Maths test week 6, complete questions can be found in the attachment on this TUTORIAL.QUESTION 11. Choose the one alternative that best completes the statement or answers the question. Sol

QUESTION 1

Choose the one alternative that best completes the statement or answers the question. Solve the problem. Round dollar amounts to the nearest dollar.

Find the yearly straight-line depreciation of a home theatre system including the receiver, main audio speakers, surround sound speakers, audio and video cables, and blue-ray player that costs $3100 and has a salvage value of $900 after an expected life of 5 years in a hotel lobby.

10 points

QUESTION 2

Solve the problem. Round unit depreciation to nearest cent when making the schedule, and round final results to the nearest cent.

A barge is expected to be operational for 280,000 miles. If the boat costs $19,000.00 and has a projected salvage value of $1900.00, find the unit depreciation.

10 points

QUESTION 3

Solve the problem. Round unit depreciation to nearest cent when making the schedule, and round final results to the nearest cent.

A construction company purchased a piece of equipment for $1520. The expected life is 9000 hours, after which it will have a salvage value of $380. Find the amount of depreciation for the first year if the piece of equipment was used for 1800 hours. Use the units-of-production method of depreciation.10 points

QUESTION 4

Solve the problem using the information given in the table and the weighted-average inventory method. Round to the nearest cent.

Calculate the average unit cost.

| Date of Purchase | Units Purchased | Cost Per Unit |

| Beginning Inventory | 25 | $32.12 |

| March 1 | 70 | $25.24 |

| June 1 | 65 | $36.24 |

| August 1 | 40 | $20.81 |

10 points

QUESTION 5

Solve the problem using the information given in the table and the weighted-average inventory method. Round to the nearest cent.

Calculate the cost of ending inventory.

| Date of Purchase | Units Purchased | Cost Per Unit |

| Beginning Inventory | 25 | $33.18 |

| March 1 | 70 | $28.60 |

| June 1 | 65 | $38.75 |

| August 1 | 40 | $21.49 |

| Units Sold | 68 |

|

10 points

QUESTION 6

Solve the problem using the information given in the table and the weighted-average inventory method. Round to the nearest cent.

Calculate the cost of goods sold.

| Date of Purchase | Units Purchased | Cost Per Unit |

| Beginning Inventory | 25 | $34.13 |

| March 1 | 70 | $27.34 |

| June 1 | 65 | $35.61 |

| August 1 | 40 | $20.77 |

| Units Sold | 62 |

|

10 points

QUESTION 7

Solve the problem. Use a fraction for the rate and round dollar amounts to the nearest cent.

Jeremy James is depreciating solar panels purchased for $3600. The scrap value is estimated to be $900. He will use double-declining-balance and depreciate over 6 years. What is the first year's depreciation?

10 points

QUESTION 8

Solve the problem. Use a fraction for the rate and round dollar amounts to the nearest cent.

Eric Johnson is depreciating a kitchen oven range purchased for $1720. The scrap value is estimated to be $172. He will use double-declining-balance and depreciate over 30 years. What is the first year's depreciation?

QUESTION 9

Solve the problem. Use a fraction for the rate and round dollar amounts to the nearest cent.

Jane Frankis is depreciating a train engine purchased for $86,000. The scrap value is estimated to be $5000. She will use double-declining-balance and depreciate over 40 years. What is the first year's depreciation?

10 points

QUESTION 10

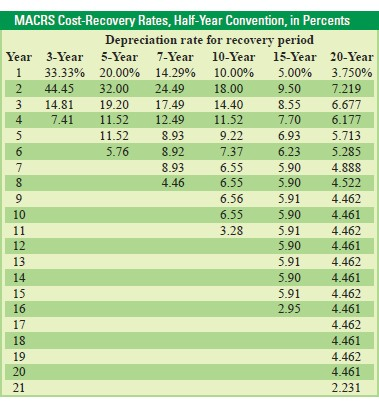

Find the depreciation for the indicated year using MACRS cost-recovery rates for the properties placed in service at midyear. Round dollar amounts to the nearest cent.

| Property Class | Depreciation Year | Cost of Property |

| 3-year | $86,600.00 |