Business Strategies based on Value Chain

Chapter 3

Building-Blocks of Business Strategies: Value Chains

| Consider the case of the Switzerland-based Nestle, whose mission is to provide a caring nest that offers good food and good life to the consumers. As shown in Exhibit 3.1, Nestle as a global corporation comprises of five major business groups: culinary foods, beverages, confectionary, milk products and nutrition. Within each of these business groups (firms), Nestle links its resource transforming functions in very different ways, and each of these ways reflect the personality and the positioning of its specific brands. Historically, Nestle has been known for its mass market appeal, with popular global brands such as Maggi in culinary foods, Nescafe in beverages, Kitkat in confectionary, Nestle in milk products, and Cerelac in (baby) nutrition. However, its confectionary business group suffered more than 25% drop in revenues in a five year period 2008-2013, and the company as a whole suffered revenue drop during 2011-2013. To offset its market share losses, Nestle has sought to aggressively promote linkages in the premium, luxury market – that has been immune to the recession and has been growing rapidly. In 2011, Nestle launched the premium Maisen Cailer brand of customized confectionary for the online shoppers in Switzerland – the customers can order Ecuador-sourced sampler pack of five chocolates. After tasting, customers fill an online survey to determine their chocolate personality, and are able to order larger boxes, marrying their favored chocolate with preferred fillings ranging from peppercorn and vanilla to raspberry and verbena. A 16-piece 128 grams box of the Maison Cailler chocolates costs 26 Swiss francs ($28.30). That means these are priced at $220 per kilogram, or $100 per pound. In the beverages group, Nestlé successfully created the luxury home coffee business by launching its single-serving expresso-maker Nespresso capsule in two countries in 1986. The capsule was offered online in the 1990s and in boutique stores in 2002. By 2012, it became a US$3.3 billion brand, with half its sales coming from the Internet and more than 250 boutiques worldwide. Nestlé already has tried its hand at other premium, customized goods. Similarly in the nutrition group, Nestle launched BabyNes formula milk capsules in 2011, which fit its own $272 single-serving machine. In the culinary group, Nestle has extended its Buitoni brand into the premium segment, by launching a sub-brand Le Creazioni di Casa Buitoni in 2011. An example of the innovative products in this sub-brand is the extra-large, extra-creamy filled pasta, with a state-of-art technology allowing pieces of ingredients, such as porcini mushrooms and toasted almonds, to remain intact. Another innovative linkage for this sub-brand includes a paper-based, partly recyclable tray, which reduces the amount of plastic normally required in packaging. Source: Adapted from Doherty (2012) and Nestle (2011) |

In the previous chapter, we examined the micro-foundations of strategic advantage involving the process, structural and behavioral characteristics of the capabilities of a firm and how they are managed in dynamic environments. However, in addition to developing foundational capabilities, strategists need to also work on building-blocs of business strategies.

Value linkages among resource transforming functions within and outside the boundaries of a firm, are its ‘building-blocs’ to successful business strategies. As a matter of fact, these building-blocs go on to form a firm’s strategic advantage in various business domains. A value linkage describes the full range of processes “required to bring a product or service from conception, through the different phases of production (involving a combination of physical transformation and the input of various producer services), delivery to final consumers and final disposal after use” (Kaplinsky and Morris 2001). Firms may have several different types of value linkages, and different firms tend to have different types of value linkages. For instance, the value linkages for the traditional mass brands of Nestle are fundamentally different from those for the new premium brands, because they are targeted at a different customer profile, and rely on different ingredients, technologies, packaging, and delivery channels.

Value chain is a specific type of value linkage, which describes the linear process of operational flow from design and sourcing of inputs, to processing, marketing, and servicing of customers. The Value chain hypothesis is concerned with the type of investments a firm makes in its efforts to develop the most competitive and sustainable value chains.

In this chapter, we will consider two distinct views on the value chain hypothesis (the most important of the value linkages): the Protection view and the Growth view. The Protection view holds that firms making consistent and dedicated investments in either differentiation capability or cost leadership capability are likely to be better protected from competitive attacks. These firms are more likely to generate stronger and more sustainable competitive advantage. This view is based on a static view of the environment, and assumes an inherent trade-off between lower cost and higher value. The Growth view on the other hand, holds that in dynamic environments, a strategy built on investments in cost reduction or differentiation enhancement for existing, known market spaces will only erode a firm’s strategic advantage. In existing known market spaces, referred to as red oceans, firms try to outperform their rivals to grab a greater share of market. These red ocean market spaces are crowded, and prospects for profits and growth are low. Conversely, an integrated approach can allow the firm to create new demand, instead of fighting for it. In this new yet unexplored space, referred to as blue oceans, there is sufficient opportunity for growth that is both profitable and rapid.

This chapter discusses the value chain hypothesis, and the business strategies deriving from the two distinct views on this hypothesis as mentioned earlier.

The Concept of Value Chain

Value chain is one of the most fundamental concepts in strategy. Value chain is a chain of functional nodes along which a firm exchanges and transforms its resources, and involves design, production, marketing, delivery and support (Porter, 1985). As products in value chains are exchanged and transformed, they flow downstream in a series of exchanges among participants at each functional node that adds value and costs. As we will see below, there are many different ways of portraying a value chain, depending on the major functions of a firm.

To analyze a value chain, one generally uses two major lenses: a value lens or a design lens.

Through a value lens, one evaluates the overall cost and the incremental value at each functional node. This allows in eliminating or outsourcing functions associated with a negative value-add, while simultaneously augmenting or insourcing functions associated with a positive value-add. It allows comparing a firm’s performance with that of its competitors, to identify gaps in cost-effectiveness and value-added, and to develop and execute plans to close the identified gaps. Exhibit 3.x illustrates how this is done using the example of two mobile network operators – Vodafone and Orange.

Exhibit 3.x: Traditional Value Chain Analysis – Closing the Competitive Performance Gaps

Vodafone

* 99% population * In-house *Own System * Own branded and * Own portal

Coverage and other retail chains

* Distributors

Orange

* 99% population * In-house *Own System * Own branded and * Own portal

Coverage and other retail chains

* Distributors

Source: Adapted from Peppard & Rylander (2006)

Through a design lens, one investigates the most appropriate value and cost linkages for target customers. Practically speaking, this value chain analysis proceeds by examining the integrated functions of a firm comprising of activities such as design, production, marketing, delivery and support. Strategies for managing investments in value linkages aimed at improving strategic advantage of a business are referred to as the “Business-level strategies”.

Customers

Suppliers

Porter (1985) was the first to offer a classification of business-level strategies using a value chain analysis, which is based on three alternative generic sources of strategic advantage – value, cost and focus. As illustrated in Exhibit 3.x, Porter’s framework offered a model of how businesses receive materials as inputs, add value to them through various functions, and sell value-added products to customers.

Customers

Suppliers

In Porter’s framework, there are two broad categories in a firm’s value chain: primary and secondary. Primary activities are directly involved in transforming inputs into outputs, delivery and after-sales support. Thus they include:

● inbound logistics—material handling and warehousing;

● operations—transforming inputs into the final product;

● outbound logistics—order processing and distribution;

● marketing and sales—communication, pricing and channel management; and

● service—installation, usage guidance, maintenance, parts, and returns.

The secondary or support activities are ones backing up the primary activities, and include:

● procurement—purchasing of raw materials, supplies and other consumable items as well as assets;

● technology development—research and development, procedures and technological inputs

● human resource management—selection, promotion and placement; appraisal; rewards; management development; and labor/employee relations; and

● firm infrastructure—general management, planning, finance, accounting, legal, government affairs and quality management.

The concept of value chain is not without limitations. It assumes a sequential chain of activities in a physical world, for transforming material inputs into products that have value at each intermediate stage of process. Upstream suppliers provide inputs that pass through the downstream to the next sequential link, and eventually to the customer. Such a worldview is appropriate for traditional manufacturing firms, operating in fairly stable to moderately dynamic environments. Such a worldview however, contributes to the commoditization of functions by promoting similarities in what firms do. It takes a static view of firm’s capabilities, target markets, and competitor dynamics. It thus may obscure dynamic capabilities and a firm’s ability to survive and grow a business by exploiting alternative market opportunities.

Generic Sources of Strategic Advantage in Value Chains

One of the major purposes of Porter’s framework is to explicate three generic sources of strategic advantage for the businesses of a firm. Strategic advantage of any business derives from the difference between the value it offers to customers and the cost of creating that customer value. Therefore, the strategic advantage of a business may derive from three generic sources:

Value, referred to as offering or differentiation advantage. If customers perceive a product or service as superior, they are willing to pay a premium relative to the price they will pay for competing offerings. A firm may achieve differentiation advantage by making investments that generate a disproportionate increase in both the value accrued from the customers as well as the proportion of this value it is able to capture. This is illustrated in Exhibit 3.x

Exhibit 3.x: An illustration of how a firm may develop differentiation advantage

| Total Value | Firm’s share | |

| Investment in a process (A) | $100 | |

| Original value accrued from customer (B) | $1000 | $500 (50.0%) |

| New value accrued from customer (C) | $1150 | $650 (56.5%) |

| Increased value accrued from customer (C-B=D) | $150 | |

| Increased value/ Investment (D/A) | $150/$100 = 1.5 > 1 |

Cost, referred to as operating or cost leadership advantage. If a firm gains a cost advantage for performing activities in its value chain at a cost lower than its major competitors, then it has flexibility to undercut competitors and offer greater value for money to its customers. A firm achieves cost leadership advantage by making investments that improve the cost structure of its value chain. This is illustrated in Exhibit 3.x

Exhibit 3.x: An illustration of how a firm may develop cost leadership advantage

| Total Value | Firm’s share | |

| Investment in a process (A) | $100 | |

| Original value accrued from customer (B) | $1000 | $500 (50.0%) |

| New value accrued from customer (C) | $750 | $250 (33.3%) |

| Reduced value accrued from customer (B-C= D) | $250 | |

| Reduced cost from process investment (E) | $400 | |

| Net cost reduction benefits retained by the firm (E-D=F) | $150 | |

| Net benefits retained/ Investment (F/A) | $150/$100 = 1.5 > 1 |

For both the differentiation advantage and the cost leadership advantage, investments may be made in one or more of the primary or secondary activities. The advantage tends to be more significant, when the impacted activity (or activities) accounts for a substantial part of the value for the customers. Exhibit 3.x illustrates this in the context of smartphone market.

| Xiaomi and Lenovo of China and Micromax of India are the leaders among the many emerging market firms that have entered the smartphone market. These firms are growing rapidly because of their capability to offer smartphones at a cost more than a third less than the Apple’s iphone. They are using a specialized chip designed for smartphones by MediaTek, a Taiwanese semiconductor company based on in Hsinchu science park, the Taiwanese Silicon Valley. Until 2011, MediaTek designed chips only for the older feature phones. Its chips took care of most of the design work, allowing its customers to manufacture low-cost feature phones without having to spend much time or money on research and development. These feature phones available at dramatically low prices revolutionized the mobile markets in emerging markets, such as of China and India. In 2011, MediaTek introduced chips designed for smartphones, allowing entry of many new smartphone firms in the emerging markets. A second major factor in the low-cost advantage of the new entrants is Google’s Android operating system. Google offers the open code for the Android operating system free of cost, as it seeks to accrue value from the online ads when customers search and consume Web content. As Google handles more online advertising than any place else, a rising online tide benefits its bottom line. Android accounts for more than 80% of the smartphone market in terms of volumes, as mobile firms such as Samsung have used it for high-end smartphones as well. In 2008, Apple had the mobile marketplace to itself, but now it is no longer the volume leader. The new entrants have targeted emerging markets like China and India, where the demand for expensive smartphones is more limited, as compared to the demand for the lower cost smartphones. In 2011, after four years of effort, Apple was selling only 10 million iPhones in China. Xiaomi founded in 2011, was able to offer a smartphone at a cost of only 2,000 yuan (US$327) – 37 percent of the cost of an Apple iPhone in China. Like other low-cost mobile handset providers, Xiaomi has razor-thin profit margins. Apple, on the other hand, lacks strategic advantage relative to the high-volume cost-conscious customers. Its advantage is with the brand-conscious customers who value usability and simplicity of design. Tim Cook, Apple’s CEO, said, “There’s a segment of the market that really wants a product that does a lot for them, and I want to compete like crazy for those customers,…I’m not going to lose sleep over that other market, because it’s just not who we are. Fortunately, both of these markets are so big, and there are so many people that care and want a great experience from their phone or their tablet, that Apple can have a really good business.” |

Source: Adapted from Einhort (2013) and Grobart (2013).

Focus, referred to as customizing or focus advantage. If a firm links activities in a value chain to a highly specialized and unique application or target market, then it may improve its strategic advantage in that distinctive market niche. A firm achieves focus advantage by making investments that customize its activities for specialized purposes, to the exclusion of other related yet more general purposes that the other firms may be targeting. For instance, many luxury firms focus on small and exclusive ultra-premium target market in Paris, because presence in this target market is an important gateway to many emerging markets, including Dubai, Mumbai, and Shanghai, where luxury fashion-conscious upwardly mobile consumers closely follow the trends in Paris deemed as the luxury fashion capital of the world.

The focus advantage may be grounded either in differentiation advantage (higher willingness of the customers to pay a value premium), or in a cost leadership advantage (lower cost structure of a firm). For instance, to stand apart in the tablet market, some firms offer tablets for kids, while others offer tablets that can be hanged in retail stores for displays. Both these firms have invested in special-purpose design processes (i.e. kid-focused or retail store-focused) for gaining a focus advantage, as compared to other firms that offer general-purpose tablets. Kids-targeting firms have also invested in cost reducing production function, to assemble lower cost special-purpose tablets that the parents find affordable for their kids, while store-targeting firms have invested in value-enhancing production function, to assemble premium special-purpose tablets that the retail chains are willing to use for store displays in place of the costlier LCD televisions.

The Protection View of Value Chain Hypothesis

As noted above, a firm may invest in its value chain to develop three different types of generic advantages: value, cost, and focus. How should it make this investment decision? Value chain hypothesis is concerned with the type of investments a firm should make to develop most competitive and sustainable strategic advantage.

Conventionally, in static markets, firms have been most concerned with the protection of their strategic advantage. As noted in the previous chapter, firms may strive to protect their advantage by investing in strengthening of isolating forces, thereby making it even more difficult for other firms to copy or substitute their valuable resources, capabilities, and core competencies. According to Porter (1985), the most effective way to do so is for firms to make consistent, persistent and dedicated investments in either differentiation or cost leadership, either broadly or in a focus area. The firms who seek to invest in both cost leadership as well as differentiation advantages are likely to be ‘stuck-in-the-middle”, and find it difficult to protect and sustain their advantage. This view is based on three implicit assumptions.

Knowledge processes/ routines assumption: firms who strategically focus all their investments in either cost reduction or in differentiation are likely to develop deep, strong knowledge processes or routines to undergird their competitive advantage, as compared to those who strive to do both.

Motivational processes/ culture assumption: firms who strategically strive to promote either cost reduction or differentiation only, are likely to develop deep, strong motivational processes, or culture, to undergird their competitive advantage. A culture of cost leadership is likely to make it difficult to be an effective differentiator, and a culture of differentiation is likely to make it difficult to be an effective cost leader as well.

Reputational processes/ credibility assumption: firms who strategically position themselves as capable of cost reduction or differentiation are likely to develop deep, strong reputation, or credibility, to undergird their competitive advantage. Customers are likely to expect these firms to have the ability to reconfigure processes to either achieve dramatic cost reductions, or command dramatic value premiums. Whereas in reality, the firms may have these abilities either in broad domains (generic cost leadership or generic differentiation), or in focus domains (focus cost leadership or focus differentiation).

Thus, the Protection View postulates that firms that pursue either differentiation or cost leadership business strategy will outperform those who pursue a mixed or hybrid strategy combining both. Overall, the Protection view offers a typology of three pure business strategies for the firms to choose from based on the three generic sources of strategic advantage discussed earlier. These pure business strategies are: cost leadership, differentiation, and focus. It is important to note that focus is not a truly pure business strategy, because the fundamental choice for the firms is either cost leadership or differentiation, but for either of these, the firm may additionally choose to focus on a specific set of customers.

Cost leadership strategy is based on strategic concentration and persistence of investments in linkages that reduce costs. The strategy involves making a fairly standardized product, combined with aggressive underpricing all rivals (Porter, 1980: 36). Standardized products are referred to as commodities, because they are undifferentiated; when these products are stripped down to bare functional basics, then they are referred to as no-frill products. The strategy requires “heavy up-front capital investment in state-of-the-art equipment” (Porter, 1980: 36), and is based on three major categories of cost reducing efforts: (1) reducing unit manufacturing costs through higher unit volume, efficient scale facilities, and experience curve; (2) exercising strict cost control over engineered costs and on exchanged costs (purchased inputs and logistics) ; and (3) a discriminating approach to discretionary costs like R&D, service, sales force, and advertising. When the strategy is based on the reduction of unit manufacturing costs, engineering costs and exchanged costs, then it may result in cut-throat price wars. The cost leaders rely on some elements of discretionary costs to aggressively build market share for their commodity-like products.

For example, Sears has been historically known for its customary dedication to cost control, offering value at a decent price. But in the appliance business, it had to combine that with a commitment to service in order to succeed (Rothschild, 1979: 95). Therefore, these discretionary costs allow cost leaders to partially alleviate the customer price sensitivity for the standardized products they offer.

Let’s consider another example: the sheet metal firms commit to exceedingly tight technical specifications, delivery schedules, and responsiveness in reordering, in order to gain preferred marketing arrangements with the auto firms (Levitt, 1980). It is imperative to note that persistence of cost-reducing efforts is critical for a cost-leadership strategy.

A firm competing solely on the basis of differentiation advantage may successfully use new product designs or process technologies to reduce costs, at times below the industry standards. Robust state technology in the TV Set industry allowed firms to achieve both higher reliability and lower cost, as compared to firms that used the older vacuum tube technology (Porter, 1983: 482-503). However, one-time or ad hoc cost reduction efforts do not constitute a cost leadership strategy, which as a matter of fact requires a deep culture of tight cost control.

Differentiation strategy is based on strategic concentration and persistence of investments in linkages that accrue value premium. The strategy involves offering superior product features to customers. In here, persistence of investments is critical, as the features that differentiate a firm or some of its product lines may no longer act as differentiators, if these become industry standard.

In the 1920s, General Motor’s CEO Alfred Sloan merged many smaller auto firms whose survival was threatened by the rapid growth of Ford as a cost leader. GM then designed the pioneering differentiation strategy of “a car for every purse and purpose.” Sloan rationalized GM’s cars into five price-quality segments, generating a hierarchy-of-models for the rising economic status of the customers through their life. The young, upwardly-mobile first-time customer was invited to choose the moderately-priced Chevrolet, over the least-costly mass-produced Ford. When the customer got promotion and some more income, the first thing he did after buying a bigger house for the family was to buy an Oldsmobile. The next step up brought a Pontiac, then a Buick. At the top of the ladder, he would acquire a Cadillac (Mantle, 1995). This strategy allowed GM to displace Ford as a market leader, and to dominate the US market until early 1980s with a total market share as high as 50%.

In Consumer Reports, for the model years through 1982, in non-luxury full-sized, midsize, and compact cars categories, GM scored first and second in virtually every year. These categories of cars represented the biggest and most profitable segments of cars in the U.S. Ford and Chrysler followed GM in introducing cars for different segments, but because of their lower market share were unable to match GM’s cost structure for the higher-end segments - paradoxically earning GM a cost leader moniker (Porter, 1980). But, over a period of time, as the features offered by GM became an industry norm in the US, European rivals out-differentiated GM by adding new premium luxury features. Japanese rivals out-competed GM by adding features that were standard on higher-end models into their base models at low costs. This sharply eroded GM’s market share and pushed it into red by the late 1980s, and forced it to find new ways to differentiate.

Focus strategy is based on strategic concentration and persistence of investments in linkages specific to a specialized domain, either for cost reduction or for differentiation. Specialized domain may take a variety of forms, such as a niche market or geographical segment, a niche distribution channel, a niche workforce, a niche application or user need, and so on. There are quite a few players whose specialized services or products have been market differentiators; take the case of Wizz Air, a specialist firm offering low fares and fast direct flights as part of its focused cost leadership strategy. It operates in Hungary, Bulgaria and Ukraine, and specializes in flying Central and Eastern European job-seekers to UK and Ireland. Car2Go is another specialist, which focuses on environmentally-conscious customers who need a vehicle for short trips. It offers small two-seat electric vehicles for very short-term rental by reservation or on demand. Customers use a member card to access a car and may leave it anywhere in the local service area. As part of its focused differentiation strategy, it bundles insurance, parking, and maintenance in its pricing, which can be by the minute, hour, or day.

Note: in industries where many different firms compete as specialists in different niches or where any one of the niches grows rapidly, the firms pursuing a broader scope may experience erosion in their strategic advantage. For instance, in 1955, Proctor & Gamble (P&G) introduced Crest toothpaste, as the first in the industry to have therapeutic benefits. Crest had fluoride that offered protection against dental cavities. The first few years, Crest occupied a small niche, with only 8.8 percent share of the US toothpaste market in 1958. P&G worked with scientists at the Indiana University, with whom it had invented the dental fluoride, to conduct twenty three separate studies to demonstrate the therapeutic benefits of fluoride. In 1960, the American Dental Association endorsed the effectiveness of Crest as an effective anti-cavity agent. Within two years from then on (i.e. by 1962), Crest’s market share in the U.S. surged beyond 30% and remained around 35% for several decades thereafter. In contrast, Colgate suffered a loss of its market share to just around 20%, and was forced to lose its first-mover advantage and to become a follower by adding fluoride and repositioning itself from cosmetic to therapeutic segment. Overall, the share of the cosmetic segment fell from about 70% in 1960 to about 34% in 1970. In contrast, the share of the therapeutic segment surged from about 15% in 1960 to about 58% in 1970 (Miskell, 2005).

Cost Leadership Strategy, Differentiation Strategy, and Firm Performance

There are three different sub-hypotheses on the relationship between cost leadership and differentiation strategies.

Mutually-exclusive hypothesis: Porter (1980: 38) contends that a differentiation strategy often requires a perception of exclusivity, which is incompatible with high market share. He further notes that a firm must make a choice among generic strategies, otherwise it will become “stuck in the middle” (Porter, 1985: 11). This is so because each generic strategy requires a different culture, different resources, different organizational structures, different management styles, and radically different philosophies (Porter, 1985: 24, 99). For instance, the Gap Corporation started with a flagship business unit The Gap. To deepen its cost advantage, it developed a lower-end business unit Old Navy. To deepen its differentiation advantage, it developed a higher-end business unit Banana Republic. To improve its focus, it further created new business units – The Gap for Men, The Gap for Women, and The Gap for Children. Similarly, many airlines have a first-class product line and an economy product line. For each of these product lines, they offer different reservation numbers, customer service counters, boarding times and procedures, seating, food and in-flight service and entertainment.

Lifecycle hypothesis: a second view is that at different phases of product and organizational lifecycles, different strategies are appropriate, depending on what will allow a firm to outpace its competitors (Gilbert & Strebel, 1987). While a differentiation strategy leads to a low-cost position in the later stage of a product lifecycle due to an increase in sales volumes, the learning curve, and economies of scale and scope (Hill, 1988), a cost leadership strategy enables firms in their later organizational lifecycle to develop a premium positioning using their accumulated experiences and knowledge development. In the 1990s, the Korean automaker, Hyundai was known to be a cost leader, with its midsize Sonata car. During the 2000s, Hyundai continuously improved its quality, and in 2008, launched the moderately priced Genesis, costing $38,000. This was followed by the Equus in 2010 within the $55,000 to $60,000 range, at the low-end of the luxury segment. Hyundai thus enjoyed a 20% annual growth in its revenues, and became the fifth largest automaker in the world. In 2011, it repositioned itself as “modern premium” – offering high-end features at affordable costs for the mass-market consumers.

Singularity hypothesis: a third view is that both cost reduction and value addition are integral to any business strategy, and are not distinct but singular. Businesses have only two generic strategic choices: how much to differentiate and what scope to decide (Mintzberg, 1988). In marketing, a differentiated product is one that “is perceived by the customer to differ from its competition on any physical or nonphysical product characteristic including price (Dickson and Ginter, 1987: 4). Mintzberg (1988) opines that cost leadership is just an element of differentiation strategy in which the basis of differentiation is not higher quality, but lower price. For instance, in the US, within the economy segment of the hotel/motel industry, Motel 6 differentiates itself by positioning the brand with a claim of offering “the lowest prices of any national chain” (Thomson and Strickland, 2008).

Similarly, there are three different hypotheses on the relationship between cost leadership and differentiation strategies and a firm’s performance.

Differentiation hypothesis: many scholars assert that firms using differentiation strategy outperform those using a cost-leadership strategy. Peters and Waterman (1982: 186) report that high-performing firms tend to be focused more to customer value than the cost “side of the profitability equation”. Thereby, such companies “tend to be driven more by close-to-the-customer attributes than by either technology or cost.”

Equivalency hypothesis: Porter (1980: 35) asserts that cost leadership and differentiation strategies offer an equally successful and profitable path to strategic advantage. This may be true in a highly cyclical economic environment. Cost leaders tend to be better positioned to compete during economic downturns, while differentiators often seek cost reduction to avoid losses. For instance, during the economic downturn in the late 2000s, Ohio-based Marco’s Pizza negotiated lower transportation costs from the freight firms, and began contracting with vendors situated near its distribution centers to further reduce its logistics costs. It eliminated small pizza boxes, and put small pizzas in Cheesy Bread boxes, to save more than $150,000 across its 170 store chain. Similarly, differentiators tend to be better positioned to compete during economic upturns with customers having more discretionary incomes. JetBlue Airways for example offers an economy class service to fly between a few US cities, but has added features such as new planes, on-board television, and leather seating to achieve a high-load factor (i.e. average percentage of filled seats) in economic upturns as well.

Contingency hypothesis: firms from different nations may have different capabilities for cost leadership vs. differentiation advantage (Baack & Boggs, 2008). Firms operating in emerging markets where the cost structures are lower, and a limited percentage of customers have high purchasing power, cost leadership strategy tends to be more profitable. In contrast, firms operating from industrial markets where customers can afford to be more discriminating, higher quality resources are more accessible, and the differentiation strategy is more profitable. For example, Baack & Boggs (2008) found that the industrial market firms are less successful using cost leadership strategy in China, which is an emerging market in world economy.

Risks of Pure Business Strategies

Research shows a lack of support for the Protection view in highly dynamic and turbulent markets. Firms that pursue only cost leadership or differentiation, may not be as successful in such markets because of the risks from the following three factors:

Risks of diminishing returns: firms investing only in cost reducing linkages eventually encounter the law of diminishing returns, which states that, as one invests progressively in one object alone (i.e. cost reduction), the cost reduction benefits become regressive. In other words, the sum amount of cost reduction generated will eventually become less than the amount of investment made in building cost reducing process capabilities.

Risks of diminishing demand: firms investing only in differentiation enhancing linkages, eventually encounter the law of diminishing demand, which states that as one invests progressively in accruing a value premium (i.e. differentiation), the willingness and the ability of the customers to accept that value premium diminishes. In other words, the size of the market interested in its products shrinks.

Risks of competitive interplay: firms investing in either one of the factors, i.e. differentiation enhancing or cost reducing linkages for their focus strategy, eventually encounter law of competitive interplay as well, which states that as a firm gains dramatic cost advantage over other firms, or commands dramatic value premium over other firms, new set of firms are inspired to challenge the firm’s rising monopoly. These new firms in turn often ride on favorable macro market shifts, such as technological breakthroughs or new customer segments. They design, produce, deliver and/or service alternative products that offer a different and better value to the customers, and render the older firm’s cost or differentiation focus advantage inconsequential. Or, they overcome isolating mechanisms, and acquire relevant resources and capabilities through trade, imitation, or substitution to offer similar products at a much lower cost, with better differentiation, and/or with finer focus.

Exhibit 3.x illustrates how Lego – who has traditionally invested only in differentiation – has suffered losses because of the above risks.

| Exhibit 3.x Lego’s Differentiation Faces a Challenge The Lego offers construction blocks for children. Their blocks are known for their bright colors, durability, good appearance, uniformity, and highest quality parts. They have rights to several exciting themes, including Star Wars, Harry Potter, and Jurrasic Park, allowing them to offer several popular pieces and sets. Its larger bricks aimed at younger children are compatible with the smaller bricks targeted at the older children, allowing its products to grow with children. Several firms around the world have challenged Lego’s monopolistic tendencies as a market leader, and its high product prices. Lego has suffered both loss in market share as well as losses, as the rivals have targeted customers whose priorities include price factor as well. One of the most successful rivals is Megabloks, a Canadian brand established in 1967. Its products are of lower quality, are duller, but are offered at low costs – some of them at one fourth the cost. It also has taken rights to several popular themes. Its bricks work well on a small scale, but are slightly misaligned on a large scale, creating structural instability in large structures. Megabloks even has a line of product whose pieces are compatible with the leading market brand (i.e. Lego). Megabloks has enjoyed profitability and growth, as the Courts have set aside Lego’s claim that Megabloks has copied its studs and tubes interlocking brick system because Lego’s patents on the design have long expired. |

Source: Adapted from Thomas (2014).

Exhibit 3.x summarizes the pros and cons of the Protection view.

Exhibit 3.x: Pros and Cons of the Protection View

Benefits of a Hybrid Business Strategy

Research shows that in highly dynamic markets, firms pursuing a hybrid strategy, based on the integration of linkages for cost leadership as well as differentiation, tend to outperform those pursuing a pure strategy (Campbell-Hunt, 2000). This has been found even for the small and medium enterprises, which tend to use focus cost leadership or focus differentiation strategies (Leitner & Guldenberg, 2010). Three factors may explain the benefits of a hybrid business strategy in dynamic conditions:

Benefits of increasing demand: as firms invest in cost reducing linkages, they gain an additional operating surplus. If they invest this additional operating surplus in differentiation linkages, then they gain the added capacity of offering differentiation to this target group. This improves their competitiveness relative to both cost leaders as well as differentiators. Such a strategy may also help focus-in on non-consumers, if they find value in the more differentiated, yet cost-effective, product offerings.

Benefits of increasing returns: as firms invest in differentiation enhancing linkages, they gain deeper insights and knowledge about the latent and unmet needs of the market. By investing in cost reducing linkages as well, firms gain an additional capability to serve these needs cost-effectively. This in turn allows them to generate increasing returns on their differentiated knowledge about a large group of customers.

Benefits of competitive priorities: firms that invest in both cost-reducing as well as differentiation enhancing linkages, benefit from the law of competitive priorities, which states that when firms must decide among competing priorities under conditions of resource constraints, then their decisions tend to be guided by a sense of what priorities their target market puts on cost reduction vs. differentiation enhancement. Thereby, these firms develop a more flexible agile capability to monitor and adapt to shifts in market priorities of different groups of customers. The shifts may be more or less constant, for instance, when the per capita income in an emerging market is rising, or when the market of interest is in a protected industrial market that is now subject to cost competition from the emerging market rivals. Or, the shifts may be periodic, for instance, when markets tend to be become cost-sensitive during recession or differentiation-seeking during economic upturn.

Exhibit 3.x illustrates how British Airways has shifted successfully from a differentiation strategy to a hybrid strategy, and tapped the above three benefits. Similarly, McDonald’s has shifted successfully from a cost leadership strategy to a hybrid strategy.

| Exhibit 3.x: British Airways and McDonald’s – Different Paths to Hybrid Strategy After 9/11, sensing greater customer priorities for lower prices, British Airways – traditionally known for its differentiation strategy – began investing in cost reducing efforts. It cut the total number of planes in its portfolio, and ordered replacement planes without special custom features. It limited menu choices for the customers, cut fees for the agents, and eliminated 13,000 jobs. It passed on some of the cost-savings to its customers in the form of lower fares; and invested the rest into new sources of differentiation while also being attentive to costs. In a meeting organized in the emerging luxury capital Dubai, its business and first-class customers told that they looked for ‘re-energization’, ‘comfort’, and ‘well-being’. Most importantly, on long-haul flights, they wanted to have a good night’s sleep. British Airways set the design challenge of creating a more comfortable seating arrangement – the flat beds, without any loss of seating capacity so that it could maintain its fares. Its R&D team developed a unique new armchair style seat, which transforms into a 6-foot, fully flat bed, that transformed the face of business travel. The innovation was soon copied by Virgin, Singapore and many other carriers, but BA followed up with other innovations such as sophisticated entertainment options, personal lockers, 10-inch flat screens and personal privacy to their customers, without any added costs. Thus, it was able to increase both its demand as well as returns.

On the other hand, in the late 2000s, sensing greater customer priorities for healthy and gourmet food, McDonald’s – traditionally known for its cost leadership strategy – began investing in differentiation efforts. In 2008, it installed McCafe coffee bars featuring cappuccinos, lattes, and gourmet coffee, offering a value similar to that of high-end Starbucks but without the same cost. It also invested in new product lines, such as fresh, premium salads, again offering the same at low costs. The move proved very successful, allowing McDonald’s to improve its demand as well as returns in the US, as well as internationally. |

Source: Synaticsworld (2010)

With globalization and growing use of information and communication technologies and knowledge analytics, many firms are successfully deploying ‘focused hybrid’ strategy combining cost leadership and differentiation advantages for specific needs of the target customer groups. In dynamic markets, some specific needs, such as sustainability consciousness, wellness, or smart design, have quite broad-based appeal. In these conditions, focus hybrid strategy can be a door to rapid growth. Next we look into this growth view of value chain hypothesis.

The Growth View of Value Chain Hypothesis

In dynamic markets, benefits of investing in isolating mechanisms diminish, while the costs of protection rise. Firms face competitive pressures from a more diverse types of rivals, using more diverse alternative sets of resources, capabilities, and core competencies. Growth, more so than protection of cost leadership or differentiation advantage, becomes a more attractive business strategy. Growth, as a business strategy, requires executives to clearly articulate how it will help create value in terms of the organizational purpose and mission. In static markets, growth is related with greater economies of scale, and generates efficiencies that contribute to higher profitability. It is also related with greater economies of scope, generating more differentiated value, and thereby higher profitability. In dynamic markets, however, growth by itself may not generate efficiencies or differentiated value. On the contrary, efficient differentiated strategy may be a precondition for growth to take place in the first place.

Before learning about how to go about growth strategy, it is useful to first ask should the firms care about growth strategy in dynamic markets. In dynamic markets, pressures of survival often lead firms to compromise on social inclusion and environmental impacts, in their pursuit of growth without any intentional strategy. Sustainable growth strategy is based on three pillars – economic, environmental, and social sustainability. With continued growth in world’s population, especially in developing nations, growth strategy is becoming even more important to ensure that children, especially girls, and mothers receive the care, nutrition, schooling, and employment opportunities they need. It is also becoming imperative that this growth be green, so that the environment is not degraded and resources are not depleted to jeopardize the current and future pursuit of growth strategy by the vulnerable children of this world.

The countries where firms have prioritized on growth strategy have seen dramatic reductions in poverty levels, and improvements in living standards, on indicators such as literacy, education, life expectancy, malnutrition, and infant, child, and maternal mortality. Firms often find it difficult to sustainably pursue growth strategy, because of market failures and unfavorable valuation of green and inclusive efforts. Non-market strategies involving government actors are estimated to give a support of about $1 trillion annually in energy, water, materials and food subsidies that encourage firm behavior of negative environmental impact. If the same amount were invested in promoting green growth strategies, economic returns are likely to be about $3.7 trillion annually (McKinsey & Company, 2011). Reporting requirements on environmental performance, for instance, have helped firms in China, Indonesia, the Philippines and Vietnam discover opportunities for growth-enabling investments that move them from being noncompliant to becoming compliant, and to do so at low or even negative costs (The World Bank, 2012).

Approaches to sustainable growth strategy

Sustainable growth strategy is based on three major approaches (see, for instance, Liabotis, 2007):

Capability approach: stop protecting the less viable, non-core parts of business – the parts that are not valued by customers, or are not at par with the competitors, or that do not support access to new market opportunities.

Value approach: increase the value of the core parts of business – transforming them to meet the different needs of diverse customer groups cost-effectively using a common, a customized, or even a personalized platform.

Opportunity approach: invest in discovering of new opportunities adjacent to the core parts of business – particularly through new collaborative efforts that enhance the firm’s capacity to innovate and incubate new prototypes.

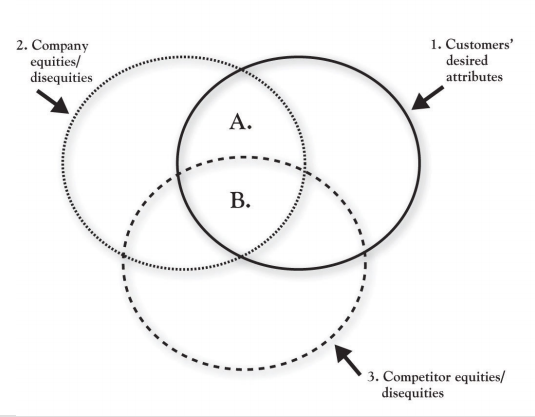

Urbany and Davis (2012) offer a three-circle model of growth strategy, where they refer capability approach as the company circle, value approach as the customer circle, and opportunity approach as the competitor circle.

In the three-circle model, customer circle is the starting point of formulating growth strategy. The firm begins by identifying a target customer segment, and inquiring the attributes of firms that affect family/ society/ customer choice. These are the criteria customers use when evaluating the firms being considered, and this evaluation is shaped by their family and social network. Not all attributes are considered by all customers. Some attributes are more important than others. Customers may be grouped together in terms of the factors that are most important in their decision making. For instance, in a performance show, customers may seek a unique venue, theme, refined watching environment, and artistic music and dance. Some may also seek fun and humor, or even thrill and danger. This helps firms define the context, and establish the value a particular customer segment is seeking – this is what the customers want.

The second step in the three-circle model is to establish the customer perception of the company attributes, i.e. the company circle. Note that the company circle here represents what attributes customers believe the firm offers, not what attributes are actually offered by the firm or are believed by the firm as its offer.

The third step is to establish the customer perception of the competitor attributes, i.e. the competitor circle. Doing so helps reveal how many of a firm’s positive attributes may be shared by the competitors, or how the firm may not have many of the competitor positive attributes.

The overlap and distinctiveness in the attributes among the three circles then helps a firm discover the points of parity (overlap among the three circles – represented by A in Figure 3.x), its points of difference (overlap only between the customer circle and the company circle – represented by B in Figure 3.x), and the competitor’s points of difference (overlap only between the customer circle and the competitor circle). Going deeper, these also help a firm discover the points of non-value (overlap only between the company circle and the competitor circle) – these are the attributes that might have been of value to the customers in the past, but are no longer so. The firm is also able to identify its points of negative value or inequity (non-overlapping company attributes), and competitor’s points of negative value (non-overlapping competitor attributes). These are the attributes customers are dissatisfied about – such as difficult to access, low reputation, and complex venue. Industry-wide dissatisfiers fall under the overlapping company and competitor circles.

Figure 3.x: The Three Circles Model of Growth Strategy

Source: Urbany and Davis (2012)

Finally, digging even deeper, the firm is able to identify the ‘white space’ – the non overlapping attributes in the customer circle. It is the value desired by the customers that is not being served (or not being served effectively) by either the firm or its competitor. These needs may be currently known or unknown (latent). Focusing on this white space opens up new uncontested market opportunity for the firm.

As we learnt in the previous chapter, the firm also needs to conduct an internal assessment of its own company attributes, and of the competitor attributes, in order to determine its points of distinctiveness and commonality in the industry. For sustainable growth, the firm needs to invest in the points of distinctiveness that are of value to the customers, and disinvest from those that are not. It also needs to invest in the points of unmet potential in the white space.

Note that a firm may not have the resources, the capabilities, or the core competencies inside its organization to cost-effectively develop the attributes in the unmet needs white space. Sustainable growth strategy, in this case, is based on developing collaborative networks, going beyond the industry boundaries. For instance, a theater firm may be a greater collaborator for complementing a firm’s capability in circus shows, to fulfill the possibly unmet customer needs of artistic performance in a circus show. By doing so, a firm goes beyond its own value chain, or even the industry’s value chain, and invests in developing linkages with the value chains of firms that have complementary sets of capabilities – the capabilities that could be integrated or combined together with those of the firm into innovations that elevate the customer experience.

What should a firm do if other firms are unwilling or unable to collaborate, or if making such collaboration work requires unusual investment of time and resources of the firm? In that case, the firms may consider an option to strategically acquire those firms, or if that is not feasible, seek to acquire the critical resources that will enable offering the value desired by the customers in the most cost-effective manner.

To summarize, firms have four major ways to pursue an organic, sustainable growth strategy in relation to their existing customers:

Improvement: to invest in improving the capabilities to offer better value to the customer groups

Scaling: to scale up the value that is meaningful to different target customer groups

Innovations: to collaborate with other firms to develop innovative combinations that elevate the customer experience

Strategic acquisitions: to acquire other firms that have complementary resources, in case the collaborative innovations option is not cost-effective or feasible.

Blue Ocean Strategy – Going beyond the white space of existing customers

In a global environment, where about 80% of the world’s population is waiting to be connected fully with the global markets, truly dramatic growth opportunity is not with the existing customers of a firm, but with the non-customers – the entirely new groups of customers not being served by it or its industry competitors. Kim and Mauborgne (2005) refer to this space as a blue ocean opportunity – where firms at least have some water to themselves. This space is contrasted from the one associated with current customers, which is referred to as ‘Red oceans.’ In Red Oceans, firms compete vigorously with their rivals, seeking to outsmart others and copy their moves. Therefore, it becomes difficult for the firms to truly sustain their growth, once they have done all reasonable efforts to meet the unserved or under-served needs of their target customers. From that point, the only sustainable growth option is to reach out to unserved or under-served customer groups, who are not currently being served by any firm in the industry. Doing so allows a firm to enhance its differentiation, while also improving its cost position.

In a study of profit and growth impacts of product launches of 108 companies (Kim and Mauborgne, 2005) have found 86% of firms were aimed at competing in red oceans. As shown in Exhibit 3.x, the other 14% were aimed at creating blue oceans, and they accounted for 38% of total revenues and 61% of total profits.

Kim and Mauborgne (2005) suggest using the Four Actions framework (illustrated in Exhibit 3.x) to formulate the blue ocean strategy; they are as follows:

1. Start with an offering experiencing a red-ocean scenario in relation to a particular target group of customers, and particular factors of value.

2. Find an alternative target group of customer, that may currently be using less desired alternatives or be a non-customer, who does not care about some of the current factors of value, but cares of some other factors.

3. Design a new product that eliminates, or reduces well below market standards, factors of value of less interest to new target customers. This step unlocks and eliminates costs that are not of much interest to these customers.

4. Increase the new product range by creating entirely new, or raise well above market standards the existing one, enhancing factors of value of more interest to new target customers.

Exhibit 3.x: Four Action Steps to Blue Ocean Strategy

Once value factors (attributes) have been identified for a new group of customers, to implement steps 3 and 4, Kim, and Mauborgne (2005) provide two additional tools. A 2x2 Eliminate-Reduce-Raise-Create Table for the value factors, and a Strategy Canvas that maps the value factors. Each value factor is assigned a performance rating from 0 to 10 (0-2 = very low; 3-4 = low; 5-6 = medium; 7-8 = high; 9-10 = very high), and mapped as a curve on the Strategy Canvas. These performance ratings can also be mapped against one or more baselines, such as the original curve and/or the curves of the strongest competitors.

Exhibit 3.x illustrates how Cirque de Soleil successfully implemented a blue ocean strategy in the circus market. In Exhibit 3.x, the strategy is portrayed on the Eliminate-Reduce-Raise-Create Table, and Exhibit 3.x shows the Strategy Canvas for the same.

| Exhibit 3.x: Cirque de Soleil Leaps Forward into a Blue Ocean In the 1980s, traditional circus market was experiencing a red-ocean scenario, in relation to its children target market. Cirque de Soleil decided to focus on an alternative target group, i.e. adult audience that had abandoned traditional circus. This group of non-customers was using alternative forms of entertainment, such as sporting events and home entertainment systems, that were relatively inexpensive and on the rise. This group did not value two of the key factors of differentiation that were an industry standard in the traditional circus market – animals and star performers, but problematic for the participating firms. The traditional circus industry was facing increasing pressures from the animal rights groups for their treatment of animals, and management of animals was becoming very costly. It also had to fight to retain a diminishing number of individual star performers, with fame for their thrilling and dangerous stunts. The acts of jokers, with knack for fun and humor, were also becoming banal. Cirque du Soleil designed a new product – circus theatre, which eliminated the animals and high-priced concessions, and reduced the importance of individual stars – the three very high cost elements. It augmented this new product by introducing an entirely new form of entertainment based on the intellectual sophistication of theatre shows that combined dance, music and athletic skill – thus furthering its differentiation appeal for both circus customers and non-customers. Each show, like a theater production, had its own unique theme and storyline; allowing customers to return to the show more frequently. Instead of requiring multiple show venues to be near to the customers, it was now possible to have limited number of unique show venues where the customers were willing to come. This blue ocean strategy using a hybrid focus approach helped Cirque du Soleil gain a significant strategic advantage and grow very rapidly by redefining circus. Source: Adapted from Kim and Mauborgne (2005) |

Exhibit 3.x: Eliminate-Reduce-Raise-Create Table of Value Factors for Cirque du Soleil

| Eliminate Start Performers Animal Shows Aisle concession sales Multiple show arenas | Raise Unique venue |

| Reduce Fun and humor Thrill and danger | Create Theme Refined watching environment Artistic music and dance |

Exhibit 3.x: Mapping Value Factors for Cirque du Soleil as a Curve on a Strategy Canvas

Assignment: Choose a real product that is already on the market (such as tablet), brainstorm the value factors of the product and develop the Strategy Canvas.

To summarize, the Growth view of Value Chain, as represented by the three-circle model or the blue-ocean strategy, holds that in dynamic environments, a strategy built on investments in cost reduction or differentiation enhancement for existing, known market spaces will only erode a firm’s strategic advantage. In existing known market spaces, referred to as red oceans, firms try to outperform their rivals to grab a greater share of market. These red ocean market spaces are crowded, and prospects for profits and growth are low. Conversely, an integrated approach can allow the firm to create new demand, instead of fighting for it. In this new yet unexplored space, referred to as blue oceans, there is sufficient opportunity for growth that is both profitable and rapid.

Concluding comments

Traditional value chain analysis, represented by the seminal work of Porter (1985), was motivated by the strategic emphasis on protection. The goal was to sustain a firm’ strategic advantage by protecting its foundations; this in turn meant creating a condition where the competitors aren’t able to attack the firm, what it does, and how it does that. The fundamental guiding principle in business strategy was to target as much of the target market as possible, as that alone would enable a firm to generate greatest economies of scale for achieving least cost, or cost leadership position in the market. Alternatively, the firm having the largest target market will have the deepest understanding of for what the customers are willing to pay a premium, allowing them to attain differentiation advantage. Of course, not all firms could be the largest, and attain either the least cost or meaningful differentiation position for this large group. For the firms who could not viably attain the goal of being the best or meaningfully different, Porter suggested the focus strategy. The idea was for the firm to find largest possible market niche, where it could viably achieve least cost leadership or differentiation advantage. In other words, if a firm could not be largest or sufficiently different, then it needed to be small enough to escape the attention of the larger rivals to have a sustainable advantage.

The new growth-based view of the value chain hypothesis does not necessarily require a firm to seek a cost leadership or differentiation advantage. Starting point of the growth-based view is not the firm capability that needs to be protected somehow, but the market opportunity that has not yet been discovered or exploited. Though the inside-firm value chain may not hold the resources, capabilities or core competencies to pursue this market opportunity, firm may still be successful if it is able to find complementary linkages between its own value chain and the value chains of other firms who do have the resources, capabilities, or core competencies that would allow exploiting the market opportunity.

Besides a firm’s capability and market opportunity, the growth-based view also emphasizes on the stakeholder value. Existing customers are an obvious stakeholder, but it is important for the firms not to limit their opportunity based on the needs of existing customers alone. Rather, they may create even greater value for an entirely new set of customers, who are non-customers for the industry currently. To identify appropriate set of customers, it is important for the firms to also consider their own constituent stakeholders – such as the values and the aspirations of their current or potential new investors, leaders, employees, vendors, and community members.

Once the firm identifies appropriate target customers to unlock its growth potential, it is important to be conscious of the need to be as cost-effective as possible, and to be as unique as possible. If a firm is not concerned about cost-effectiveness, then it would not accrue as much value for the target customers or for itself to support further growth or other priorities. If a firm is not concerned about being unique, then it would not be as attractive to the target customers and will not be as successful in realizing its strategic intent. Cost leadership and differentiation, then, is more of an aspirational goal and guiding principle for the firms pursuing the growth business strategy. It is not the foundation for their business strategy, nor is the foundation of the success or failure of their business strategy. Thus, the Growth view represents an additional type of generic source of strategic advantage for firms, which is different from the other three types covered in the first part of this chapter – cost, value and focus.

References:

Campbell-Hunt, C.C. (2000), What have we learned about generic competitive strategy? A metaanalysis, Strategic Management Journal, 21, pp. 27–154

Daniel W. Baack, David J. Boggs, (2008) "The difficulties in using a cost leadership strategy in emerging markets", International Journal of Emerging Markets, Vol. 3 Iss: 2, pp.125 – 139.

Dickson, P. R., & Ginter, J. L. (1987). Market segmentation, product differentiation, and marketing strategy. Journal of Marketing, April, pp. 1-10.

Doherty, D. (February 16. 2012). “Nestlé's Bespoke Chocolate” Accessed http://www.businessweek.com/articles/2012-02-17/nestl-s-bespoke-chocolate

Einhort, B (September 10, 2013). Apple Really Needs That Cheaper IPhone, Business Week, Accessed http://www.bloomberg.com/news/articles/2013-09-10/apple-really-needs-that-cheaper-iphone

Gilbert, X., & Strebel, P. (1987). Strategies to outpace the competition. Journal of Business Strategy, 8 (1), 28-36.

Grobart, S. (September 20, 2013). Apple Chiefs Discuss Strategy, Market Share—and the New iPhones, Business Week, Accessed http://www.bloomberg.com/news/articles/2013-09-19/cook-ive-and-federighi-on-the-new-iphone-and-apples-once-and-future-strategy

Kaplinsky, R. and Morris, M. 2012. A handbook for value chain research. Accessed: http://hdl.handle.net/10568/24923.

Kim, W. C., & Mauborgne, R. (2005). Blue ocean strategy: How to create uncontested market space and make the competition irrelevant. Boston, Mass: Harvard .Publishing.

Leitner, K.L. & Guldenberg ,S. (2010), Generic strategies and firm performance in SMEs: a

longitudinal study of Austrian SMEs, Small Business Economics, 35, pp. 169-89.

Liabotis, B. (2007). Three Strategies for Achieving and Sustaining Growth, Ivey Business Journal, July/August 2007, Accessed http://iveybusinessjournal.com/publication/three-strategies-for-achieving-and-sustaining-growth/

Mantle, J. (1995). Car Wars: Fifty Years of Backstabbing, Infighting, and Industrial Espionage in the Global Market. NY: Arcade Publishing.

McKinsey and Company. 2011. “Resource Revolution: Meeting the World’s Energy, Materials,

Food, and Water Needs.” McKinsey Global Institute.

Mintzberg, H. (1988). Generic strategies: Toward a comprehensive framework. In R. Lamb, & P. Shrivastava (Eds.), Advances in strategic management (Vol. 5). Greenwich, CT: JAI Press.

Miskell, P. (January 17, 2005). How Crest Made Business History, Harvard Business School Working Knowledge, http://hbswk.hbs.edu/archive/4574.html

Nestle (2011). Buitoni targets foodies with new premium range, Press Release, http://www.nestle.com/media/newsandfeatures/buitoni-targets-foodies-with-new-premium-range

Peppard, J & Rylander, A. (2006). From value chain to value network: insights for mobile operators. European Journal of Management, 24(2-3): 128-141.

Porter, M. E. (1980). Competitive strategy. New York: Free Press.

Porter, M.E. (1983). Cases in competitive strategy. New York: Free Press.

Porter, M.E. (1985). Competitive Advantage. NY: The Free Press.

SynaticsWorld (2010). http://synecticsworld.com/british-airways-traveling-in-comfort-and-style/#

The World Bank (2012). Inclusive Green Growth - The Pathway to Sustainable Development, Washington DC: The World Bank.

Thomas, M.A., (February 28, 2014). Mattel to buy Mega Brands to build up against Lego. Accessed http://www.reuters.com/article/us-megabrands-offer-mattel-idUSBREA1R0QB20140228

Thompson, A. A., Jr., & Strickland, J. (2008). Crafting and executing strategy: The quest for competitive advantage. New York: McGraw-Hill Irwin.

Urbany, J, & Davis, J.H. (2012). Grow by Focusing on What Matters: Competitive Strategy in 3-circles (Strategic Management Collection). Business Expert Press.

32