Communication Audit Report

COMMUNICATION AUDIT REPORT

Prepared for

Board of Directors

Houston Bank

and

Dr. Marguerite Joyce, Professor

Managerial Communication

Prepared by

Michael L. Garcia

BCOM 5203.Z01

April 30, 2015

EXECUTIVE SUMMARY

On March 18, 2005, interviews were conducted to uncover effective and non-effective communication techniques at Synergetic Communications. The purpose of these interviews was to evaluate employees’ answers to determine the effectiveness of communication and give feedback for improvements.

The company President and two administrative employees provided information on formal and informal communication. Most of the information gathered for this report was from primary data obtained during the interviews. Secondary information was taken from business articles relating to effective communication.

The research uncovered the following findings:

Formal oral communication needs little to no improvement.

Communications with customers are mostly by e-mail.

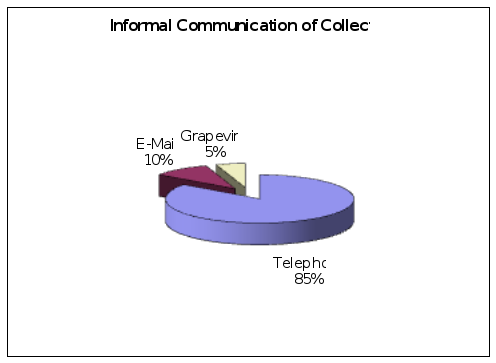

Telephone is 85% of the collectors’ form of communication.

Internal e-mails are 70% of the managers’ form of communication.

Least used modes of communication are video conferencing, intranet, and website.

Recommendations for improvement in communications are as follows:

Implement a company newsletter.

Create formal standards in external e-mails.

Set up a company website.

Utilize video conferencing.

Consider cross training of employees for other communication channels

COMMUNICATION AUDIT REPORT

INTRODUCTION

In most successful businesses, high usage of formal and informal communication occurs. This is why reviewing the effectiveness of the communication flow of a business is vital to its long-term success.

As Board of Directors of Houston Bank, it is likely that effective communication is something that is taken for granted. The effects of good communication internally and externally must be reviewed periodically. The purpose of this report is to describe and evaluate the Company’s effectiveness of communication channels along with recommendations for improvement.

The primary source of my information was interviews with Mike Orlando, President and two administrative employees, Shannon Houdek and Virginia Swatek, on April 3, 2015. Secondary sources of information were current articles relative to communication effective.

Detailed descriptions of current methods of communication used by Houston Bank are presented, including formal and informal communication channels.

FORMAL COMMUNICATION

The analysis of communication was directed towards formal and information channels of communication used by Houston Bank.

Formal Oral Communication

Management meetings and company meetings are examples of formal oral communication at Houston Bank.

Management meetings

According to the interview findings, management meetings take place on a weekly basis between the President and his management team. The purpose is to have the President’s message relayed to the rest of the Company. It also provides valuable communication back to the President and should continue to be a valuable form of two-way communication.

Company meetings

Interview findings showed that Company meetings are held on a monthly basis. The primary purpose of the meetings is to give formal communication from the management team as to the previous month’s results as well as the next month’s goals and objectives. Another purpose of the meeting is to give the employees motivation and direction in their job functions.

1

2

Written Communication

Company policy manuals, external e-mail, newsletters, intranet, and the website are examples of formal written communication at Houston Bank.

Policy Manuals

The interviewees made me aware of the inception of the Debt Collection Act of 1977; legislation has mandated behavioral guidelines for creditors. This has forced Houston Bank to produce policy manuals to help properly train and educate its people in order to minimize violations of the Federal Trade Commission rules.

Houston Bank’s constant evaluation and training for the policy has enabled the Company to survive and prosper in a competitive industry. These policy manuals of communication should continue to help the Company in alleviating the possibilities of accruing penalties and fees along with any other legal issues.

External E-mail

According to interview findings, external e-mails are a large source of communication among the managers and customers at Houston Bank. Communication is usually through a request for settlement or other files on a debtor. The managers use this form of communication with clientele is frequent.

E-mail is easily overlooked as a means of communication. This is because e-mail can give a sender the false impression of informal communication. When dealing with customers, e-mails should be treated with just as much planning and thoughtfulness as a formal letter.

Houston Bank’s managers would also benefit by creating a universal format when communicating with customers via e-mail. The message received by the customer would send powerful impressions that could strengthen or save relationships. This could also help establish Houston Bank as an organization willing to communicate in modes that accommodate its customers.

To ensure that a newsletter is successful, you need to make sure the “topics presented [are] in depth [which] are more likely to spark readership than a canned newsletter filled with trivia” (Clift, 2014 para. 7). Perhaps Houston Bank can begin creating a more effective newsletter.

Currently, Houston Bank is not utilizing the Company’s intranet. However, this is something that is in the process of being put in place and should be operating within the next six months, as stated by the senior banking officer. The intranet is a valuable form of communication that will “save time and energy by managing information and documents” (Dernovsek, 2012, para. 9). Eventually, the saving on edits and revisions of posted policy manuals, newsletters, and job functions will save considerable cost and time. The convenience of knowing where to get updated information and job details will be an invaluable tool for employees.

3

According to the interview findings, a website is not in place at Houston Bank. This is another communication tool that could help maximize exposure to the market and validate the Company as a significant industry leader. Putting a website in place will help current and potential clients learn why it’s important or easy to do business with you. With website design and cost being very minimal, it would be critical for your organization to optimize and maintain business by implementing a website.

According to my the interviews, video conferencing is not currently in effect at Houston Bank. However, the discussions between the management team have expressed interest. This would allow effective communication between Houston Bank’s (1) San Diego, (2) Idaho and (3) Houston offices. This is a cost effective way to communicate among offices. Video conferencing adds more to the interaction because people can actually see the other managers during virtual meetings.

The senior lending officer also shared with me the use of the audio card at Houston Bank. The audio card was established as a marketing tool to attract new clients and separate Houston Bank from the competition. This is a brilliant form of communication with your external customers that keeps the Company’s name ever present in the market place.

INFORMAL COMMUNICATION

T

Figure 1

he findings revealed an analysis of informal communication.

Informal Oral Communication

Telephone and grapevine are examples of

informal oral communication.

According to my interviews, the telephone

is the single most important communication tool

that the managers use. This form of

communication is used by 85% of the

interviewees. This is depicted in Figure 1.

For the managers and executives, it is used

by 40% of them as a tool with

Houston Bank’s external customers.

The internal grapevine is another form of communication that generally only passes along non- vital information about the Company. For example, according to my interview findings with the managers, if an employee’s attendance is sporadic , the grapevine could contradict the employee’s calling in sick.

4

The President of Houston Bank receives more information through the grapevine than most organizational chiefs. Continued interest in communication through this channel will help the President to be aware of employees’ concerns and rumors. The less communication shared through formal channels with employees, the more active the grapevine will be. To minimize the grapevine activity, the employees need to hear different information through a variety of formal channels.

Continue discussion of remaining questions and data results on pages 5 to 8, etc. Include at least two to three graphic aids (tables or figures) for significant questions.

5

6

7

8

9

SUMMARY

Interviews with the mid-level managers and senior managers have led to an analysis of Houston Bank’s communication channels. As discussed, there are several channels that are currently operating very effectively; yet, a few others that need improvement. This is why reviewing the communication structure of the business is so vital to its long-term success. With all due respect, recommendations for improvement in the effectiveness of the flow of communication at Houston Bank are for the success of the Company.

RECOMMENDATIONS

It is recommended that periodic reviews of communication channels for re-evaluation and effectiveness of the formal and informal communication be conducted annually. It is also recommended that cross training of departments’ employees to expose them to other methods of communication be implemented. The effectiveness of the flow of communication at Houston Bank would certainly improve with the following:

Newsletter

External E-mail Standards

Website

Video Conferencing

Cross Training

REFERENCES (fictitious)

Clift, V. (2012). Time to rethink your newsletter? Marketing News 28(20), 7. Retrieved March 20, 2005, from Business Source Premier database via SHSU.

Dernovsek, D. (2012). Creating an effective intranet. Credit Union Magazine 68(9), 16A-20A. Retrieved March 24, 2005, from Business Source Premier database via SHSU.

13