Human Resource assignment

Capstone Case – Johor Insurance

Background

Johor Insurance(JI) has a 127-year history in Singapore, starting as a friendly society (British Colonial Mutual Society) in 1890, which self-insured mutual fund contributors. Insuring mainly factories, exporters and shipping operators, they de-mutualised and became a publicly listed company (as JI) on the Malayan Stock Exchange in 1960. JI’s headquarters are still in the original location in Victoria St. When Singaporean and Malaysian currency interchangeability ended in 1973, JI was one of the first firms to delist on the Stock Exchange of Malaysia and Singapore (SEMS) and re-list on the new Stock Exchange of Singapore (SES).

Over the next 100 years, JI’s business drifted into the major insurance markets of the day – life insurance, home and contents insurance, and car insurance. Their market share, once close to 50% of the entire insurance market in Singapore, had drifted slowly but steadily down since the 1955, after a change in Government policy that made the new Central Provident Fund (CPF) compulsory for all Singaporeans. Most workers were

choosing to “add-on” life insurance to their CPF contributions, rather than pay into and maintain a separate policy. A move in the 1970s to taking on insurance policies in West Malaysia helped stabilise the company for a decade.

Through the 1990s, JI’s board attributed the declining market share to the dramatic reduction in the life insurance business after the CPF decision, however 20 further years of declining share led to a point where they were now a ‘legacy’ company – their customer base was mainly older people, lifelong customers who were not sufficiently motivated to change companies. As a result, their profit margins, adjusted for natural disasters, was the lowest of all Singaporean insurance companies.

An activist shareholder accumulated JI stock through this time, and finally had enough votes to get two of his staff onto JI’s board. They immediately instructed the CEO to call in an international management-consulting firm to analyse the business, and recommend a strategy to regain market share and profitability.

This consultant’s assessment of the consumer insurance business (cars, homes, household goods) showed a very crowded, intensely competitive market, thin margins, mass offshoring of back-office support services, and very risky reinsurance and underwriting practices. Moreover, the industry was fundamentally changing. The “rusted-on” customers, who generally didn’t change insurers due the inconvenience involved with comparing quotes, bargaining between providers, and negotiating premiums, were now using free apps and websites to compare premium rates, and insurers were having to bid against each other for consumer-level policies, further driving down cash flow and profits.

The management consultant’s recommendations surprised many board members.

Rather than advocating for cost reductions (staff, property, cash holdings, and reinsurance costs), and aggressive price-led marketing to regain market share at the retail consumer level, they recommended a radical refocus of the business.

The consultants recommended dividing the business into two sub-units, each a wholly owned entity. One unit will keep servicing the existing home and car insurance customers, the other the will use existing insurance knowledge, skills, and capital to focus on insurance associated with business customers. Business insurance customers typically insure against loss occurring from theft, burglary, fraud, transit damage and breakage, fire, third-party loss, indemnity, and life policies on key staff.

Once the home and car insurance arm had stabilised and established as a profitable going concern, it is to be sold, providing the capital needed to underwrite and expand the business insurance arm. It is the business insurance arm that JI is staking its future on, and will be the niche market they plan to dominate for years to come.

The current structure at JI has four main departments, each headed by a Director (not at board level):

Sales (in three main sub-departments)

online and call centre sales staff conduct sales direct to retail customers, and handle outbound selling to customers who are due to renew their policies.

resellers’ agents – these sales staff deal with insurance resellers, those companies that offer an insurance policy as an extra to their normal services. For example, a car dealerships who get a commission for bundling a JI car insurance policy with new car sales.

Marketing

Claims (online, call centre)

Adjusters

Professional services (actuaries, re-insurance specialists, treasury, legal, regulatory compliance, HRM)

The following chart illustrates the process on a general level.

The phases of JI’s change.

Existing JI Staff

The consultant’s report also made a specific mention of the importance of JI’s staff throughout this change. Specifically, they mentioned:

To maximise the sale price of the retail arm of JI, they need to all retain key executives, for two reasons. Firstly, their research has shown that it is easier to sell a business to international interests when experienced and stable management is already in place. Secondly, the insurance industry in Singapore is very heavily regulated, and all firms involved in life insurance, general insurance, and any deposit-taking activity are required to have key personnel approved and registered with the Monetary Authority of Singapore (MAS). Having to replace these key personnel and have them approved by MAS would be a very challenging task – it may take over a year.

The new organisation, to be known as Commercial Underwriters Asia-Pacific (CUAP) will need staff with a set of skills, qualifications and attributes that suit the task of setting up a new organisation.

The competing needs between the two arms of the organisation are apparent – JI wants to retain the best available staff to be attractive and stable to potential purchases. The emerging arm of CUAP wants the best staff possible to build and launch the new enterprise.

JI follows the National Wages Council’s

(NWC) guidelines on wage increments.

Staffing Profile Sales

As with most of JI’s workforce, the bulk of their sales staff are in the Victoria St building. A 320seat call centre occupies three floors of the building. The call centre is set up in such a manner that call agents can sit anywhere, handle incoming and outgoing sales calls, and answer internet-based enquiries.

Each of the sales sub departments has offices on these three floors.

The 190 phone sales and renewal staff took up most space, 12 sales team leaders, reported to one of eight shift managers. The operating hours for sales staff started at 7am and went to 10pm, every day of the year except National Day, Chinese New Year, and Good Friday.

At the same time the telephone sales staff were working, a smaller team of 20 staff covered the “chat sales” desks – their job was to respond to online enquiries form the internet, either through “chat services” or responding to e-mail enquiries. There were two team leaders managing the chat sales desks.

The (nine-person) reselling team, despite being physically and organisationally situated with sales and marketing, did not actually do any active selling. Their role is to negotiate agreements with channel partners, set up and support the administration of reselling agreements, and every month, calculate resellers’ commissions and remit payments. The consultants’ report made no mention of CUAP doing channel sales, as these sales are nearly always of retail and consumer level policies.

The marketing team is unusually large for a firm this size – nearly 30 staff are directly engaged in marketing JI, however the consultant’s report showed the marketing team is functionally and structurally unbalanced. For example, six staff are directly engaged in writing and placing advertisements and fliers in magazines and newspapers, even though less than 2% of new customers could be traced back to these advertising channels. The marketing staff also handled incoming media enquiries, although there is no outgoing, proactive public relations activity. All marketing staff were engaged in marketing direct to retail level consumers, none had any experience or desire to deal with reselling channel partners or to business clients.

Claims

For JI, claims staff are seen as an administrative function. They also work in the Victoria St location, taking up one entire floor. Customers have the option of calling through a claim, or lodging the details online. For incoming claims by phone, staff are required to recite a script from their computers, and input the customer’s responses into designated fields. At the end of the conversation, the computer program will make a determination on how the claim is to proceed – it may indicate either an automatic, uncontested payout, or indicate that a claims adjuster needs to be appointed to investigate the claim and make a determination.

In a separate subdivision, a team of clerks cleared the incoming information from online and postal claims. In a similar way to the call centre staff, they had to populate fields in a computer program in a certain order, and follow up where there was missing information. Again, the computer made the determination whether to proceed the claim with an uncontested payout, or engage a claims adjuster.

The two teams of claims processors never worked together, although sometimes a worker who failed or performed poorly at processing phone claims was re-allocated to the online and postal team. Hence, staff across the company saw the online and postal team as a “dead-end”, where the incapable and poor performers were sent to wait until retirement.

One major internal issue the consultant identified was the poor productivity of the claims section. JI promised a 24/7 claims hotline, and due to safety regulations, a minimum of three people had to be rostered on at any one time. Some nights there were as few as three phone claims, and the staff spent their time doing low-value “busy work”, or watching TV. Absences from night shifts were very high, and the overtime penalties JI paid to regular day-shift staff to cover the night shift added up to over $200 000 a year.

Worse, the consultant employed a “shadow-shopper” to lodge fake claims by phone and online, benchmarking the experience against other major insurers. Of the eight companies investigated, JI ranked seventh overall, the eighth company had a notoriously poor outsourced claims call centre.

AdjustersThe 60-strong adjusting workforce is distributed across the country, with only a small team in the Victoria St office. They are a very mobile workforce, most of them don’t have a desk or an office, instead working from cars and home offices. The adjusting workforce also an issue identified by the consultant. Contemporary insurance practice was to have a very small team of adjusters who handled long-term cases, and contract independent adjusters for everything else.

In contrast, JI’s adjusting workforce did nearly all adjusting activities. There were two reasons where external adjusters are used;

were in outlying areas and in west Malaysia, where it was unfeasible for JI staff to travel for hours to investigate a single case, and

where serious fraud was suspected or highly technical specialist investigations were needed.

Since most of JI’s current business is home and car claims, most adjusters spend their days travelling between sites, inspecting home damage, looking at crashed cars at panel-beaters, and meeting with staff from other insurance companies to settle claims. This cost of each adjuster’s car averaged $28 000 a year, once depreciation, maintenance, fuel, and insurance were accounted for. Added to this are the allowances JI have to pay to adjusters for home offices, home internet, and frequent travel for training.

However, JI had a long history of directly employing adjusters, their rationale being that directly employed adjusters are more likely to spend time with cases, investigating deeper, and saving more money on payouts. Contracted adjusters, who only get paid when they finish and settle a case, are more motivated not to investigate too deeply and quickly pay out on a case, thereby costing JI money on claims that should have been denied.

One threat to the change the consultant identified is the total absence of any specialist knowledge in adjusting commercial and business insurance claims. Although the existing adjusters are experienced and very well trained in assessing and investigating home burglaries, and dented cars, they have no exposure to typical business insurance claims such as employee fraud, business interruption payouts, deliberate sabotage, or ICT systems malfunction or intrusion. The lack of capacity here is a significant barrier to the successful spin-off and sale of CUAP.

Professional Services

The Professional Services department consisted of the team of specialists that are essential to running an insurance company. These specialists include:

actuaries,

re-insurance specialists,

treasury managers,

legal officers,

regulatory compliance officers, and

• HRM staff.

All staff in the professional services division

(with the exception of the administrative-level HRM staff) are on individual workplace contracts.

Another issue the consultant flagged as requiring attention is the contracts the Professional Services staff work under – there is no consistency between salaries, allowances, and other terms and conditions of employment. Some contracts require minimum three-months of notice to resign, some are

only a month. The actuaries and re-insurance specialists all have a 12-month non-

competition clause in their contracts, should the employment relationship end, however the legal and regulatory officers do not. Contract terms are summarised in the below table.

| No-compete clause in contract Three month notice period One month notice period Annual grant of special-class share options with 3-year vesting period. Performance bonuses – cash. Professional body memberships paid Continuing education allowance | | |

|

| |

|

| |

|

|

| |

| |

|

| | | |

| | |

| | |

|

|

| | |

|

|

| |

|

| | |

| | |

|

| | | |

| |

| | | | |

Capstone Case – JI Part 2 – Two months later. Affect and behaviour of staff.

The staff’s reaction to the impending change at JI was predictable – a mixture of fear, uncertainty, and anxiety. A small number of staff were quite looking forward to it – they saw an opportunity to gain a promotion amongst all the change and turmoil.

The Board of Directors has asked for, and is receiving, updates on the change project every two weeks. The two new Board Members have directed the CEO to meet with representatives of the Singapore Insurance Employees' Union (SIEU) to open a line of communication about the coming few months.

Internal research amongst employees, and feedback from the SIEU indicated that staff have formed an opinion that JI was nearly bankrupt; would all be laid off; and not receive their accrued benefits and entitlements.

This information is untrue and was not communicated by the company – it may have been a rumour sparked and fuelled by competitors who see the opportunity to poach high-value staff and large clients. As a result, productivity fell, especially in the claims section.

The Board decided to take an unprecedented step as an act of good faith to both the staff and prospective owners of JI Retail. They commissioned a major auditing firm to analyse the projected financial liabilities associated with the promises made to staff regarding accrued leave (of all types), voluntary redundancy provisions, training, relocation, bonuses and other rewards. The auditors came back in a week with the figure of $23.5 million, subject to further investigations.

The board then lodged $23.5 million in a fiduciary trust account, naming an independent lawyer as trustee and fiduciary and all current staff as beneficiaries. The CEO announced this to staff and the share market simultaneously on a video/tele conference. A formal letter from the trustee was then couriered to all staff outlining the terms of the fiduciary relationship they had with the independent lawyer. Specifically, it made mention that all expenditure relating to staffing entitlements had to be requested by JI or the staff member (or their bargaining agent) directly to the independent lawyer, who would assess the request on its merits against the current workplace policies, and remit the funds as needed. Regular wages and salaries were still paid by JI.

This unprecedented gesture had an immediate effect across the company. Many staff called the fiduciary lawyer’s information hotline to clarify information, and the level of emotional unrest supervisors were reporting to the executives immediately fell.

With this major issue temporarily dealt with, the Board and CEO could now focus on the progress in each individual division.

Preparations for separating CUAP.

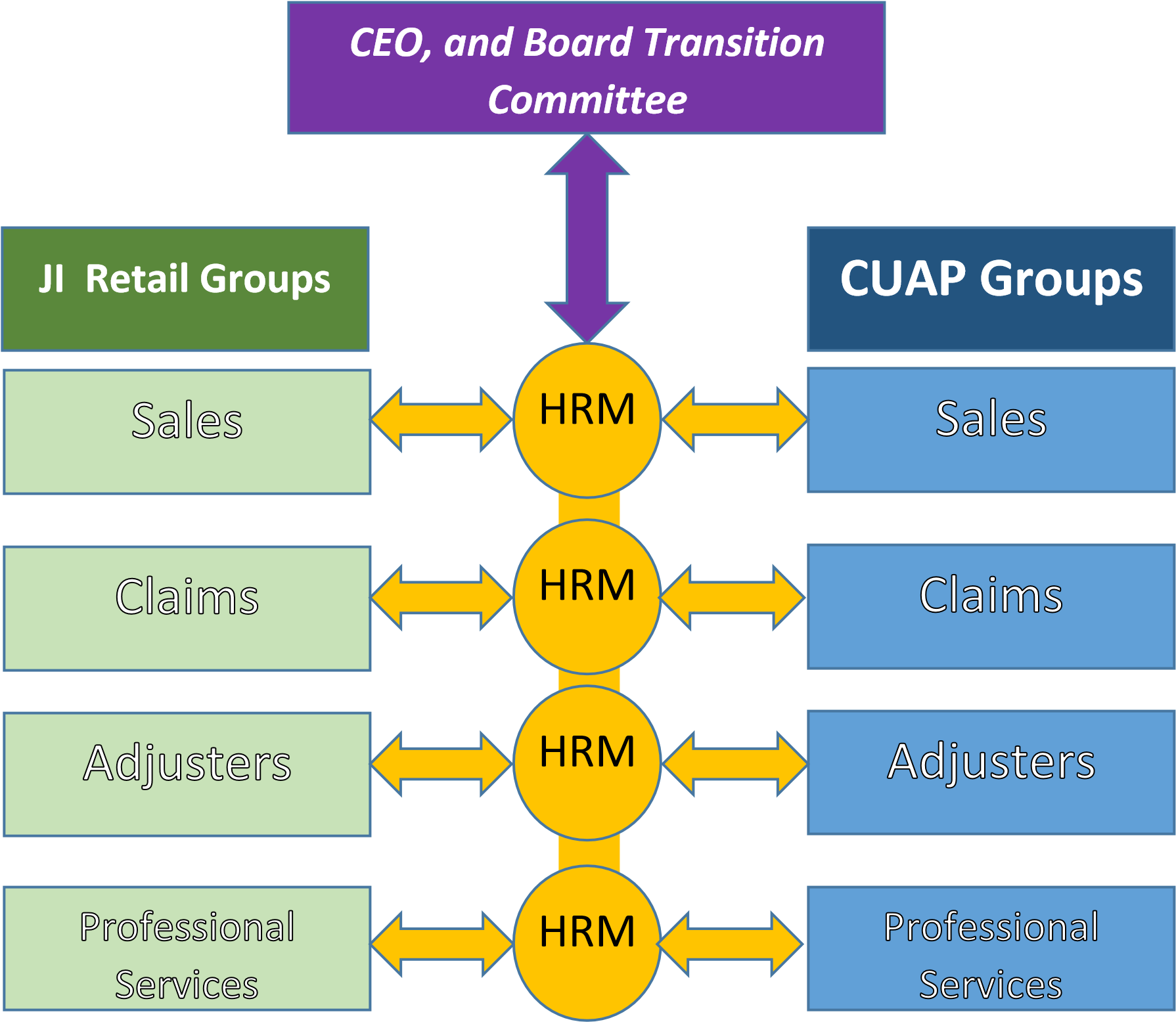

The CEO has created a series of working groups; four staff from each from Sales, Claims, Adjusters and Professional Services. There are two parallel sets of working groups – one for the entity that will become CUAP, and one for JI Retail.

Working from the benchmarking reports the consultants provided earlier, the teams are drafting ‘ideal’ workflows and organisational structures to equal or exceed competitors’ practices. A member of the HRM management is in each group, mainly to ensure that groups stay focussed on what is ideal, not “retrofitting” an ideal future to current practices.

For reasons that will become apparent in the progress reports (below), the HRM delegates started to discuss the employment relations framework to which the posttransition organisations had access. While JI in its current form was adequately served by the guidelines from the NWC, the new entities, especially CUAP, may not be. The Board Transition Committee has added the investigation of this issue to your brief.

Division-by-division progress

Sales

This department faces the biggest change in size and structure in the organisation. In theory all sales staff are needed by one or the other parts of the company, however, an over-supply of sales and renewal staff emerged.

The project managers have adopted a “field sales only” model for CUAP, meaning that all selling and renewals is done by a team of sales staff who visit the customers’ premises for new policies, and for renewals; working on the assumption that once familiar with CUAP, customers could be upsold more insurance.

Projected workforce needs modelled on the workflow of JI Retail shows the size of the internal (call centre) workforce has a surplus of 40 sales staff on phones, and five from the online chat service.

The sales staff are not yet aware of this; most are operating on the assumption that they will all have the same job in one of the organisations.

JI Retail intends to maintain the reselling business.

The Board does have concerns over the ability of the current marketing team. Launching two new brands in a new niche market is a difficult task; even with the advantage JI has from 127 years of operations. There is a heavy public relations workload coming up, something in which the current team has very little experience or capability.

Your team needs to put in place plans to manage the size and composition of the sales workforce, (for both JI Retail and CUAP) which may include an organisation-wide reallocation of staff.

Claims

The claims workforce also faced reshaping. The CUAP Claims working group investigated the benchmarking report, and then did their investigations into contemporary practices in business insurance claims. By far the most successful model was a “customer partnership” model, where claims staff actually visited the customer’s premises. Research indicated that business and commercial customers felt more “attached” to their insurers when they could deal with them face to face.

Clearly, this was the model with which to launch CUAP. The issue obstructing it is clear – all JI’s claims staff are in Victoria St, and claims staff are needed to move to other areas of Singapore and Malaysia.

The Claims working group from the JI Retail side projected that they would need 65 staff in the new organisation, leaving a surplus of 25 staff. CUAP need ten in central Singapore.

Adjusters

According to working groups from both streams, this part of the workforce is going to be under-resourced. The JI Retail adjusters working group briefly considered activating the Board’s offer of voluntary redundancies to all JI Retail adjusters, but when that was fed back up to the Transition Committee by the HRM staff, they decided against it.

Although the consultants’ benchmarking report showed that independent, contracted adjusters were now an industry norm, the Board did not want to change a practice and structure that worked reliably and effectively before the sale. Even the smallest teething problems with such a critical part of the operation may spook potential buyers.

This division presented perhaps the least difficult re-sizing to deal with. It is projected that at least another 20 adjusters will need to be placed into the organisations.

The only issue was the limited experience the current adjusters have with investigating and negotiating settlements with commercial and business-to-business customers. Some claims businesses put through for losses such as income disruption or key personnel accident and injury; required special investigative skills, forensic accounting, and particular legal knowledge. These skills are essential for CUAP to be successful, and the Board Transition Committee has added the resolution of this issue to the brief.

Professional Services

Of all the departments, Professional Services is the only one that faces a significant staffing shortfall.

Because of MAS and Insurance Act (Cap 142) requirements, the entire professional services department needs to be duplicated, approved, and registered before the formal offer for sale goes through.

The Board has specifically mentioned this department as a potential beneficiary from a new industrial relations framework, and has added to the brief a requirement to discuss using an enterprise agreement for CUAP, particularly given the flexibility an agreement would supply for the rewards and bonuses for the Professional Services group.