After reviewing the essential concepts, readings, and cases for 3.1, 3.2, and 3.3 complete the following steps: Read the Tesla Case Study & watch the video at the end of these instructions. Clear

Tesla Comes to China

Tesla is a new American Automobile company dedicated to reducing dangerous carbon emissions by producing an electric car that will be within the price range of most consumers. This upstart company, under the visionary leadership of Elon Musk, has already overcome tremendous obstacles in surviving competition against better funded automotive giants in America. Now Tesla is going to the world’s largest electric vehicle market in China which might determine the future of both Tesla and the electric vehicle as a substitute product for fossil fueled cars on a global scale.

History of the Electric Car

Although Tesla is only a fifteen year old company, the electric car has been around since the 19th century. William Morris developed the first electric cars in America in 1890, and by the early 20th century, a quarter of the cars on the roads were electric. They were particularly popular in the cities, where their limited range was not a problem. The electric car began to go into decline with two disruptive innovations in the second decade of the twentieth century. One was the electric starter, which eliminated the troublesome hand crank on gasoline engines. The other innovation, which drastically reduced the price of gasoline powered cars, was the production line developed by Henry Ford for the Model T. The production line allowed gasoline powered cars to undersell electric cars by 50%, and the electric car was almost forgotten for the next fifty years.

The electric car began to make a comeback in the 1970s. The moon rover was an electric car powered by solar energy. The Arab Oil Embargo of 1973 ended the era of cheap gasoline, so Americans again started to think about alternatives to fossil fuel. Another issue facing the Americans was increased air pollution in their cities due to gasoline powered vehicles. In the 1990s the California Air Resources Board (CARB) pushed the automakers to produce more electric vehicles to lower carbon emissions. General Motors designed the EV1, which had a range of 80 miles, but it joined with other companies and the oil companies to fight the mandate in court. When the courts reduced the mandates, the American car companies recalled all the electric cars even though they had been popular with consumers.

Although the American car companies appeared to be temporarily successful in wiping out competition from electric vehicles, there was still a demand for cars with better gas mileage and lower emissions. Honda and Toyota recognized this market and developed hybrid vehicles in 1999 and 2000. These vehicles relied on batteries for in town use and gasoline for highway driving, and they were able to get over 50 miles per gallon. The Toyota Prius became one of the most successful vehicles in their product line and helped them become the best selling brand in America. There was still an opening in the market for an all electric car with zero – emissions. Tesla Motors would step into that opening in 2003.

Tesla- A Case of Disruptive Innovation

Disruptive Innovation is prohibitively expensive, so it requires a niche market. Electric vehicles had a reputation for being slow and boring like golf carts. A couple of engineers in silicon valley decided to change that by designing an electric vehicle which would perform like a sports car. They developed the Tesla roadster, which went from 0 to 60 mph in 3 seconds, and they wanted to deliver their product for under $100,000. They were better engineers than businessmen, and they ended up losing almost $50,000 per car.

At that moment the Board of Directors stepped in and appointed a new CEO, Elon Musk. Elon was a South African who was a drop out at Stanford, but he had been a wildly successful entrepreneur. He founded PayPal, which allowed secured transactions for e-commerce, and he was also CEO of SpaceX, which was delivering commercial satellites for NASA. He was considered to be a “Rock Star” CEO whose declared ambition was to die on Mars. He believed that for the planet to survive there had to be a shift away from fossil fuels and that all electric cars were the best way forward.

Elon became the face of Tesla. He led the efforts to get investors through an IPO, and he developed a more stable business strategy. The expensive roadster was discontinued in 2011, for a more conventional Model S which offered high safety, extended range batteries, and a more affordable price. He continued with the Model X, which was an SUV offering to counter a growing SUV market in the US. Finally, in 2017 he offered the Model 3, which would become the first mass produced electric vehicle, reducing its offering price to $35,000 which would make it affordable to most US consumers. In the Model 3, he hoped to have the answer to the Model T and to come up with an electric car that had been dethroned by mass production a century ago.

The key to his mass production factory was his new giga-factory for batteries. His new factory was based in Nevada, close to lithium mines, and close to his final production facility in Fremont, California. This shorter supply chain allowed for fewer production delays and better quality control. Seeking to reduce his carbon footprint further, Musk acquired Solar City, a solar panel company in 2016. Tesla motors now became Tesla Inc., which offered Solar Power and Power storage, in addition to its electric vehicles.

In conducting a SWOT analysis of Tesla, one of the most noteworthy strengths of the company is the visionary leadership of Elon Musk. It also has considerable strengths in its technology leadership in the field of electric vehicles, and it has had some tax incentives that help lower the price for American consumers. It has established a niche market for consumers who like new technology and also want to be protective of the environment. It also has a unique distribution system that is better suited for the online shoppers. Some weaknesses include its getting enough financial support to compete against better funded competitors, the struggles of building up manufacturing capacity for mass production, and a company that does not have a strong media presence outside of social media.

The opportunities for Tesla include a Silicon Valley workforce, which leads the world in innovation, a European market, which has consumers more concerned with climate change, and the world’s largest EV market in China, which Tesla entered in 2014. Some threats to Tesla include being overcome by better funded competitors, the end of government subsidies in the forms of tax incentives, and the use of Tesla open technology by competitors to overcome the technological lead of Tesla. Of course, a big weakness is that if the Stock crashes, and Tesla can’t borrow money, it will run out of cash.

Tesla also has a unique marketing mix. Its price strategy has been high-end up to this point, but that could change with the Model 3, which is based on affordability. Tesla’s zero dollar promotion strategy is based on social media and word of mouth. The product itself is hi-tech, eco-friendly with zero emissions. Finally, the place where selling takes place is not in a car dealership, but online, which more closely mirrors Amazon than American car companies.

The Tesla Financial Paradox

Tesla is not without its critics, particularly those who pay close attention to its balance sheets. By 2017, Tesla had a net loss of $2.2 billion and an 18% loss margin. Another disruptive innovator, Apple, by contrast, has a 22% profit margin. Profit margins do tend to be thinner in the automobile industry, but even most American automobile companies manage to maintain a profit of 5 to 7 %. The key factor to Tesla’s financial survival is that while Tesla is burning cash, it is not running out of cash.

A closer look at the 2017 income statement shows how Tesla is continuing to survive financially. Tesla posted an operations loss of only $60 million, which was an improvement over previous years. The investment of $4.4 billion in the new Giga factory will produce the 500,000 battery packs needed to ramp up production of the Model 3. Tesla was able to raise $4.6 billion in financing due to a relatively good bond rating, and a high share price of the stock. The high price allows the company to sell fewer shares, which does not dilute the stock, and it does not pay dividends, which further lowers equity costs. In 2017 Tesla became the #1 American automaker in terms of market capitalization, even though they only sold 76,000 cars compared to 10 million from General Motors. Tesla sales increased by 300% while GM and Ford sales remained relatively stagnant.

In 2018, Tesla showed a profit in the 3rd and 4th quarters, largely driven by the demand for the new Model 3. The full tax incentive of $7,500 per car closed out at the end of 2018, and Tesla had brisk sales of 140,000 Model 3s. The Model 3 has a 20 percent profit margin, and there are 600,000 reservations for the vehicles. By the end of 2018, Tesla was able to produce 7,000 units per week, which could result in the annual goal of 500,000 cars if this pace continues. In December 2018, Tesla outsold the hybrids for the first time. With the 50% reduction in the tax credit in 2019, Tesla began to look to overseas markets to make up for reduced demand in the United States.

Tesla Comes to China

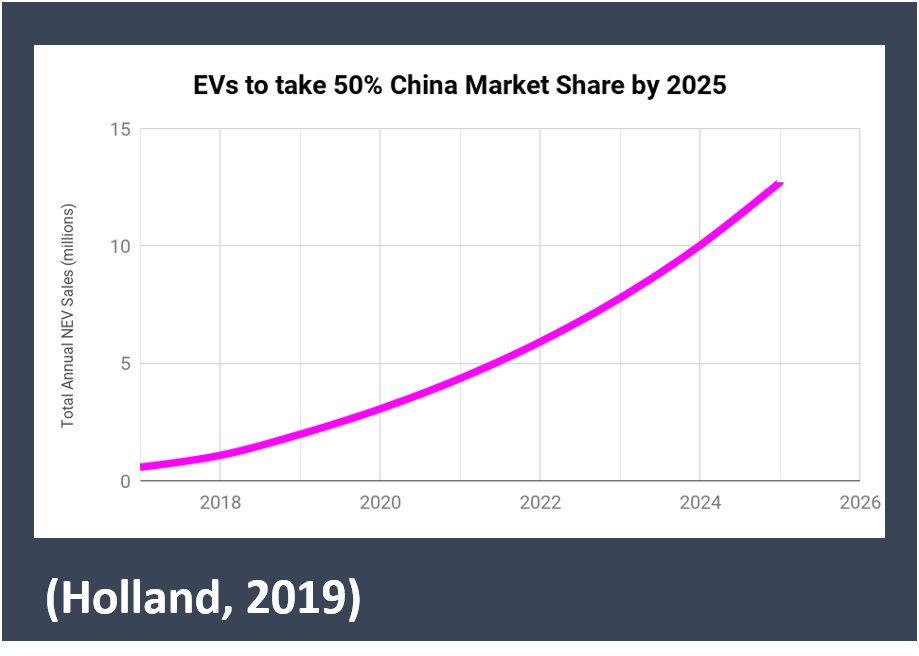

Tesla had been selling cars in China since 2014, but it was a minor player in a crowded market. As seen in the chart below, China is the largest EV market in the world, selling over a million vehicles in 2018, more than three times the U.S. Market. China also had a growing luxury car market, which had been the niche for Tesla. With projections of 2 million EVs in China by 2020, Tesla needed to reduce its price to get better market share. The only way to reduce the price was to produce the cars in China, so in 2019 Tesla will open its first automotive plant outside of the United States in Shanghai, China. Tesla will also start deliveries of the Model 3 sedans in February, but it will not be able to get the desired volume of sales until it can produce the cars in China.

In 2025, it is projected that China EVs will have a 50 percent share of the Chinese automobile market. Some of the reasons driving this are climate change fears, national security concerns, air pollution, and desire for competitive advantage in green technology. Most of the Chinese population is located close to water, so rising water levels could have a devastating effect. China is now a major importer of oil and does not want to have oil supplies cut off like the United States and Europe during the Arab Oil Embargo. The air pollution in cities has led the government to push for more zero emission vehicles. Japan was able to jump out in front in the United States auto market with hybrid technology. China would like to jump out in front of Japan with all electric automobile technology. The figure below shows the projected rise in market share for electric vehicles in China.

Tesla does have significant challenges in China. It has no tax incentives from the government. The vehicle price is more than double of domestic vehicles due to taxes and tariffs. It has no Chinese partner, and its charger network is undeveloped for a country the size of China. There are fifty startups in the EV space and it is growing every day. Some are particularly well-financed such as BYD (Warren Buffett), NIO (recent IPO), XPENG (Alibaba/Foxconn). Some have state support such as BAIC or SAIC Motor. Of course there are European and Japanese competitors as well, such as Mercedes, Volkswagen, and Nissan.

Tesla is hoping that its new Shanghai factory will even the playing field in the China EV Market. The Shanghai plant should provide reduced labor costs, reduced transportation costs, elgibility for government incentives, and a base for suppliers close by. The plant will be tooled for both the Tesla Model 3 and the Model Y, and affordable Teslas could lead to an extraordinary demand in China. There are still some questions about financing of the plant, the unknown quality of the local supply chain and local battery packs, and what tariffs/ taxes will be applied in an enterprise zone in Shanghai. The last question will probably not be resolved until there is a new bilateral trade agreement between the United States and China.

Porter’s 5 Force Model

Questions for Discussion:

Provide a summary of the case and identify key issues.

Compare a SWOT analysis for Tesla with at least one of its competitors in China.

Suggest a Marketing plan for Tesla in China, and compare and contrast it to at least one competitor in China.

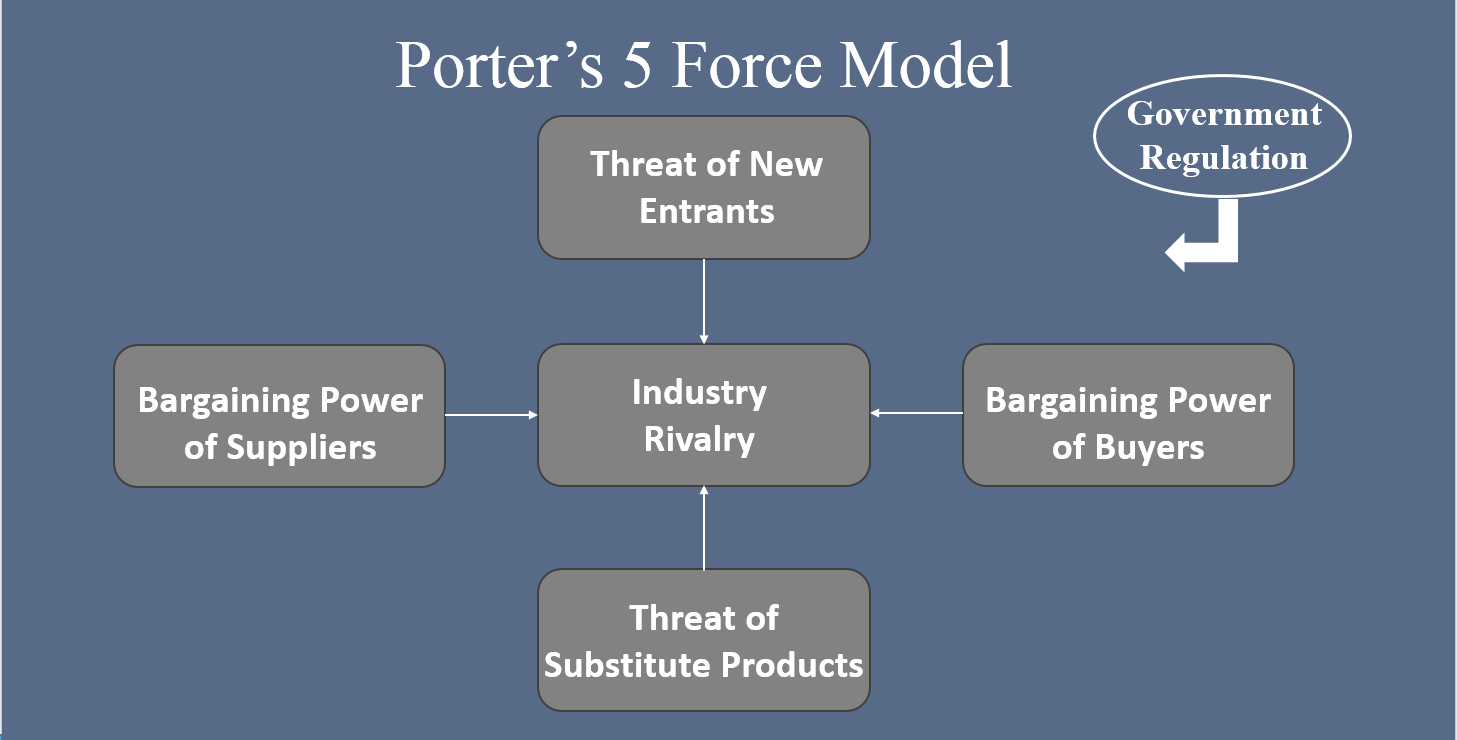

Analyze how the Electric Vehicle market in China reflects the element of Porter’s 5 Field Analysis.

Provide recommendations for Tesla on how it can become a major player in the Chinese EV market.

Provide recommendations for at least one Tesla competitor on how it can withstand the challenges of Tesla entering the Chinese Market with its new plant in Shanghai.