized cost accounting systems. The impact of prospective payment and managed care has led to an ever-increasing focus on the profitability of individual procedures, or patient types, and ultimately a “product-line” perspective. This product-line perspective has in turn caused managers to need more timely and accurate information about the resources consumed.

Cost accounting systems generate information for a variety of purposes. First, we are interested in being able to make appropriate reports for external users such as Internal Revenue Service (IRS) and the American Hospital Association (AHA).

We also want information to ensure that the healthcare organization is functioning in a controlled manner. For example, we must carefully determine the information needs in managing information related to treating patients in a cost effective manner.

A key concept in healthcare accounting methods is cash versus accrual accounting. Most healthcare organizations operate under the accrual basis.

Cash basis accounting: A transaction is not recorded in the books until the cash is either received or paid out.

Accrual accounting: Revenue is recorded when it is earned - not when payment is received - and expenses are recorded when they are incurred - not when they are paid.

There are four basis financial statements that a healthcare manager should be familiar with. They include the balance sheet, the statement of revenue and expense, the statement of fund balance or net worth, and the statement of cash flows.

The balance sheet is a snapshot of what an organization owns, what it owes, and what it is worth at a particular point in time. The elements in the balance sheet can be envisioned as:

Assets = Liabilities + Net Worth/Fund Balance

An organization's assets account for what it owns. Those assets can be identified as current assets, property, plant and equipment, or other assets. Current assets are those that are convertible to cash within one year Property, plant and equipment are considered long-term assets and other assets are identified as noncurrent items.

Liabilities are shown as either current or long-term debt. Current liabilities are those expected to be paid within one year. Long-term debt can be paid over a period of many years.

A statement of revenue and expense covers a period in time rather than a particular point in time. The formula for a statement of revenue and expense can be defined as:

Operating revenue - Operating expense = Operating Income

The concept is that if the revenue coming in is greater than the expense going out then the organization had a good year. The opposite would indicate that the organization was not profitable for the year if the expenses outpaced the revenue. The statement of changes in fund balance/net worth traces the flow of excess revenue over expenses back into the equity or fund balance.

A statement of cash flows is a report that provides details of the cash flow in and out of an organization. It is used to determine the short-term viability of an organization and its ability to pay its bills on time.